Bank of America (BAC 1.70%) is packing up its bags for an extended stay.

The bank is bucking the trend of branch closures, as it's planning to open as many as 500 branches in new markets, many of them in the old stomping grounds of JPMorgan Chase's (JPM 1.44%) CEO, Jamie Dimon.

At its recent annual meeting, Bank of America outlined plans to expand in nine markets, five of which are JPMorgan Chase strongholds where the company has historically had the benefit of being the only megabank in town.

Some banking history

While Dimon has become the face of JPMorgan Chase, it's important to remember he came to the institution by way of Bank One, which was folded into JPMorgan in 2004. At the time, Chicago, Illinois-based Bank One was the sixth-largest institution in the United States, and their merger was then the third-largest merger in financials history.

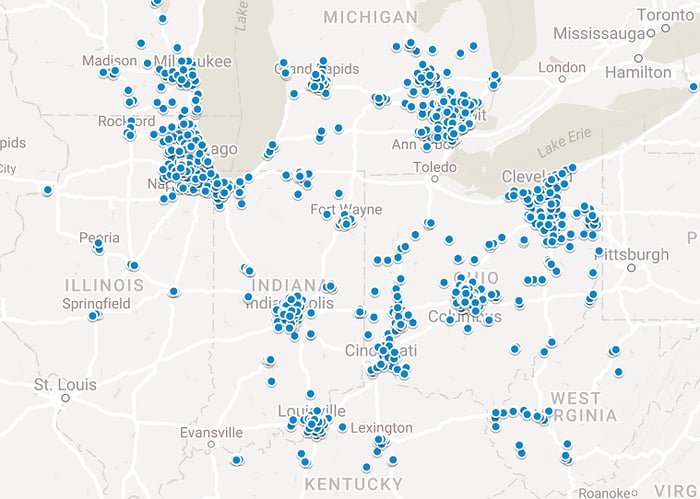

Image source: JPMorgan.com.

Bank One was a true "rust belt" bank. By deposits, it was the largest bank in Indiana and Illinois, with its headquarters in Chicago and mortgage and card operations in Indiana. It also ranked as the third-largest bank in Michigan and the fourth-largest institution in each of Ohio and Kentucky.

|

State |

Deposit Rank in 2003 (Bank One) |

Deposit Rank in 2017 (JPMorgan) |

|---|---|---|

|

Illinois |

No. 1 |

No. 1 |

|

Indiana |

No. 1 |

No. 1 |

|

Michigan |

No. 3 |

No. 1 |

|

Ohio |

No. 4 |

No. 5 |

|

Kentucky |

No. 4 |

No. 2 |

Data source: FDIC.

Much of the Bank One legacy lives on, even if under a new name. JPMorgan Chase has hundreds of offices littered across these five Midwestern states, ranking no lower than No. 5 by deposits in any given state.

Remnants of the Bank One legacy also appear in JPMorgan's core business lines. Its vast card business is owed in part to Bank One, which was the largest Visa issuer in the world when it merged with JPMorgan. The relationship between the card network and card issuer has only strengthened in the years since, as the Dimon-led institution inked a deal to effectively lease Visa's network as if it were its own.

Bank of America's trip to Dimonland

Charlotte, N.C.-based Bank of America has many of Bank One's legacy markets in its sights with its expansion plans. In Ohio, it plans to open new offices in Cincinnati, Columbus, and Cleveland. It's also taking aim at Lexington, Kentucky. In Indiana, the bank is opening branches in the capital city of Indianapolis.

JPMorgan has a substantial presence in each of these markets, thanks to its acquisition of Bank One nearly 15 years ago.

Data source: FDIC. Map by Author, using Google Maps.

While these metro areas are served by super-regional banks including PNC, Fifth Third, and U.S. Bancorp, JPMorgan is the only megabank competitor with a true retail operation. Just weeks ago, Wells Fargo decided to sell all of its branches in the Indiana, Ohio, and Michigan. Citi, of course, sticks to the coasts, and doesn't have the retail operation that the other "big four" banks do.

The last frontier for growth

It was only a matter of time until the nation's largest banks started looking inland for growth. The largest U.S. banks, and particularly Bank of America, have generally focused on the largest 20 metropolitan statistical areas (MSAs). Cincinnati, Columbus, Cleveland, and Indianapolis are ranked No. 29 to No. 34 by population, according to U.S. Census estimates.

Given their size, de novo branching is the only way for America's megabanks to grow. The law prohibits banks from acquiring others when they control more than 10% of the nation's deposits. So as smaller banks are rapidly acquiring and merging with one another to scale their operations, Bank of America has to grow the old-fashioned way by opening new branches in new markets.

To be sure, Bank of America won't change the Midwestern banking landscape overnight. And while JPMorgan Chase and smaller regional banks would prefer not to compete with yet another financial institution, Bank of America's entry serves as validation that Dimonland is a good place for a bank to be.