The energy industry is booming, from domestic natural gas production to global oil prices. That's good news for investors.

But the stock market's caught on, and that means that a lot of energy stocks have already climbed by double digit percentages this year. That's not so good for investors looking to buy into the industry, because it makes it tougher to find solid investments at attractive valuations.

We asked three Motley Fool investors what energy stocks they think are still good buys right now. They picked Enterprise Products Partners (EPD 0.03%), Cheniere Energy Partners LP (CQP -0.75%), and ConocoPhillips (COP 0.14%) as stocks that are likely to outperform. Here's why.

The energy industry is booming, and these three companies are poised to benefit. Image source: Getty Images.

Performance plus safety

John Bromels (Enterprise Products Partners): Sure, a lot of energy companies are looking good right now, but what if oil and gas prices suddenly plummet, like they did back in 2014? Would your energy investment be able to weather the storm? Well, pipeline operator Enterprise Products Partners has a history of doing just that, but also has a compelling growth story that won't leave investors behind if the boom continues.

First of all, Enterprise's current 5.9% distribution yield will reward investors quarter in and quarter out. And that distribution is likely to continue to grow, thanks to Enterprise's excellent distribution coverage -- fully 1.5 times in the first quarter -- and a decade-long history of providing quarterly distribution increases, even during the Great Recession and the oil price slump of 2014-2017.

Often, "safe" companies aren't well positioned to grow, but that isn't the case with Enterprise. Not only is the company constantly bringing new projects on line -- including the new ECHO pipeline, which has a 475,000 barrel/day capacity -- but it also has about $5.3 billion of additional projects currently under development that should come on line within the next two years, fueling further growth.

Offering safety and performance at a valuation that's in line with the company's historical trends, Enterprise Products Partners looks like a great candidate to add to your energy portfolio right now.

The most lucrative way to invest in U.S. natural gas

Tyler Crowe (Cheniere Energy Partners LP): The ability to unlock oil and natural gas from shale formations has completely transformed the U.S.' prospects as an energy-producing country. So, investors have searched far and wide to find ways to invest in this booming business. Here's the challenge, however. Even though we are producing more and more natural gas, the price at which natural gas sells isn't that lucrative for producers. If you want to find a way to make money in the natural gas business, look further down the value chain to natural gas exporter Cheniere Energy Partners.

Perhaps the most attractive aspect of Cheniere's business is that it has revenue contracts in place that guarantee a significant portion of the company's liquefied natural gas (LNG) facility will have customers. More than 85% of the capacity of the Sabine Pass LNG facility in Louisiana is secured with long-term, take-or-pay contracts with fixed charges that isolate a large portion of the business from commodity prices. As construction at the facility finishes up, this will ensure that cash flows are relatively steady for a long time and will enable the company to pay its rather generous distribution, which yields 5.2% today.

What's even more encouraging is that demand for that other 15% of the facility's capacity has been high lately. So much so that parent company Cheniere Energy's (LNG -0.64%) business of buying cargoes of LNG from the partnership at fixed prices and selling them at market rates has blown past expectations.

With another liquefaction production train under construction that will add 20% to its total capacity and an additional train in the planning phase, Cheniere Energy Partners earnings aren't going to cap out with the completion of its initial construction. With a stock reasonably priced today with these additional revenue streams coming down the pipe, Cheniere Energy Partners looks like one of the most sure-fire bets in America's booming natural gas landscape.

The fuel to continue riding high

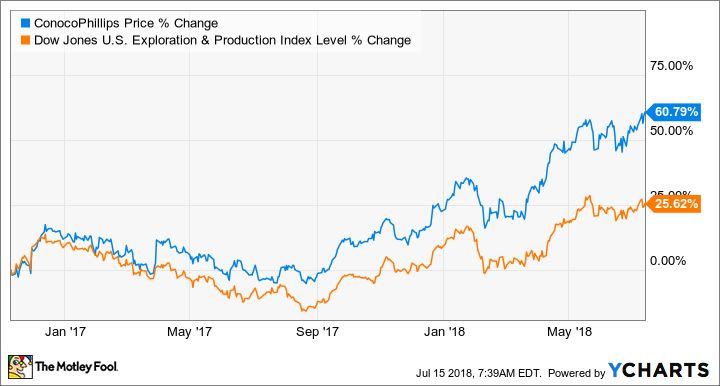

Matt DiLallo (ConocoPhillips): Oil giant ConocoPhillips has been one of the best-performing oil stocks this year. While higher oil prices have helped fuel some of those gains, what has shifted its stock into overdrive is its share buyback program. That's evidenced by the fact that ConocoPhillips has significantly outperformed other oil stocks since announcing its initial repurchase program in late 2016.

Even after that run, the company's CFO, Don Wallette, said on last quarter's conference call: "We think our stock is well undervalued and has a lot of upside to it." CEO Ryan Lance recently reiterated that belief by saying they "still see upside potential for our shares." Lance made those comments earlier this month while announcing that the company would significantly bolster its buyback. For 2018, ConocoPhillips now expects to repurchase $3 billion in stock, which is 50% more than the recent authorization and double the initial level. On top of that, the oil giant added another $9 billion to the overall program, boosting it to $15 billion in total, which is enough money to retire 20% of its outstanding stock from the starting point in late 2016.

Those future share repurchases should provide ConocoPhillips' stock with the fuel it needs to continue outperforming rivals, especially since the company will combine the buyback with a returns-focused investment plan that should steadily increase cash flow. That upside potential makes its stock one of the top buys in the oil patch right now in my opinion.