When you first hear about cryptocurrency mining, it sounds too good to be true. By using your computing equipment to verify transactions on a blockchain, you'll earn crypto rewards. It doesn't require much effort on your part, so once you get it set up, it's passive income for you.

But there are some potential issues to know about, most notably that mining could cost you more than you earn if you don't plan ahead. To help with that, we're going to cover how to mine cryptocurrency and if it's still profitable in 2022.

What is cryptocurrency mining?

Cryptocurrency mining is the way that proof-of-work cryptocurrencies validate transactions and mint new coins. It was the first method used that enabled cryptocurrencies to be decentralized. They function without a central governing body confirming their transactions.

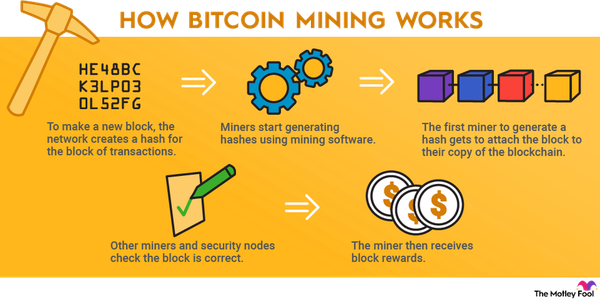

Under the proof-of-work model, which was introduced with Bitcoin (BTC 4.7%), miners check transactions using computing devices that solve complex mathematical equations. By providing the correct answer, the miner has shown proof of doing work.

The first miner to get the correct answer wins the right to confirm a block of that cryptocurrency's transactions. When the block is confirmed, it's added to the cryptocurrency's blockchain, a distributed digital ledger of all its transactions.

The lucky miner also receives a block reward for the trouble of confirming the transactions. The block reward is a set amount of the cryptocurrency they're mining. The rewards usually come from new coins that have been minted and the cryptocurrency's transaction fees.

Types of cryptocurrency mining

There are many ways to mine cryptocurrency. Here are the different types of cryptocurrency mining you can choose from:

- ASIC mining: Mining using an application-specific integrated circuit (ASIC). This type of device is made to mine a specific cryptocurrency. It's expensive, but it also typically provides the highest hash rate, meaning it offers more mining power.

- GPU mining: Mining using one or more advanced graphics processing units (GPUs), commonly known as graphics cards. These also provide considerable mining power but at a somewhat high up-front cost.

- CPU mining: Mining using a computer's central processing unit (CPU). Although this is the most accessible way to mine crypto, CPUs don't have nearly as much mining power as ASICs and GPUs. For that reason, profits from CPU mining are minimal.

- Mining pools: Groups of miners who work together to mine crypto and share block rewards. Miners pay a small percentage of those block rewards as a pool fee.

- Solo mining: Mining on your own. It's much harder to earn block rewards this way, so mining pools are often the better choice.

- Cloud mining: Paying a company to mine crypto on your behalf with its own mining devices. Cloud mining requires a contract, and the terms almost always favor the company and not the miner.

The right type of mining depends on the type of cryptocurrency and how much you can afford to invest. In most cases, your best bet is to go with either ASIC mining or GPU mining and to join a mining pool.

How to mine crypto

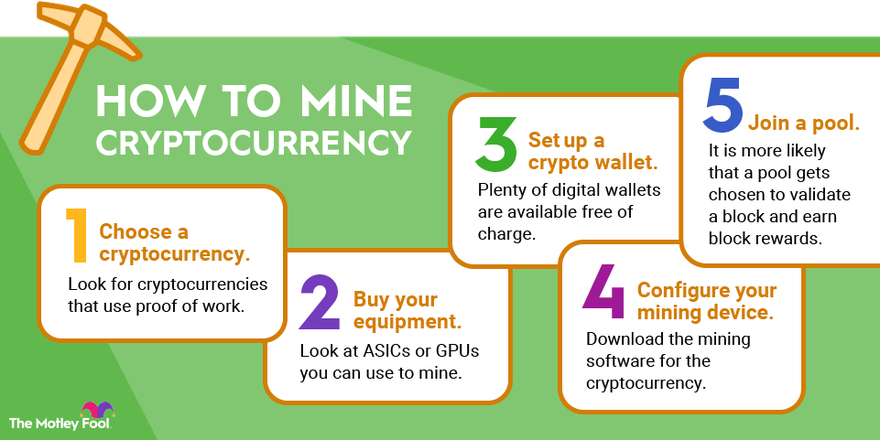

Once you're ready to start mining crypto, here are the steps to follow.

