Walt Disney (DIS 1.17%) and Netflix (NFLX 3.05%) have both delivered fortune-creating returns to their long-term shareholders. But which of these stocks should investors buy today?

Competitive positioning

Netflix is a beneficiary of two powerful trends. The first is cord-cutting, whereby consumers are canceling their expensive cable subscriptions in favor of cheaper streaming options. And the second is the stay-at-home trend, in which many people are increasingly choosing home-based activities rather than going out (such as binge-watching Netflix instead of going to the movies).

With these two powerful tailwinds propelling its growth, Netflix can seemingly do no wrong in the eyes of investors. The stock has crushed the market in recent years as its subscriber count, revenue, and profits all exploded higher. And with CEO Reed Hastings predicting another two decades of strong growth for internet-based TV, it's not hard to see why bulls expect more gains in the years ahead.

Disney, however, finds itself in a difficult position: Moving aggressively into streaming could accelerate losses in its cable networks, but failing to do so could result in competitors -- like Netflix -- building an insurmountable lead. It's a classic innovator's dilemma, and some, such as my colleague Jeremy Bowman, argue that Disney has failed to take the proper actions in this regard.

Still, Disney did recently release a new ESPN-branded streaming service, and the company plans to launch a Disney-branded streaming service in 2019. Additionally, Disney's pending acquisition of Twenty-First Century Fox's (FOXA) (FOX) entertainment properties will give Disney a 60% stake in fast-growing streaming service Hulu. In turn, Disney believes that offering a reduced-price bundle to consumers who want all three of these services could help it quickly gain subscribers, though time will tell if this will be the case.

All told, with its incredible collection of brands, characters, and storylines, Disney is an entertainment powerhouse. But it's clear that the world is moving toward streaming video and away from traditional cable TV. In light of that, I'd argue that Netflix is better positioned to profit from this long-term global trend.

Advantage: Netflix

Cord-cutting is a boon for Netflix and the bane of Disney. Image source: Getty Images.

Financial strength

Let's now take a look at some key financial metrics to see how Disney and Netflix stack up.

|

Metric |

Disney |

Netflix |

|---|---|---|

|

Revenue |

$57.91 billion |

$13.88 billion |

|

Operating income |

$14.38 billion |

$1.36 billion |

|

Net income |

$12.02 billion |

$0.99 billion |

|

Operating cash flow |

$14.01 billion |

($1.66 billion) |

|

Free cash flow |

$9.85 billion |

($1.78 billion) |

|

Cash and investments |

$4.33 billion |

$3.91 billion |

|

Debt |

$23.67 billion |

$8.34 billion |

Data sources: Morningstar, Yahoo! Finance.

Interestingly, Netflix arguably has a stronger balance sheet with only $4.4 billion in net debt, compared to more than $19 billion for Disney. However, Disney's revenue and profits dwarf those of Netflix. Moreover, Disney is a cash-generating machine, with operating and free cash flow of $14 billion and $10 billion, respectively, over the past year. Netflix, on the other hand, has produced negative cash flow during this time, as the company ramps up its spending on content. Thus, Disney has the edge when it comes to financial fortitude.

Advantage: Disney

Growth

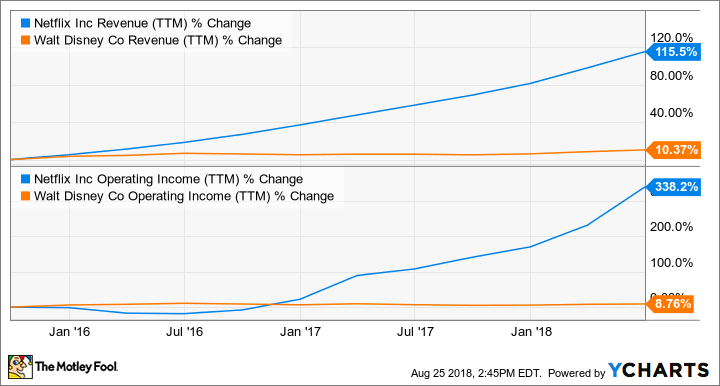

Disney may be more financially powerful, but Netflix is growing much faster.

NFLX Revenue (TTM) data by YCharts.

Wall Street expects this trend to continue. Netflix is forecast to grow its earnings per share by more than 60% annually over the next five years, fueled by subscriber gains and operating margin expansion. Disney, meanwhile, is projected to increase its EPS by about 11% annually during this same time, with cable subscriber losses expected to somewhat offset growth in other areas of its entertainment empire. So in terms of growth prospects, Netflix has a clear edge over Disney.

Advantage: Netflix

Valuation

Finally, let's review some key value metrics for these two entertainment titans, including price-to-sales (P/S), price-to-earnings (P/E), and price-to-earnings-to-growth (PEG) ratios.

|

Metric |

Disney |

Netflix |

|---|---|---|

|

P/S |

2.87 |

11.26 |

|

Trailing P/E |

14.13 |

162.88 |

|

Forward P/E |

15.15 |

82.30 |

|

PEG |

1.44 |

2.02 |

Data source: Yahoo! Finance.

Disney's stock is much less expensive than Netflix's in terms of both price-to-sales and price-to-earnings. This is to be somewhat expected, considering Netflix's vastly higher growth rates. But even when we account for this -- as we do with the PEG ratio -- Disney's shares are still significantly cheaper. So, in terms of price, Disney's stock is the better bargain.

Advantage: Disney

The better buy is...

Ultimately, you'll need to decide which of these factors is more important to you. Value investors will likely gravitate toward Disney's superior cash flow generation and more attractively priced stock, while growth investors will appreciate Netflix's strong competitive position in streaming and attractive long-term expansion potential. Yet whether you choose Disney or Netflix, you'll be investing in an elite business that's likely to reward you with solid gains in the coming years. For this reason, you may be best served by buying stock in both of these entertainment leaders today.