Dividend investors haven't necessarily had the easiest time finding good deals over the past few years. Despite a relatively strong economy that's kept most dividend-paying companies strong and growing their payouts, historically low interest rates have caused many fixed-income investors to move to stocks instead, paying high premiums for the best dividend stocks.

But there are still solid deals to be found on some great dividend stocks. Three Motley Fool investors have identified Latin American lending specialist Bladex (BLX 1.30%), tech stalwart Cisco Systems, Inc. (CSCO 0.67%), and canned food giant Hormel Foods Corp. (HRL 1.00%) as dividend stocks that are great buys right now.

Money trees may not be real, but high-quality dividend stocks can be just as good. Image source: Getty Images.

If you're looking to invest soon, keep reading to learn what makes these three very different companies worthy of your capital. You might find that one or more is perfect for your portfolio right now.

When short-term weakness hides long-term strength

Jason Hall (Bladex): On the surface, it might seem like a great time to avoid Bladex, given it reported declining revenue in both its fiscal 2017 fourth quarter and fiscal 2018 Q1. The Panama-based bank saw a steep 38% drop in profits in the first quarter.

So how does Bladex make the cut as a dividend stock to buy? In short, because management is prioritizing high-quality lending over maintaining asset levels, and that bodes well for the long-term health of the bank and the sustainability of its future earnings, as well as keeping the dividend well-supported for investors.

BLX Dividend data by YCharts.

Lastly, Bladex's focus on Latin America augurs well for its long-term prospects, and a likely return to growth in the near future, especially when paired with an emphasis on credit quality that should pay off with reduced downside risk and fewer losses, especially during economic down cycles.

Put it all together, and Bladex's recent weakness belies both its long-term prospects and how its approach to high-quality lending should make it a stronger business to own. Combine what should be a solid long-term business with a 5.8% dividend at recent prices, and Bladex deserves a spot on dividend investors' short list. It's worked its way onto mine.

A core business that has relentlessly increased its shareholder rewards

Chuck Saletta (Cisco Systems): Since initiating its dividend back in 2011, Cisco Systems has regularly increased the amount it pays its shareholders quarterly. Its payment now stands at $0.33 per share per quarter, for a respectable 3% yield. Best of all for shareholders, that dividend payment is easily covered by the company's operating cash flow, which gives investors reason to believe those dividends can continue to grow over time.

What makes Cisco Systems worth considering as a purchase right now is the fact that its backwards-looking accounting earnings have been suppressed by a one-time hit from the Tax Cuts and Jobs Act. Cisco Systems took a whopping $11.1 billion one-time charge associated with that move, which threw it to an $8.8 billion accounting loss for the quarter ending in January.

Yet despite that accounting hit, Cisco Systems was able to increase its dividend by 14% and announce a $25 billion stock buyback program, showcasing the company's incredible cash-generating abilities. Shareholders buying Cisco Systems today get a business priced at around 15 times estimated forward earnings that is estimated to increase those earnings by around 9.4% annually over the next five years.

CSCO Dividend data by YCharts.

Furthermore, Cisco Systems has a healthy balance sheet that is easily capable of supporting both the dividend and the share buybacks even if operations don't grow as quickly as expected. That gives today's investors even more reason to believe it will be able to continue to reward its shareholders with cash for the financial risks they take by owning the business.

On sale despite the incredible dividend history

Reuben Gregg Brewer (Hormel Foods): Protein-focused food manufacturer Hormel has increased its dividend every single year for an amazing 52 consecutive years. Not only does that make it a Dividend Aristocrat, but this streak puts it in a league with companies like Procter & Gamble and Coca-Cola, at 61 and 56 years, respectively. However, these two consumer goods giants have increased their dividends in the mid single digits in recent years, while relatively tiny Hormel is still growing its dividend in the mid-teens.

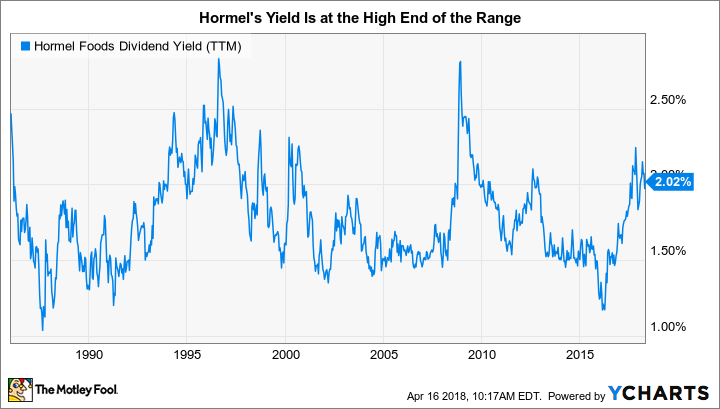

While Coke and P&G yield more than Hormel today, the disparate dividend growth shows why you shouldn't get too caught up in the absolute value of the yields here. But there's more: Hormel's dividend yield, at around 2.1%, is at the high end of its historical range. That suggests the company is on sale today.

HRL Dividend Yield (TTM) data by YCharts.

Part of the reason for the high yield is a shift in consumer buying habits. Hormel isn't sitting still, hoping things get better. It has been selling less compelling assets like Diamond salt and buying businesses that resonate more with its customers, like Wholly Guacamole. It's also pushing into higher-growth areas of the grocery store, like the deli. And it is looking to expand globally, which is only a small part of its business today, with investments in China and a foundational acquisition South America.

Some investors will look at Hormel and think its center-of-the-grocery-store portfolio is a problem. But when you step back and look at the bigger picture, this food manufacturer looks like a top dividend buy right now.