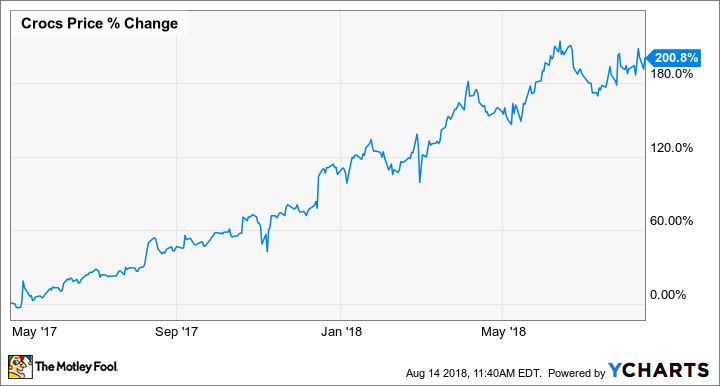

After coming so far, so fast over the past year, Crocs' (CROX -0.45%) latest earnings report seemed to throw its turnaround efforts in doubt.

Its chief financial officer is resigning, and it's closing the last of its company-owned manufacturing plants, leading some to initially think the business itself was getting ready to shut down. But Crocs' turnaround is here to stay.

Data by YCharts.

Smaller is better

The near tripling of the stock's value notwithstanding, the footwear company's improved fortunes have been a long time coming. First started in 2014, the turnaround really began to take shape this year, as Crocs started showing sales growth on a consistent basis, notching 4% growth in its fiscal fourth quarter of 2017, followed by 1% and 2% gains in the first and second quarters of 2018, respectively. Profit margins also continued to improve.

The sales growth has come about despite the continued closure of retail stores, totaling nearly 50 over the first six months of the current fiscal year and well over 100 last year as Crocs has been focusing more on online sales. Just under 400 stores remain.

Now Crocs is closing down the last of its manufacturing facilities, one in Mexico and the other in Italy, as it switches over completely to third-party production. That shouldn't be a hindrance to continued improvement, because it already contracted out most of its production to third-party manufacturers, primarily in China and Vietnam. Over the past three years, Crocs has not produced more than 15% of its own footwear.

Image source: Getty Images.

Kicking sales higher

The footwear maker has targeted clogs and sandals as its growth market, and CEO Andrew Rees said both silhouettes continued to perform well in the second quarter. Previously, he identified the clog market as a $4 billion opportunity worldwide, where Crocs was already a leader, while sandals were estimated to be $23 billion globally.

Crocs' clog revenue rose 11.4% in the quarter and represented 52% of total footwear sales, and sandals jumped almost 18% to comprise 26% of sales. Both put up similar results in the first quarter. E-commerce revenue was up 23.8% in the period, its fifth-straight quarter of double-digit growth, while wholesale was up 7%.

When you look at Crocs' combined retail and e-commerce results, direct-to-consumer comparable sales rose nearly 12%, marking the fourth consecutive quarter of rising comps. By selling its manufacturing plants and going 100% to outsourced production, Crocs says it can meet the growing demand for its footwear, because capacity is higher.

Key investment takeaway

It's quickly becoming apparent that a smaller Crocs is a better Crocs, one that can manage its costs more effectively while achieving the sort of growth numbers it needs. And though the resignation of a senior executive can create uncertainty, Crocs' CFO has arranged for an orderly transition and will be around until Apr. 2019. Moreover, the footwear maker has already found a capable replacement -- someone who worked for Crocs previously before leaving to work at Amazon.com's online shoe seller, Zappos.com. Considering Crocs' renewed focus on e-commerce, it looks like a good fit.

Despite the initial chaos created by the twin announcements, investors can feel confident that Crocs is on more solid footing than it has been in a long time, and the turnaround they've been waiting for is here in full swing.