Many people have good intentions when it comes to investing for retirement. But even the best-laid plans can go awry, especially if your investing habits aren't as routine as buying groceries or paying bills.

To avoid falling short of your investment goals, which could delay your retirement, you can automate your investing activities. While you'll have to do some extra work initially, automation ensures that you continue investing at a steady pace. Learn how to automate investments in five easy steps.

5 steps to automating your investments

You can automate your money decisions by following these five easy steps:

- Step 1: Automate investments in an employer-sponsored retirement account.

- Step 2: Consolidate your investment accounts.

- Step 3: Automate investments in other retirement accounts.

- Step 4: Establish an automatic investment plan.

- Step 5: Automate dividend reinvestment.

1. Automate investment in an employer-sponsored retirement account

One of the easiest automatic investment options is a work-related retirement plan such as a 401(k). If the company you work for offers this benefit, take full advantage. At a minimum, try to maximize your company's matching contribution. Many companies will match 50% to 100% of every dollar you contribute up to a certain percentage of your salary. By not taking advantage of this opportunity, you miss out on part of your total compensation package. And, in the process of making sure you receive your full work retirement benefit, you've helped automate your finances.

Most employer matches cap out before you reach the 401(k) contribution limits, which are $19,500, or $26,000 if you're 50 or older, in 2021. However, that doesn't mean you can't max out this plan if you like your investment options. Doing so is a good way to invest automatically in the stock market.

2. Consolidate your investment accounts

The average person changes jobs about every five years. Unfortunately, many forget to take their 401(k)s with them. The Center for Retirement Research at Boston College estimates that Americans have left behind 24 million old 401(k) plans with $1.35 trillion in assets from their old jobs.

While it might be a hassle to roll over an old 401(k) into an IRA, that move has several benefits:

- Managing your own investment portfolio is easier when you have all your old work-related retirement accounts consolidated into one account.

- It could save you money since some 401(k) plans have higher fees.

- It could improve your returns if you left your old 401(k) funds in a lower-return investment.

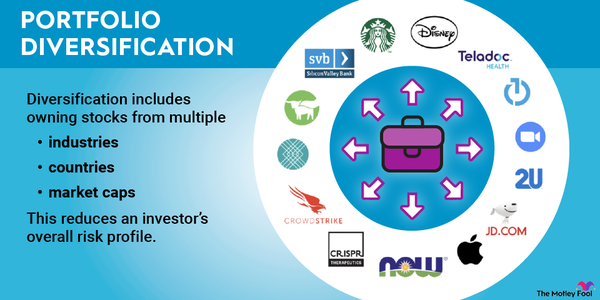

In addition to consolidating your old work-related retirement accounts, you should consider doing the same if you have investment accounts at multiple brokers. Putting everything in one place will make it easier to simplify and automate your investments.

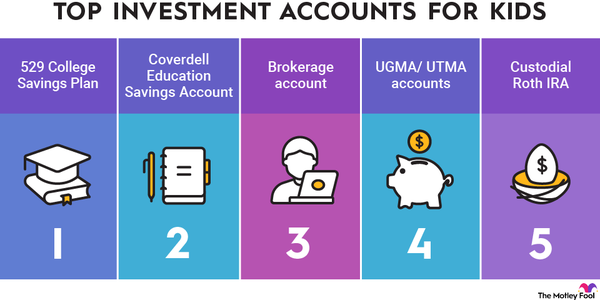

Also, this is the time to consider setting up other new automatic investment accounts. For example, if you have kids, you might want to set up a 529 plan to help save for their educational expenses. You should also see if you're eligible for a health savings account (HSA).

3. Automate investments in other retirement accounts

You could max out your 401(k) plan and call it a day. However, many choose to stop at their employer match because they'd prefer to put the rest of their money in a different investment vehicle. Sometimes a 401(k) isn't the best automated investing option because of high costs or limited investment choices.

