While many energy giants have created master limited partnerships (MLP) to exploit tax advantages and protect profits, a significant number of these stocks simply have not delivered market-beating returns to unitholders over the years. Much of that can be chalked up to the complexity of energy markets, but in mid-March 2018 changes were proposed to how pipeline MLPs structured the rates charged to customers. That eroded the advantages of partnerships enough to force many parent companies to devise plans to roll up their MLPs under one roof.

Well, those plans may be headed to the scrap heap now.

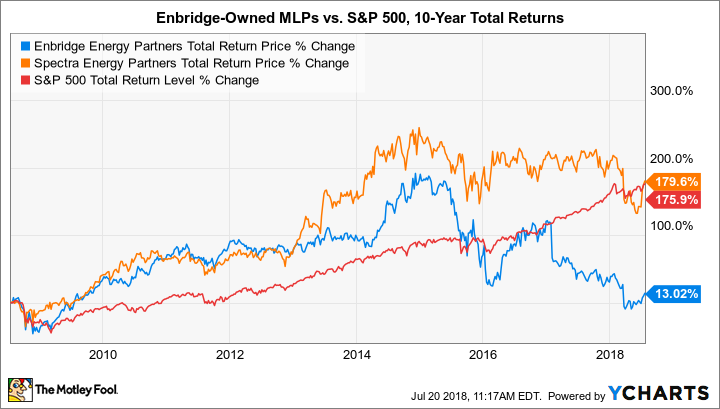

On July 18, regulators proposed a new ruling that could make MLPs viable once again by providing a way to mitigate the rule change from March. That could throw a wrench into Enbridge's plans to simplify its operating structure, specifically affecting the fates of Enbridge Energy Partners (EEP) and Spectra Energy Partners (SEP), which it owns 35% and 83% of, respectively. If these partnerships continue trading as separate entities, then one is actually a better buy than the other.

Image source: Getty Images.

The matchup

Enbridge Energy Partners is a nearly $5 billion company focused on midstream operations, including crude oil pipelines and storage in the United States. The business is a favorite of income investors thanks to its 12.9% distribution yield, which is supported by healthy cash flows. In the first quarter of 2018 the company reported $592 million in revenue and $212 million in distributable cash flow.

But the future became much less certain in mid-March when the Federal Energy Regulatory Commission (FERC) announced MLPs could no longer tack on a fee covering income taxes to the rates charged to customers using certain types of pipelines. The abrupt change to the long-standing rule caused chaos, with Enbridge Energy Partners stock falling by double digits. Management originally stated the rule change would have a modest effect on the business, but later noted it would lower distributable cash flow for the year by $125 million, or 17% from the midpoint. So if the FERC rule announced in July creates a way to mitigate the lost tax allowance, then investors may want to dust off that original guidance.

Management originally prepped investors to expect full-year 2018 distributable cash flow of $745 million at the midpoint and distribution coverage of 1.15 times. Combined with organic growth and balance sheet management, the company could sport a debt to EBITDA ratio of 4.0 by 2020, down from 4.5 at the end of 2017. That would help to make its nearly 13% distribution even more sustainable.

EEP Total Return Price data by YCharts

Spectra Energy Partners is a nearly $18 billion midstream giant that owns over 15,000 miles of pipelines, 170 billion cubic feet of natural gas storage, and 5.6 million barrels of crude oil storage. In fact, it's one of the largest MLPs in the United States, and it generates over 90% of all revenue from fee-based agreements. How badly was the business affected by FERC's rewriting of the tax allowance rules for pipeline operators?

Surprisingly little, judging from full-year 2018 guidance. The company expects to deliver $1.65 billion in distributable cash flow, maintain 1.1x to 1.2x distribution coverage, increase its distribution each quarter, and end the year with a debt to EBITDA ratio under 4.0. Unlike its peer, Spectra Energy Partners didn't change its guidance when first-quarter 2018 results were discussed. But it still has beef with FERC.

On the fourth-quarter 2017 earnings conference call, management stated that the business might have to eat $110 million to $125 million in unmitigated impacts to revenue and distributable cash flow from losing out on accumulated deferred income taxes (ADIT) due to impacts from U.S. tax reform. Spectra Energy Partners is actively negotiating with FERC to be paid back for the ADIT it has contributed over the years and, if successful, it would be able to lift its full-year 2018 guidance, which currently accounts for the impact.

Either way, it's important to note that the up-to-$125 million impact amounts to just 7% of total annual distributable cash flow for the larger partnership. Beyond that, it has $2 billion in expansion projects coming online in 2018 that could help to grow the distribution up to 6% per year through 2020 and lift annual cash flow $1.8 billion in 2020.

Image source: Getty Images.

By the numbers

Both Enbridge Energy Partners and Spectra Energy Partners clearly stand to benefit from decisions made by FERC. While the larger partnership didn't appear to be greatly affected by removing the long-standing tax allowance rule on pipeline operators, it still received an offer to be wrapped up into the operations of parent company Enbridge. That could still happen, but if the new loophole announced in July thwarts those plans, then there's a case to be made for the nearly $18 billion company being the better buy. Here's how the two MLPs stack up side by side.

|

Metric |

Enbridge Energy Partners |

Spectra Energy Partners |

|---|---|---|

|

Market cap |

$4.77 billion |

$17.7 billion |

|

Dividend yield |

12.9% |

8.5% |

|

10-year total return |

9.6% |

176.8% |

|

Forward PE |

15.8 |

12.1 |

|

Debt to EBITDA |

4.3 |

4.1 |

|

Total debt |

$6.7 billion |

$8.6 billion |

|

Available liquidity |

$1.4 billion |

$1.0 billion |

Source: Yahoo! Finance.

As the table above clearly shows, Spectra Energy Partners is more favorably valued on the basis of its debt and future expected earnings. Importantly for investors, it has absolutely walloped the long-term total returns of its smaller peer Enbridge Energy Partners and almost exactly matched the total returns of the S&P 500 in that span (barely beating the index, in fact). While it pays out a slightly lower yield, there's not much to complain about with a 8.5% distribution. Besides, what good is a 12.9% yield if the investment only returns about 10% in the span of a decade?

Image source: Getty Images.

The better buy is...

Spectra Energy Partners is the better buy in this matchup. The company has used and can continue to use size to its advantage by tapping into growth opportunities and mitigating regulatory uncertainty. If it remains a separately traded entity (albeit with only 17% of its units on the public market), then investors may not want to overlook it.

However, considering there's still plenty of uncertainty about what, exactly, Enbridge will do regarding its partnerships, investors likely are better off waiting for more clarity on the fate of these (and a handful of other) MLPs. That could come in the first week of August when both partnerships report second-quarter 2018 earnings.