What happened

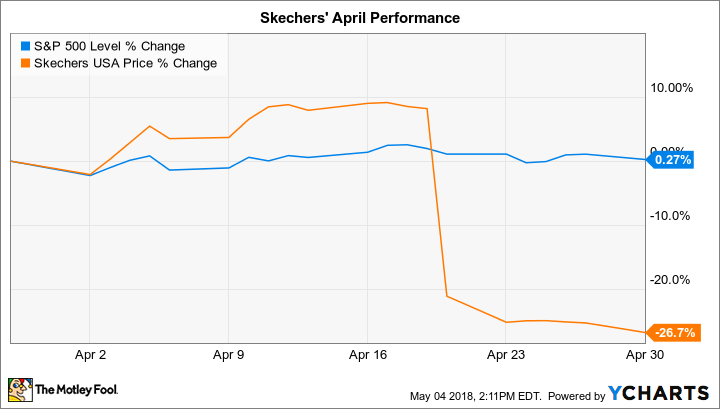

Shoe retailer Skechers (SKX -0.79%) fell 27% last month compared to a slight increase in the S&P 500, according to data provided by S&P Global Market Intelligence.

The decline erased much of the stock's recent gains to put it roughly level with the broader market over the past 12 months.

So what

April's slump came following a first-quarter earnings report that unnerved investors. While Sketchers reported healthy sales gains in both its domestic and international segments, and improving profitability, executives issued a cautious outlook for the current quarter that implied far slower growth on both the top and bottom lines.

Image source: Getty Images.

Management said the weak forecast was just an issue of order shipment timing, but many investors chose to believe it instead reflected mounting demand and profit pressures.

Now what

That mystery will be solved one way or the other over the next few months. But investors who believe that the slowdown isn't a reflection of deeper issues, particularly around Skechers' international growth plans, might consider picking up shares in what's become a much cheaper stock.

Sure, there's no guarantee that Skechers won't continue dropping. But current prices will look like an attractive buying opportunity in retrospect if growth indeed picks right back up following the second quarter.