If you're wondering how to automate investing, another good move is to set up a monthly transfer to your individual retirement account (IRA). Consider maxing out your IRA. For 2021, the IRA contribution limit is $6,000, or $7,000 if you're older than 50. So if you wanted to max out your IRA by making a monthly deposit, you'd set the automatic transfer at $500 a month if you're younger than 50.

If you have more money you want to invest after maxing out your retirement plans, consider setting up additional automatic deposits to your consolidated brokerage account, 529 plan, or your HSA.

4. Establish an automatic investment plan

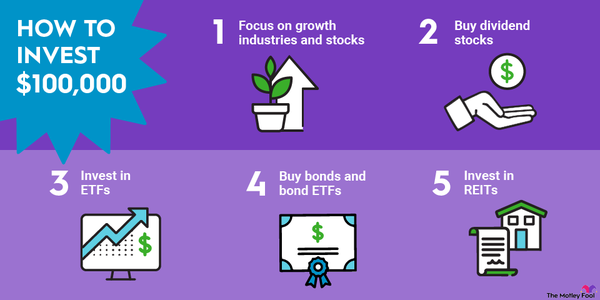

Once you have regular money flowing into your retirement plans and other investment accounts, consider automating investment purchases so that your cash doesn't pile up. Many brokerage accounts will allow you to set up an automatic investment plan.

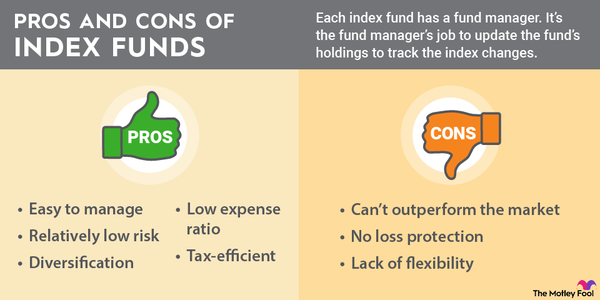

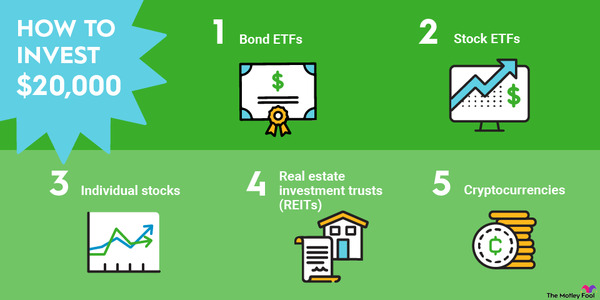

One of the best ways to automate your investments is through a low-cost index fund that tracks a stock market index like the S&P 500. Most brokers will allow you to set up an automatic investment plan for funds you own in your brokerage, retirement, 529 plans, and other accounts. That way, your automatic transfers are immediately invested.

5. Automate dividend reinvestment

If you choose to hold individual stocks, you might want to consider setting up automatic dividend reinvestment. Most brokers allow you to put your dividends on autopilot by automatically reinvesting them to buy more shares of the same stock or fund.

That way, the dividend payments won't pile up in your account, earning little to no interest until you decide what to do with them. Thanks to the power of compounding, automatically reinvesting dividends can significantly boost your returns over time.

Related investing topics

Why automate your investments?

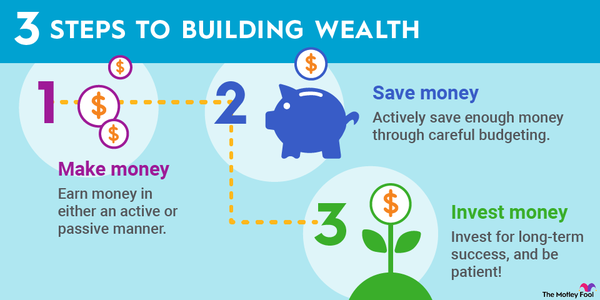

To assist with automating your investing strategy, you can always choose to meet with a financial advisor for guidance. While some people love actively managing their investments, others don't or lack the required time. Automating your investments pairs well with buy-and-hold investing, which is the surest path to building significant wealth over time.