Qualcomm's (QCOM 0.73%) board plans to give CEO Steve Mollenkopf a raise as a vote of "confidence in his leadership through a grueling period" for the chipmaker, according to a recent Bloomberg report. Mollenkopf was already one of the highest paid tech CEOs in America, getting $60.7 million in compensation when he was promoted to CEO in 2014. He subsequently collected $10.3 million in compensation in 2015, $11.1 million in 2016, and $17.4 million in 2017. Mollenkopf has a base salary of $1.1 million, so the vast majority of his earnings come from stock bonuses.

Qualcomm CEO Steve Mollenkopf. Image source: Qualcomm.

In December, Mollenkopf will collect the final tranches of a $50 million restricted stock grant he received when he became CEO, so the pay raise will coincide with the end of those big equity bonuses. However, Qualcomm's board shouldn't give Mollenkopf a pay raise, for six simple reasons.

1. The stock went absolutely nowhere

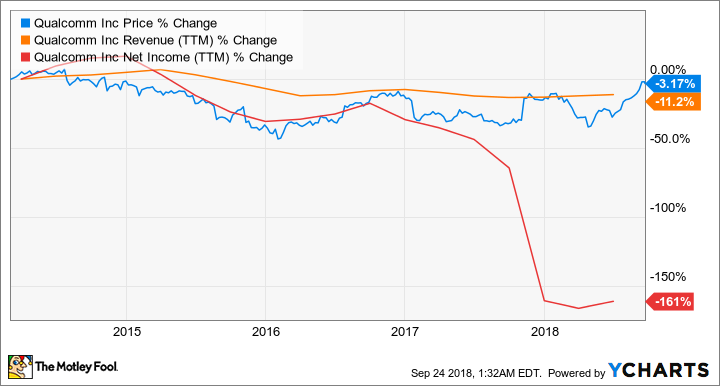

Mollenkopf took over as CEO on March 4, 2014. Here's what's happened to Qualcomm's stock price, revenue, and net income growth since then.

Qualcomm's stock price has declined over the past four-and-a-half years, yet Mollenkopf's annual compensation (excluding his initial pay package in 2014) kept climbing.

2. Complacent dependence on licensing fees

Under Mollenkopf, Qualcomm continued to rely on its high-margin wireless licensing fees, which gave it up to a 5% cut of the wholesale price of every phone sold worldwide, to generate most of its profits. But that business model only worked as long as OEMs made profits from phones.

Unfortunately, the saturation of the smartphone market crushed most OEMs' margins, causing them to retaliate against Qualcomm's licensing fees. Many of those OEMs, along with antitrust regulators in several countries, claimed that Qualcomm's cut should be based on wireless components instead of the entire device. That argument sparked a wave of probes and lawsuits across the globe.

3. Its failure to buy NXP Semiconductors

In addition to the threats to its licensing business, Qualcomm's chipmaking unit faces tougher competition from cheaper chipmakers like MediaTek and first-party chipsets from companies like Apple (AAPL 0.64%), Samsung, and Huawei.

Qualcomm's proposed solution was to buy NXP Semiconductors (NXPI 3.18%), the largest automotive chipmaker in the world, to diversify its chipmaking and patent portfolios away from mobile devices.

However, NXP's investors resisted the deal, Chinese regulators sat on the approval as trade tensions escalated, and Qualcomm refused to raise its final bid from the final $44 billion ($127.50 per share) offer. The deal collapsed nearly two years after it was announced, and Qualcomm paid NXP a $2 billion breakup fee.

Image source: Getty Images.

4. Its resistance of Broadcom's buyout

Meanwhile, Broadcom (AVGO 2.02%) tried to buy Qualcomm via a hostile takeover. Broadcom made a "final" $121 billion offer ($82 per share) this February, but subsequently lowered the bid to $79 after Qualcomm hiked its bid for NXP. Broadcom also called for Qualcomm's investors to oust the company's board.

Broadcom nearly succeeded -- but Qualcomm made an eleventh-hour request for the U.S. Committee on Foreign Investment (CFIUS) to probe the bid, which caused President Trump to block the deal. Today, Qualcomm's stock remains well below Broadcom's "best" offer.

5. Starting a fight with Apple

Mollenkopf also picked a fight with Apple, one of its biggest customers, after it assisted South Korea's FTC in a probe of the chipmaker's patent licensing practices. In response, Qualcomm suspended its final "rebate" payments to Apple for its exclusive use of Qualcomm modems from 2011 to 2016.

That conflict escalated into lawsuits and countersuits across multiple countries, and caused Apple to stop using Qualcomm's modems and halt all licensing payments to Qualcomm. Apple's defiance also caused Huawei to temporarily halt its licensing payments on similar grounds. If Qualcomm simply left Apple alone, it would probably still be supplying some modems for its new iPhones and collecting more licensing fees.

6. Buybacks instead of acquisitions

Lastly, Qualcomm is addicted to stock buybacks. After the NXP deal fell apart, it replaced its existing $10 billion buyback authorization with a new $30 billion buyback plan, most of which will be executed before the end of fiscal 2019 (next September).

That sounds great, since $30 billion is equivalent to nearly 30% of Qualcomm's market cap, but some of those buybacks will simply go toward offsetting the stock dilution from its executives' big compensation packages. More importantly, that $30 billion would be better spent on acquiring other companies to reduce its dependence on the mobile market.

The bottom line

I believe Qualcomm's board is hiking Mollenkopf's pay to prevent him from being poached by Intel in its ongoing CEO search. But I think Qualcomm would be better off under a new leader, and it's ridiculous to give Mollenkopf a raise after all the mistakes he made over the past few years.