It's been a long time coming, but Dividend Aristocrat Illinois Tool Works' (ITW 0.13%) stock is starting to look attractive from a valuation perspective. Alongside the stock of multi-industry peer 3M Company, Illinois Tool Works' stock has fallen this year amid fears of a cyclical slowdown in some of its segments and pressure on its margin from rising raw material costs. However, according to the company's guidance, the industrial equipment producer is set for a strong year, and the dip looks like it could provide a good entry point for long-term investors.

The long wait for Illinois Tool Works' stock to move into value range may be coming to an end. Image source: Getty Images.

Why the valuation looks attractive

As you can see in the chart below, the mid-teens decline in the stock price means that its valuations -- especially the enterprise value (market cap plus net debt)-to-earnings before interest, tax, depreciation and amortization (EBITDA) ratio -- are moving into attractive territory.

ITW EV to EBITDA (Forward) data by YCharts.

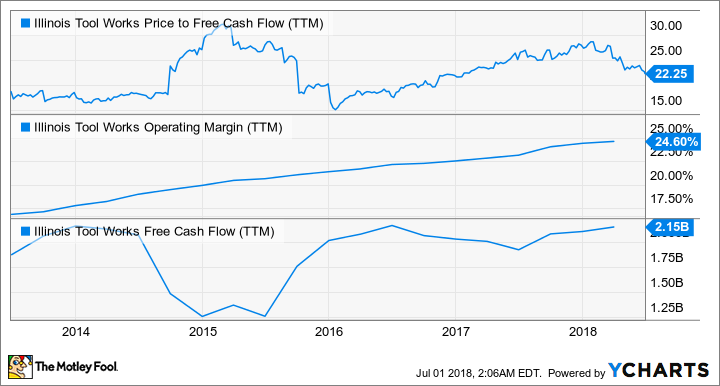

Moreover, Illinois Tool Works has been on a multiyear drive to improve operating margin through its enterprise strategy, a series of "self-help" initiatives that include focusing on selling its most profitable products, new sourcing initiatives, and applying the so-called "80/20 front to back process," wherein the company focuses on the top 20% of its customers because they tend to provide 80% of its business.

As a consequence, operating margin and free cash flow (FCF) have improved and management expects to convert more than 100% of its net income to FCF in the 2018-2022 period. Based on the company's EPS guidance for 2018, my calculations put Illinois Tool Works on a forward price-to-FCF ratio of around 17.9 -- and as you can see below, that's a historically attractive figure.

ITW Price to Free Cash Flow (TTM) data by YCharts.

So the stock looks like a good value. But why has it sold off this year?

Why the market is selling off Illinois Tool Works

It seems odd to talk about the declining stock price of a company that actually raised its full-year EPS guidance range (from $7.45-$7.65 to $7.60-$7.80) in its first-quarter earnings presentation.

On the other hand, there were a few areas of concern:

- First-quarter organic revenue growth came in at 3%, but the company's forecast for full-year 2018 is for 3%-4% growth -- something to look out for in future quarters.

- Like 3M Company, Illinois Tool Works has faced margin pressure from rising raw material costs for items such as steel.

- There are weakening trends in some key end markets, such as automotive and food equipment, and concerns that the construction market could slow.

Illinois Tool Works' margin

The margin pressure from rising costs is obviously a concern, but there are two factors to consider. First, as noted in the first-quarter earnings release, "While price/cost impact was dilutive to margin percentage, on a dollar basis pricing actions more than offset the impact of raw material cost inflation." In other words, the negative contribution from price/cost (see chart below) could easily turn positive if exchange rates move in Illinois Tool Works' favor.

Second, the enterprise strategy initiatives have driven margin expansion in recent years, as shown in the chart below. At the electrical products group conference in May, the company's vice chairman, Chris O'Herlihy, claimed there was more runway to come: Management continues to expect 100 basis points of margin expansion from these initiatives in 2018 (100 bp equals 1%).

Data source: Illinois Tool Works presentations. Chart by author.

End markets weakening

The following chart of organic revenue growth by segment demonstrates some of the key trends to look out for in 2018. On a positive side, welding and the test and measurement and electronics segment are seeing a cyclical upswing, driven by the recovery in U.S. industrial production.

However, the key concerns relate to slowing global automotive production, a weak U.S. food equipment market, slow automotive aftermarket (seen in the polymers and fluids segment), and the possibility that the construction market has passed its peak.

Data source: Illinois Tool Works presentations. Chart by author.

The company has demonstrated an ability to grow automotive original equipment market (OEM) sales more than the market, but worldwide auto builds declined 1% in the first quarter and the segment's organic growth was a disappointing 1%. Meanwhile, a weak automotive aftermarket in the U.S. led to flat organic growth in polymers and fluids. (3M Company also cited weak aftermarket sales to explain its disappointing first-quarter earnings.)

Turning to food equipment, Dover reported a horrible 7% organic revenue decline in its refrigeration and food equipment sales in its first quarter, and Middleby's organic sales also decreased 7% in its first quarter.

What it means for investors

There's little doubt that the company faces headwinds in some of its segments in 2018, but ultimately the question boils down to whether they are going to be near-term problems or lasting ones.

If they are temporary -- and history suggests employment gains usually support consumer spending on cars, dining out, and housing -- then the dip is a good buying opportunity in a dividend investor favorite. Moreover, the company's self-help initiatives should deliver margin expansion again this year. Just be aware that the near-term headwinds may well cause a reduction in earnings expectations for 2018.