The stock market is up 18% over the past 12 months to outpace its long-run average by a wide margin. After a run-up like that, many investors prefer to focus on deals by hunting for stocks setting new 52-week lows. These stocks, the theory goes, carry the potential to exceed the low expectations Wall Street has placed on them.

I'm a bigger fan of a different strategy that looks at companies setting new highs thanks to sharply improving operating results. In many cases, the optimism doesn't fully reflect how well these businesses can do over time.

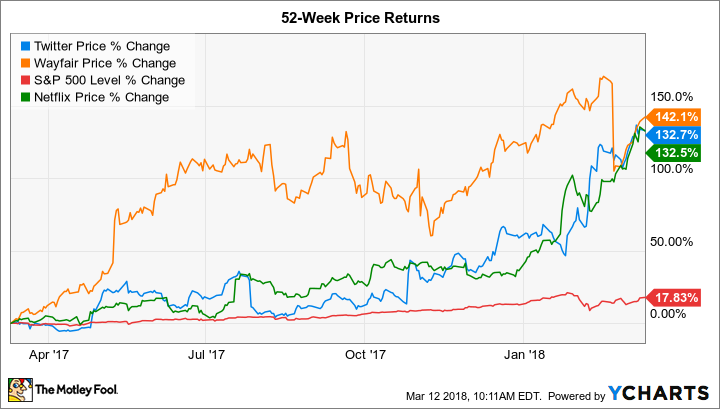

With that approach in mind, let's look at a few stocks that have risen by 100% or more in the past year with an eye toward whether that growth streak might just be getting started.

Twitter strikes a profit

Twitter (TWTR) stock has tripled the return of its larger social media rival Facebook (META 0.37%) in the past year. Much of that gain came recently, following a fourth-quarter earnings report that included Twitter's first reporting period of profitability on a GAAP basis. Sales growth turned positive last quarter, too, as gains in user engagement levels offset continued weakness in advertising trends, especially in the core U.S. market.

These are encouraging metrics for the micro-blogging service, which is targeting a full year of profitability in 2018. However, its stock price rally can't be sustained simply by cost cuts, which are currently driving its improving finances. For this business to really shine, CEO Jack Dorsey and his team need to post accelerating user growth that helps its base of 330 million close the massive gap with Facebook's 2.1 billion users.

Netflix goes global

Few companies can claim as good a year as the one that streaming video giant Netflix (NFLX 2.41%) recently posted. Global subscriber growth shot up to an 8.3 million user pace in 2017 to blow past management's original goal of 6.3 million. That success meant Netflix added 24 million members last year, up from 19 million in 2016. Profitability marched higher as well, implying streaming fans had no qualms about paying increased monthly prices.

Image source: Getty Images.

With over 100 million global users and an annual content budget of $8 billion, Netflix has solidified its leadership position in a market that could see decades of growth as the home entertainment industry transitions from broadcast TV to an internet-delivered infrastructure. At a price-to-earnings ratio of over 260, investors are paying a hefty premium for that optimism. It will be interesting to see whether the established entertainment giant can earn that valuation as its future relies more on the production of original content.

Wayfair builds a following

Wayfair's (W -5.44%) stock dropped following its holiday-quarter results, but there was little in that report to justify the sharp sell-off. The home furnishings e-commerce specialist managed a 48% revenue spike even as it scaled back on digital advertising spending. Its base of loyal customers shot higher, with 62% of orders coming from repeat shoppers in the fourth quarter.

Image source: Getty Images.

Wayfair is aiming to keep a hold on those users even as rival e-commerce giants seek to elbow in on its market over the coming years. Its brand strength should help in that goal, and so should its proprietary delivery network that's enabling quick, efficient fulfillment on products that were once unthinkable as online niches. To name just a few examples, Wayfair delivered hot tubs, pool tables, large appliances, and sofas as part of its record-smashing Cyber Monday performance late last year.

The company isn't profitable, and that's not likely to change in 2018, or 2019, as Wayfair invests in building out its shipping infrastructure and extending the business into international geographies. Yet its persistent market share gains suggest the retailer has a good shot at hitting management's long-term target of adjusted profitability that's near 10% of sales. Success on that metric would easily justify more stock price gains ahead for this surging business.