Seagate Technology's (STX) recent recovery has been rewarded handsomely by investors. Shares of the storage specialist have soared remarkably over the past few months and as of this writing sit at 52-week high, thanks largely to impressive cost control measures and the increasing demand for its storage products and solutions.

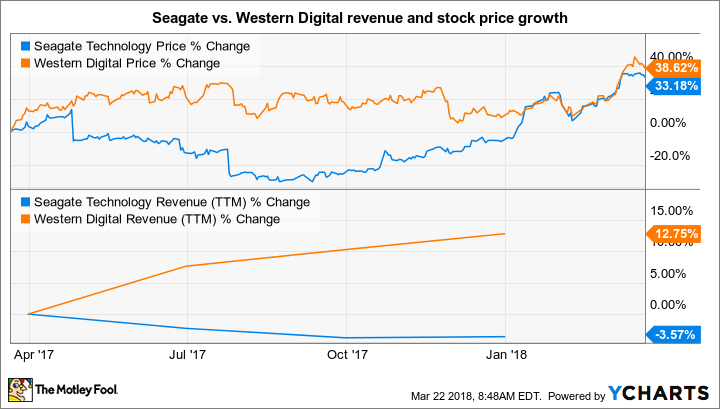

But concerns have been raised about the sustainability of Seagate's terrific run as rival Western Digital's (WDC 4.28%) aggressive move into the solid-state drive (SSD) business after the SanDisk acquisition has given it an upper hand.

What's more, Western Digital has set itself up for long-term growth thanks to the growing demand for flash-based storage, while Seagate continues to bet on the legacy hard-disk drive (HDD) market. So, will Seagate's strategy of sticking to the HDD business pay off in the long run and help the stock soar higher? Let's take a look.

Image Source: Getty Images.

Seagate's HDDs are gaining traction

Seagate's focus on the HDD market, as opposed to the fast-growing SSD market, has weighed on its top line in recent quarters, but things are gradually improving. For instance, revenue in the December-ended quarter revenue was flat year over year, and its top line should remain in good shape thanks to the positive end-market dynamics.

PC shipments, for example, are finally getting better. Gartner estimates that PC sales will rise by 2 million units in 2018, and gain more traction in 2019 with sales expected to rise by 3 million units. The market was at 270 million units in 2016.

Meanwhile, enterprise cloud storage is expected to grow at almost 24% a year through 2022, driven by the growing demand for hybrid cloud storage and other applications such as enterprise mobile management. HDDs are expected to play a crucial role in satisfying this demand thanks to their cost advantage over solid-state drives.

A 512GB HDD, for example, retails online in a range of $44 to $65, while an SSD with identical capacity goes for anywhere between $140 to $170, according to data storage provider Backblaze. Demand for Seagate's HDD products has taken off in recent quarters as data centers need a cost-effective solution to store such large amounts of data. The company shipped 87.5 exabytes of HDD capacity last quarter, up 28% from the prior-year period.

Looking ahead, Seagate should be able to maintain its hold on the enterprise storage market thanks to its focus on coming out with larger HDDs, which should also boost margins.

Seagate's earnings power will improve

Seagate's focus on optimizing its operational efficiency has led to massive cost reductions in recent quarters as it has scaled down its manufacturing footprint. Last year, the company had announced that it was shutting down one of its largest HDD manufacturing plants in China as the market is moving toward higher-capacity drives.

In fact, Seagate's average capacity per drive increased to 2.2 TB last quarter as compared to 1.7 TB in the year-ago period. As a result, the number of HDD units the company shipped fell slightly year over year last quarter -- so Seagate now needs to make fewer hard drives because it is packing more memory into each unit, leading to a leaner manufacturing footprint.

This is why the company's operating expenses fell 15% year over year last quarter. What's more, Seagate expects its operating expenses to drop another 2% to 3% sequentially in the current quarter. More importantly, the company should be able to limit its expenses in the long run as it is working on the introduction of higher-capacity drives.

Seagate recently started pilot shipments of hard drives based on Heat-Assisted Magnetic Recording (HAMR) technology and expects to start shipping HDDs with 20 TB-plus capacities by next year. By comparison, Seagate's 10 TB and 12 TB products are currently its best-selling offerings.

So, the company is looking to aggressively push up the storage density of its drives, and it aims to roll out HDDs with capacities of 40 TB or higher by 2023. Seagate believes that this increase in the storage density of an HDD will allow data center operators to reduce the total cost of operation significantly.

Moreover, the company should be able to consolidate its manufacturing footprint further by making bigger HDDs, which should lead to lower operating expenses and bigger profits. Analysts expect Seagate's earnings to increase at 8.4% a year for the next five years. By comparison, the company's bottom line has shrunk by almost 9% a year for the past five years.

Attractively valued

Seagate's valuation indicates that there's still room for more upside. The stock's trailing price-to-earnings (P/E) ratio of 27.6 is much lower than rival Western Digital's P/E of almost 80. What's more, Seagate stock gets cheaper on a forward P/E basis with a multiple of just 12.

Also, Seagate's dividend yield of 4.2% gives investors yet another solid reason to invest in the stock despite its terrific run in recent months. All in all, the company is making smart moves to tap the growing storage demand, trades at an attractive valuation, and carries a hefty dividend yield, so there's no reason why investors shouldn't think of adding Seagate shares to their portfolio.