If you are in retirement, you're probably looking for conservative, long-term stocks that offer notable income. International energy giant ExxonMobil Corporation (XOM 0.39%) fits that bill. The best part today is that investors have put this energy giant's stock on sale. Here's why Exxon is a retiree's dream stock right now.

A tough run opens up an opportunity

ExxonMobil stock has underperformed over the past year or so. The stock is down around 6% in the last 12 months, while most of its major competitors are up 20% or more. Peer Royal Dutch Shell is up a huge 33%! While it might be easy to suggest that Exxon has lost its way and should be avoided in favor of other oil majors executing better today, that would be a mistake. Exxon's low price has created an opportunity for retirees.

Image source: Getty Images.

For starters, Exxon's yield is over 4%. That's more than twice what you'd get from an S&P 500 Index fund. The dividend, meanwhile, has been increased annually for 36 consecutive years. That includes right through the recent oil downturn, a period that led to stagnant dividends, or even cuts, at some of Exxon's peers.

The most recent hike was 6%, announced in April. The company's 10-year average annualized dividend increase is around 8%. Both numbers are handily above inflation's historical growth rate of about 3%. With an above-market yield and dividend growth that expands your purchasing power over time, Exxon gets a check for the income component of a retiree dream stock.

What about safety?

That said, there's clearly a long-term risk to a company that makes its money extracting, processing, and selling fossil fuels. However, even as the world switches to alternative energy sources, oil and natural gas will remain a key part of the energy equation for decades to come. For example, the U.S. Energy Information Administration expects oil production to increase for another decade or two before leveling off. Natural gas production, meanwhile, will continue to expand out to 2050. Exxon has a long runway before fossil fuels are out of the equation.

XOM Financial Debt to Equity (Quarterly) data by YCharts.

Then there's the balance sheet, on which Exxon is carrying around $23 billion worth of debt. That's up from $6.5 billion at the end of 2013. However, Exxon is a large company, and even after that huge increase in leverage, long-term debt only makes up around 11% of the capital structure. That's a modest amount for any company. All in, there's little risk that Exxon is going out of business anytime soon.

It's falling behind... but working to catch up

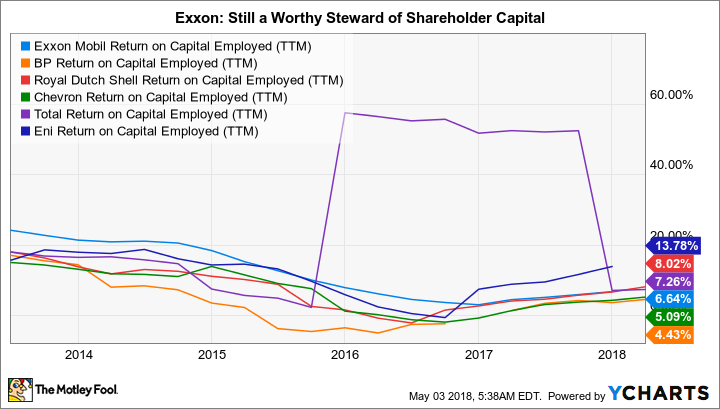

The issue that's gotten investors so concerned, though, is that Exxon appears to be falling behind its peers on some key metrics. Notably, production has been falling, and its return on capital employed has gone from leading the industry to just average. These are legitimate concerns, but they need to be looked at in a broader context.

For example, while production has been on the decline, Exxon is aware of the issue. It currently plans to increase its capital spending so it can expand its production in the onshore U.S. market, build deep-water projects in Guyana and Brazil, and invest in a natural gas project in Mozambique, among other things (it's also looking to increase its scale in the refining and chemicals areas). Production is an issue today, but management is working to fix the problem. Given enough time, today's production concerns will be addressed.

XOM Return on Capital Employed (TTM) data by YCharts.

As for return on capital employed, Exxon has gone from leading the pack to middle of the pack. That's a far cry from suddenly turning into a poor steward of shareholder capital. And like production, Exxon realizes it needs to do better. Its goal is to increase return on capital employed from the single digits to the mid-teens in the coming years. To get there, it will take greater control of its investments, focusing on being the operator of an asset wherever it can instead of just being a financial partner. Exxon has a long history of solid execution on giant, complex projects. There's no reason to doubt it can improve the trend, here.

An opportunity

There are clear problems at Exxon today. However, they are short term in nature at a financially strong company that has laid out a plan for improved results. Exxon is just a very large ship, and it takes time to turn it. If you are willing to give management the time it needs to make changes, you have an opportunity to collect a hefty 4% dividend yield backed by a growing dividend stream.

But just how big is the opportunity today? Exxon's price to enterprise value hasn't been this low since the 1980s. Big yield, long-term dividend growth, financially strong company, a plan to improve results, and a relatively cheap price -- that sounds like a dream stock to me.