Even when we're not writing about stocks, we're probably discussing some investment theme or stock that piques our interest. Here's a sneak peek at some of the conversations that go on behind the scenes with some of our writers here at The Motley Fool.

Tyler, Jason, and I (Matt here) were recently discussing why natural gas stocks have taken it on the chin over the past year. While some have been the victim of their own mistakes, shares of many of the country's largest gas-focused producers have lost value even though oil prices have been on the upswing. For example, the country's leading gas producer, EQT Corp. (EQT 1.19%), has seen its stock tumble more than 20%, while other large gas-focused companies such as Antero Resources (AR 1.49%), Cabot Oil & Gas (CTRA 1.95%), and Southwestern Energy have declined between 5% and 15% over the past 12 months. Those sell-offs caught our attention. Here's what we think is weighing down gas stocks these days.

Image source: Getty Images.

Hard to sell natural gas when several others can practically give it away

Tyler Crowe: The advent of shale drilling has made the U.S. one of the world's lowest-cost sources of natural gas on the planet. The ripple effects are still being felt as companies are investing billions to exploit gas as either an exportable product or even as a feedstock for manufacturing. Despite its incredibly low cost, though, there is another source of gas that's even less expensive: associated gas. That's the natural gas produced as a byproduct of oil wells, and it isn't always monetized. In oil-centric shale basins such as the Permian Basin, producers are flaring -- burning the gas at the wellhead -- at a rate of as much as 7.7 billion cubic feet per month, because there isn't adequate pipeline capacity to take it away.

As pipes get put in to monetize that gas, it could be a major issue for companies focused on natural gas production. According to liquefied natural gas export company NextDecade, there's more than 500 trillion cubic feet of associated gas in the Permian Basin alone that can be economical at less than $1 per thousand cubic feet. That's one-third the current spot prices for natural gas. In some cases, producers are better off giving gas away in pipelines simply because of the regulatory costs of flaring gas over the long term.

Companies looking to source cheap natural gas for one reason or another are going to inevitably build the infrastructure necessary to exploit that associated gas, and it's likely to have a profound impact on natural gas spot prices. Even the lowest-cost natural gas-focused producers can't compete with associated gas. There isn't enough associated gas to supply the entire market, but there's enough that it could keep prices low for years and make profits for gas drillers razor thin.

Image source: Getty Images.

Weakening peak demand from this huge gas consumer

Jason Hall: According to the U.S. Energy Information Administration, U.S.-marketed natural gas production increased 14% from 2012 to 2017. Over that same period, U.S. consumption of natural gas increased 6.1%. In short, it's a basic supply-and-demand situation that even the growth in natural gas exports in recent years can't offset.

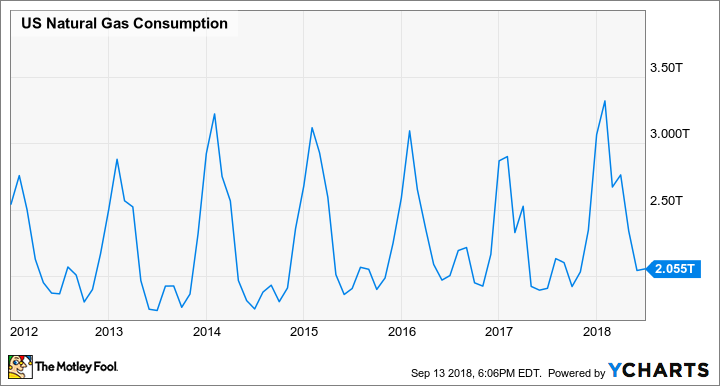

And a surprisingly big part of why is warmer winters. About 62% of domestic natural gas consumption goes toward electricity production (34%), and residential (16%) and commercial (12%) use for heating and cooking. But as this monthly chart shows, peak winter consumption fell in three of the past four winters, offsetting a significant portion of the growth in consumption during the rest of the year.

US Natural Gas Consumption data by YChart

This trend has had a big enough impact that annual consumption from these key users was down from 2015 to 2017.

US Natural Gas Consumption data by YCharts

Will that trend continue? It may not from one winter to the next, but on a global basis, average temperatures continue to trend higher, and that seems likely to keep happening. If that continues to be the case, the baseline for peak winter consumption will be lower than in the past. Simply put, gas producers can't count on high winter demand to spur prices the way they did a decade ago.

Pinched on both ends, but still growing as fast as they can

Matt DiLallo: As Tyler pointed out, producers in the Permian are unleashing a torrent of ultra-low-cost associated gas. Production there is already up 52% since the end of 2016 to around 7 billion cubic per day (BCF/D) and is on pace to more than double over the next decade. Meanwhile, as Jason noted, demand for gas hasn't been growing as much as it could because of warmer winter weather.

However, despite these two headwinds, gas-focused producers continue to grow as fast as they can. According to one forecast, production from the Marcellus and Utica Shale is on pace to rise from 24 BCF/D this year to 43 BCF/D by 2027, which is more than double the size of the Permian's growth.

Fueling that outlook is the nearly insatiable appetite of producers in that region to expand output as fast as they can. Antero Resources, for example, expects to grow its production at a 20% annual pace through 2020 and 15% in 2021 and 2022. Meanwhile, Cabot Oil & Gas is planning to boost its output at a 17% to 21% compound annual growth rate over the next three years, while EQT expects to reinvest all its free cash flow through the end of next year to drill more wells. That torrent of new production has the potential to keep a lid on gas prices.

Instead of growing as fast as they can, these companies should take a more measured approach by balancing production growth with cash returns to shareholders such as dividends and stock buybacks. Cabot is one of the few that has started heading in that direction by increasing its dividend 150% in 2017 and another 20% this year, while also authorizing a share repurchase program that could retire as much as 7% of its outstanding stock. However, until more natural gas stocks take their foot off the accelerator and start returning cash to investors, their stock prices are likely to remain depressed.