Choose a cryptocurrency to mine

There are many cryptocurrencies you can mine, but not all of them use this method to verify transactions. Specifically, you'll want to look for cryptocurrencies that use proof of work. Here are some suggestions:

- Kadena (KDA 4.15%) is a cryptocurrency built for businesses and powering global financial systems. It's one of the more profitable cryptocurrencies when you mine it with an ASIC.

- Ergo (CRYPTO:ERG) is a platform designed to provide an efficient way to implement financial contracts on blockchain. Because Ergo is resistant to ASIC mining, you can mine it using a GPU.

- Dogecoin (DOGE 4.94%) is a meme coin. Although it started as a joke, it became extremely popular in 2021, and it's possible to make a profit mining it with an ASIC.

One notable cryptocurrency that I wouldn't recommend mining is Bitcoin. Because it's so popular and there are so many miners competing to earn rewards, it's extremely difficult to make a profit with Bitcoin mining.

Buy your mining equipment

After you've picked a cryptocurrency, start looking at ASICs or GPUs you can use to mine it. A CPU won't cut it in terms of mining power since you'll almost certainly make far less than $1 per day.

To compare mining devices, use a profitability calculator for the cryptocurrency you'll be mining. These calculators let you plug in a machine's hash rate and your electricity cost to see how much you'd make per day. Then you can use that information to estimate how long it would take to pay off the cost of the mining device.

Set up a crypto wallet

As you mine cryptocurrency, you're going to need a crypto wallet to receive your rewards. Fortunately, this isn't hard to find.

The cryptocurrency's website will probably have recommendations on compatible wallets. For most cryptocurrencies, there are plenty of digital wallets that are available free of charge. When you've set up your wallet, you'll be able to generate an address where you can receive and safely store your cryptocurrency.

Configure your mining device

Once you have your mining device, there are a couple of things to do to get it ready. First, download the mining software for the cryptocurrency. You should be able to find the software on the cryptocurrency's website.

Make sure you set up your mining device in a safe location with the proper cooling. Mining devices can generate quite a bit of heat, and they can be a fire risk if you're not careful.

Join a mining pool

It's possible to mine cryptocurrency on your own, but that's rarely a good approach. Earning block rewards is much harder when you're mining alone.

For that reason, most miners opt for mining pools. Since a mining pool has a group of miners who are combining their efforts, it's more likely that the pool gets chosen to validate a block and earn block rewards.

Is cryptocurrency mining worth it?

Cryptocurrency mining isn't worth it for the typical investor because it's so difficult to make a profit. For crypto enthusiasts, mining may be worthwhile as a hobby and a way to possibly earn some extra money.

To make reasonable money from crypto mining, you need an ASIC or a GPU. Many of the most popular choices cost $1,000 or more. Depending on the cryptocurrency you mine and how its price changes, breaking even on your mining device can take six months, a year, or longer. And these devices eventually become obsolete or break down.

Electricity costs are another important consideration. Crypto mining is usually energy-intensive, and you won't make much money without cheap power.

You're probably better off using the money you planned to put in a mining device on a good cryptocurrency investment. That could be something as simple as buying the cryptocurrency you were planning to mine or checking out cryptocurrency stocks.

If you want to support your favorite cryptocurrency or you're willing to spend a lot of time maximizing profitability, mining is a viable option. However, most investors will likely find that mining just isn't worth the hassle.