What happened

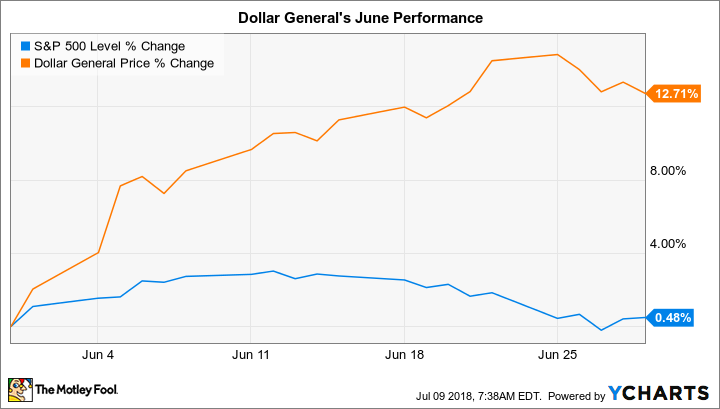

Discount retailer Dollar General (DG -1.36%) outpaced the market last month by gaining 13% compared to a less-than-1% increase in the S&P 500, according to data provided by S&P Global Market Intelligence.

^SPX Price change. Data source: YCharts.

The rally lifted shares into modestly positive territory for 2018, and the stock is up significantly against the broader market in the trailing five-year and 10-year periods.

So what

Investors responded positively to the retailer's first-quarter earnings report that was released on the last trading day of May. That announcement showed a 9% sales increase, driven by a rising store base and 2% higher sales at existing locations.

Image source: Getty Images.

Dollar General posted slower revenue gains and a small drop in profitability as customer traffic turned slightly negative, but these challenges were mostly weather-related.

Now what

CEO Todd Vasos and his team said that the fiscal second quarter is off to a strong start and so they saw no reason to lower their sales or profit targets for the full year. Instead, they affirmed a 2018 outlook that calls for overall revenue gains of about 9% and significantly higher earnings thanks in part to lower tax expenses. Investors can expect those returns to be amplified by aggressive stock repurchase spending and a steadily climbing dividend.