Shares of gold mining companies Yamana Gold (AUY) and Eldorado Gold (EGO -0.40%) are moving in opposite directions after their recent second-quarter earnings releases. As a matter of fact, that's how it has been for the two gold stocks in the past one year, with Yamana gaining almost 22% as of this writing even as Eldorado turned out to be the worst-performing gold stock in the one-year period through June.

But before you decide which gold stock to buy now, it's important to see where Eldorado and Yamana see themselves headed for the rest of the year and beyond, and the valuations at which the stocks are currently trading. The latter, in particular, will shock you.

Which gold miner fared better in Q2?

Let's first check how Yamana Gold and Eldorado Gold performed in their respective second quarters. We have some really interesting numbers here (all year over year).

Yamana Gold:

- Gold production up 1.4%.

- Revenue up 0.7%.

- Net income of $18 million versus a loss of $39.9 million in the year-ago period.

Eldorado Gold:

- Gold production up 56%.

- Revenue up 85%.

- Net loss of $24.4 million versus a profit of $11.2 million in the year-ago quarter.

What just happened there? Yamana's revenue was flat, but it turned its losses around to healthy profits. Eldorado did the reverse, incurring a huge loss despite a stunning recovery in sales. One company is evidently managing its costs better than the other.

While greater production from Eldorado is hugely encouraging, higher costs -- right from production, operating, mine standby, and asset writedowns, to stock and pension-related -- punctured its bottom line. Eldorado's all-in sustaining cost (AISC) jumped 10% to $934 per ounce of gold.

Image source: Getty Images.

Yamana Gold, on the other hand, displayed remarkable cost efficiency last quarter, cutting down its co-product AISC by roughly 4% to $837 per gold ounce. Yamana's silver and copper production also came in higher than expected during the quarter, driving its gold equivalent ounce production up by nearly 7% year over year.

That pretty much explains why the two stocks moved in opposite directions post-earnings. But with both Eldorado and Yamana upgrading their full-year guidance, could things look any different in the near future?

Eldorado Gold has an update on Greece, and it's not what you want to hear

Eldorado upgraded its fiscal 2018 production guidance by 8% at the midpoint to 330,000-340,000 ounces. That sounds great, and speculators might want to try their luck, but for long-term investors, Eldorado's biggest risk remains as-is: an uncertain future for its largest mine, Kisladag in Turkey.

To be fair, Eldorado had already warned investors about low gold recoveries from Kisladag last year. The company is mulling an alternative mining process, but production won't pick up before 2020.

| Kisladag mine | 2018 | 2019 | 2020 |

|---|---|---|---|

| Production guidance (gold ounces) | 140,000-150,000 | 40,000-50,000 | 20,000-25,000 |

| Cash cost guidance (per ounce of gold) |

$700-$800 | $900-$1,000 | $600-$700 |

Data source: Eldorado Gold financials. Table by author.

Meanwhile, Eldorado's latest statement on Greece sounds unconfident and cautious:

Eldorado continues to engage the Greek government in discussions concerning the outstanding permits required to advance the Skouries project. However, the Company is unable to provide guidance as to when the permits may be issued. The Company is evaluating its legal options in this regard.

That's not what investors want to hear; they were waiting for a positive update after the Greek government announced intentions to resolve its standoff with Eldorado within "weeks" in May. Eldorado now mulling "legal options" raises further questions. As the company elaborated, it requires "collaborative government dialogue and a clear line of sight to free cash flow" to develop Skouries, one of its key projects in Greece.

One might argue that Eldorado has other projects, like Efemcukuru in Turkey, Lamaque in Canada, and Olympias in Greece, to fall back on, but I'll leave you with a final thought to ponder: Eldorado foresees its gold production to hit 600,000 ounces by 2021, but only if its Kisladag plan succeeds. Otherwise, even with Lamaque, Eldorado's production would be around 300,000 ounces in 2021, at best.

Yamana Gold is exceeding its own expectations, and the stock's still cheap

In a recent article about Yamana Gold, I outlined three promising areas that the market was overlooking. The miner delivered on all three fronts last quarter: rising production, falling costs, and healthy cash flows.

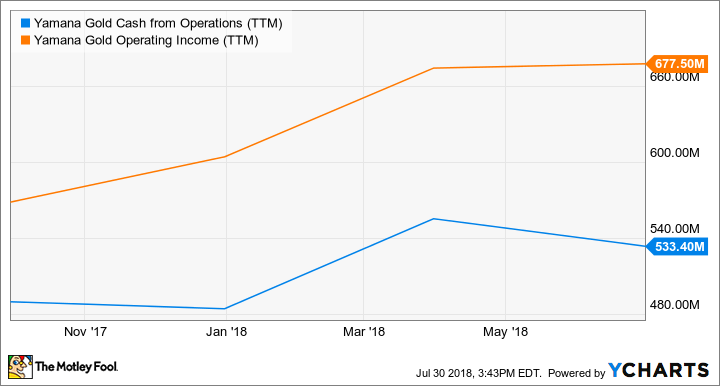

AUY Cash from Operations (TTM) data by YCharts.

With its low-cost seventh mine, Cerro Moro, rapidly ramping up, Yamana now expects to "exceed" its full-year gold production guidance of 900,000 ounces. That positions the miner for strong growth at favorable costs in coming years, as it highlighted in its latest corporate summary report.

GEO = Gold equivalent ounces. Image source: Yamana Gold.

With production plans in place, Yamana Gold's management now plans to prioritize maximizing returns on capital invested and cash flows in the coming quarters. If the company can return to positive free cash flows, it will be one of the strongest gold-mining stocks in the industry from all aspects, right from production to costs to financials.

Would you believe, then, that Yamana Gold is trading at only 5.6 times price to operating cash flow, or less than one-third the valuation Eldorado Gold shares are commanding right now? That should make it really easy for you to choose between Eldorado Gold and Yamana Gold.