It's an impressive feat for a company to increase its dividend every single year for 25-plus years, with only around 130 companies managing to achieve such a streak. That's not a lot of names, but it's a good starting list for income-focused investors. In fact, it's broad enough that at least some names are likely to be working through tough times -- which means, if you are selective and patient, you can find some bargains.

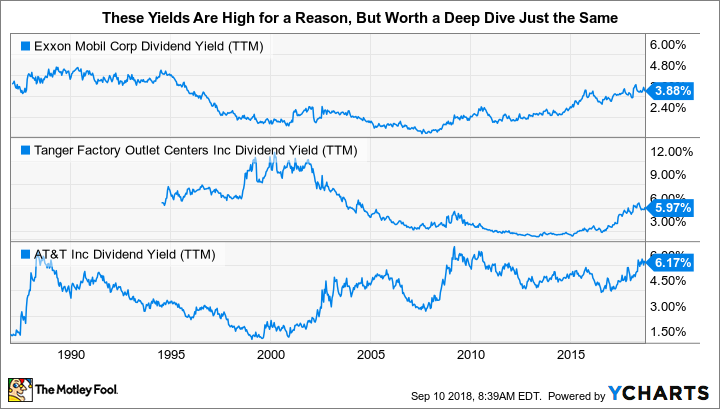

Today, ExxonMobil Corporation (XOM -0.57%), Tanger Factory Outlet Centers, Inc. (SKT -0.37%), and AT&T, Inc. (T -0.43%) are all offering big yields for investors willing to think long term.

1. The waiting game

Exxon is projecting that it will double earnings by 2025 if oil prices remain around where they are today. And earnings could increase by as much as 225% if oil prices go up to $80 a barrel. Those are pretty impressive projections, but it will take a lot of work for Exxon to get from today to 2025. And a lot of fortitude for investors to stick around.

Image source: Getty Images.

The integrated energy giant's recent performance has been weak, relatively speaking. For example, production has been falling for several years, and its once industry-leading return on capital employed numbers are now just middle of the pack. But this conservatively run giant isn't sticking its head in the sand and simply hoping for better days. While some peers are pulling back, Exxon is increasing capital spending from around $24 billion in 2018 to a run rate of $30 billion by 2023.

That spending is going toward new oil and gas drilling in the U.S. onshore market, offshore in Guyana, and liquified natural gas in Mozambique, among other production efforts. Exxon will also be growing its chemicals and refining footprint along the way, too. All of these investments, though, will take time to play out, with Exxon putting its expertise in bringing large products to fruition to greater work -- which should help to encourage its return on capital employed figures back into the mid-teens.

With Exxon shares offering a roughly 4% yield, the highest level in around 20 years, long-term investors may want to take a close look at this dividend champion, with 36 years of annual dividend hikes under its belt, while it works through its current issues. Long-term debt at just 10% of the capital structure, meanwhile, suggests it has the balance sheet to bring its plans to fruition even if oil prices weaken again. Just go in knowing that Exxon is emphasizing high long-term returns, not a quick fix -- a fact it noted during its second-quarter conference call.

XOM Dividend Yield (TTM) data by YCharts.

2. The retail apocalypse will, eventually, pass

Tanger is a real estate investment trust, or REIT, that is focused on owning outlet malls. These are interesting assets that are very different from the enclosed malls feeling the pain today as anchor tenants like Sears and J. C. Penney shut their doors. Tanger has no exposure to such companies. However, the REIT hasn't completely avoided the impact of the so-called retail apocalypse, with names like Nine West and Rockport falling into bankruptcy and closing stores at Tanger's outlets. It's just much easier to fill small spaces than cavernous anchor locations.

Tanger, meanwhile, is using the same playbook it has in previous years when retailers were struggling. It is offering rent concessions to keep the occupancy at its 44 outlet centers high (maintaining the desirability of its centers for customers and tenants) and limiting capital spending on new facilities. Pulling back, meanwhile, has freed up a material amount of cash, which Tanger is putting to work reducing debt and buying back shares. Better yet, for dividend investors, the REIT expects its funds from operations (FFO) payout ratio to be less than 60% in 2018, providing material safety for the dividend -- which has been increased through thick and thin for 25 consecutive years.

Things may look ugly for a little while, which is why Tanger's yield at nearly 6% is as high today as it was during the deep 2007 to 2009 recession. But if history is any guide, it will survive this tough spot just like has others in the past.

3. Ma Bell is a work in progress

AT&T has increased its dividend for 34 consecutive years. However, AT&T from 34 years ago isn't the same AT&T of today, noting that former spin-off SBC bought AT&T and rebranded itself with the AT&T name in 2005. But that's just one piece of the puzzle, because AT&T has shifted from a landline telephone company to a cell phone company. And now it's transitioning again, with the government-contested purchase of Time Warner Inc. AT&T is now calling itself a telecommunications, media, entertainment, and technology company.

T Financial Debt to Equity (Quarterly) data by YCharts.

There really is a lot of change happening at Ma Bell today. And the transformation process isn't likely to be over, either, with companies like Netflix and Amazon forcing continued innovation in many of AT&T's core sectors. Now add in the fact that AT&T's purchase of Time Warner Cable has added notable leverage, with both debt to EBITDA and debt to equity at 10-year highs. This isn't a slam-dunk investment option -- there's a fair amount of uncertainty, here.

That said, with a yield of 6.2% (the high end of its historical range), more aggressive investors are being paid very well to hang around through this transition process at a company with a long history of rewarding investors via dividend hikes. If that sounds like you, then AT&T should be on your watchlist.

A little ugly now, but with the potential to become sparkly

There's that old saying about diamonds in the rough, which gets to the core issues here. Exxon, Tanger, and AT&T all have their challenges today, but given time, they could all turn into very rewarding investments as they work through tough patches. And investors looking for big yields from company with incredible histories of annual dividend increases would do well to get to know each of them today. If you wait too long, you might just miss the opportunity to grab their historically high dividend yields.