What happened

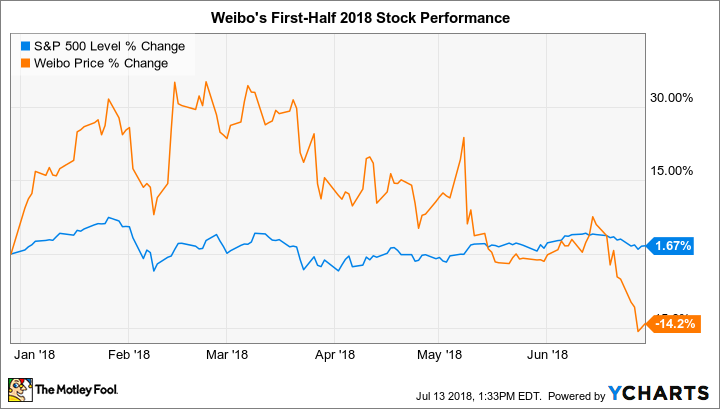

Shares of the Chinese social network specialist Weibo (WB 0.66%) trailed the market through the first six months of 2018 by shedding 14% compared to a 2% uptick in the S&P 500, according to data provided by S&P Global Market Intelligence.

The decline removed just a small part of the significant gains that shareholders have seen lately, and the stock remains up nearly 500% over the past five years.

So what

This year's slump came following a first-quarter earnings report that, while strong, failed to meet investors' high expectations. Weibo announced in early May that sales had spiked 79% as it added 70 million people to its service to push its active user base to 411 million. By comparison, Twitter's user pool is 336 million, and it increased by just 6 million in the most recent period.

Image source: Getty Images.

Now what

Weibo continues to benefit from favorable industry trends and demographics that together are pushing advertising sales far higher. Executives' latest forecast, for example, calls for sales to rise by about 70% to between $420 million and $430 million in the second quarter.

That success has pumped plenty of optimism into the valuation of this stock, so investors should brace for more volatility ahead in the share price.