Major business shifts have been taking shape at Calumet Specialty Products Partners, L.P. (CLMT -0.51%) and Ashland Global Holdings Inc. (ASH -1.30%). Overall, both of these chemical and refining companies have been changing for the better, but investors need to carefully consider the moves being made and, equally important, the foundation supporting the changes. That last point helps explain why Ashland is the better option for most investors today. Here's what you need to know to understand why.

OK, that hurt

Calumet Specialty Products is a limited partnership, a corporate structure designed to pass income on to investors. Only the distribution was eliminated in 2016, which is never a good sign for a limited partnership and clearly a painful event for unitholders to bear. But it's an important sign of the times for the refining and chemical industry.

Image source: Getty Images.

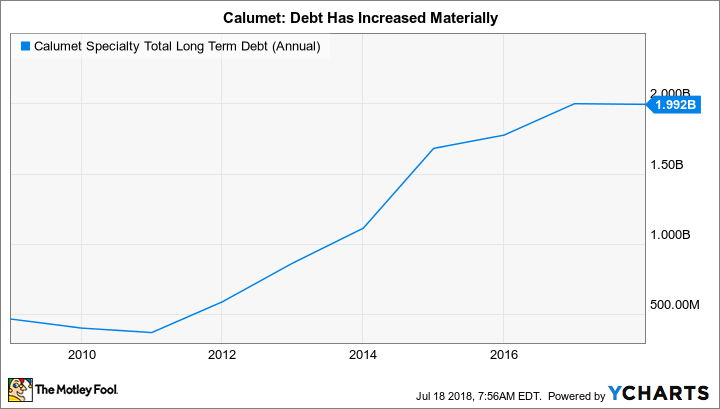

The cut was largely driven by leverage taken on to support acquisitions. Calumet's long-term debt increased from $400 million at the end of 2010 to nearly $2 billion at the end of 2016, a fivefold boost in roughly five years. While revenue jumped about 65% between 2010 and 2016, the partnership's bottom line has fallen deeply into the red. It has lost money in each of the last five years. Interest expenses growing by more than five times over that span certainly didn't help.

The distribution cut signaled management's dedication to getting the partnership back on the right track. That has notably included shifting toward higher-margin chemicals over refined commodity products like gasoline. And, as you might expect, reducing debt. At this point, long-term debt has fallen to around $1.6 billion. That's a big improvement, but debt is still a heavy burden for the partnership. First-quarter interest expense, for example, was only down 4% sequentially from the fourth quarter and was actually up 2% from the year-ago period. The company's trailing times interest earned ratio, which compares interest expense to earnings before interest and taxes, in the first quarter was just 0.8 times. In other words, it still isn't covering its interest costs.

CLMT Total Long Term Debt (Annual) data by YCharts.

To be fair, Calumet has been making good progress in its turnaround effort. Investors, meanwhile, rewarded the units for this success with a huge 90% price advance in 2017. The units have flatlined so far this year, however, which hints at the fact that, despite progress, Calumet still has more to do. This remains a turnaround story bogged down by a heavy debt load. Most investors should avoid it until more progress has been made, with the resumption of a distribution signaling that it might be time for a reexamination.

Half the company it used to be

The big change at refiner Ashland was the spinoff of the company's Valvoline oil change business in mid-2017. That makes the company's historic reported revenue look a little frightening, with a decline of 34% between the calendar first and second quarters of 2017. The move to spin off Valvoline was made so that both companies could focus on their core businesses, which are vastly different in nature.

The transaction happened less than a year ago, meaning that investors will have a more apples to apples comparison of its financials once we have more than a year of results. However, the company's debt levels have never been as onerous as those hampering Calumet. Debt fell after the spinoff, too, as you might expect, since Valvoline took on some of the combined company's debt. That said, Ashland's trailing times interest earned figure in the most recent quarter was 1.3 times. Note also that earnings had only dipped into the red once in the last 10 fiscal years, and the company just upped guidance for the current fiscal year. Things are going pretty well right now.

ASH Revenue (Quarterly) data by YCharts.

So, on the whole, Ashland is working off a more solid financial footing than Calumet and results have been improving recently, but the changes aren't over yet. For example, it expanded its reach in Europe with an acquisition shortly after spinning off Valvoline. It also augmented its position in the growing nutraceuticals market via an acquisition in 2017 that it further integrated into its business this year when it combined some of its existing operations with those of the acquired company. That sets up the big one: Ashland recently announced that it's evaluating an even larger shift toward specialty chemicals, with plans to consider selling a European facility and its composites business.

Although there's still change afoot at Ashland, its strengthening financial results and stronger financial position make it the better choice for most investors than Calumet. That said, conservative types might still want to avoid the uncertainty of the continuing business overhaul by sitting on the sidelines until Ashland has made a final call on the composites business.

Change is hard

Big corporate moves are never easy. However, they are much easier to make from a position of financial strength. That's the overarching story here and why most investors should avoid Calumet in favor of Ashland. Still, any change brings uncertainty, so conservative investors might be better off avoiding both of these refiners right now, since Ashland doesn't appear to be done with its corporate overhaul just yet.

{%sfr}