Investors are bullish about the retailing industry again as results from giants like Walmart (WMT -1.75%) and Target (TGT -0.36%) confirm that customers still enjoy making trips to their local stores even as they head online for more of their shopping needs.

Costco's (COST 1.01%) business was looking strong even before the recent industry uptick, but investors have good reason to expect even better news from the warehouse retailing giant when it announces earnings results on Thursday, Oct. 4.

Image source: Getty Images.

Impressive sales trends

Costco still reports monthly sales results, so we already know the fiscal fourth quarter was a strong one in terms of revenue gains. Comparable-store sales surged by 7%, the company said in early September, after excluding exchange rate shifts and fuel price changes. The growth was powered in part by an 8% increase in the core U.S. market.

We'll learn on Thursday just how big of a role customer traffic growth played in the latest sales wins. It's likely that those gains outpaced Walmart's 2.2% jump by a wide margin. Costco's traffic growth might even approach the 6% surge that formed Target's best result on that metric in over a decade.

Besides Costco's long track record for outgrowing these peers, investors are especially optimistic about the fact that sales gains accelerated through the end of the year to finish with a 9% increase in the U.S. segment. These factors all suggest that management will have positive comments to make, both about the last few months of demand trends and the momentum heading into the new fiscal year.

Stable profits

One of the big benefits of Costco's membership model is that it protects profits even during periods when peers are slashing their prices. The retailer gets most of its earnings from subscriber fees, after all, so its prices are already about as low as they can go.

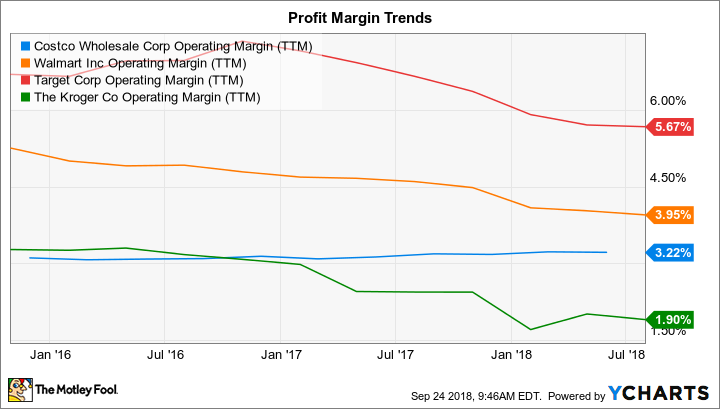

Sure, that setup means Costco books a lower operating margin -- about 3% of sales, compared to 4% for Target and 6% for Walmart -- but it also delivers steady profitability when all of its rivals, including Kroger, are drifting lower.

COST Operating Margin (TTM) data by YCharts.

Booming traffic and healthy sales demand gave Costco many opportunities to lift merchandise margins during the fourth quarter. Yet the company likely resisted that temptation in most cases, as usual, in favor of holding on to its valuable price leadership position. Its earnings are still expected to rise significantly thanks to higher subscriber fees.

Membership wins

Costco's key membership metrics are all pointing in the right direction, with renewal rates ticking up last quarter to a stellar 90.1% as the company added 199,000 new subscribers to its base. The retailer achieved that healthy growth through a mix of new store openings and additions at its mature locations. Importantly, the gains came despite the higher annual fees that helped lift membership income higher by 14% last quarter.

CFO Richard Galanti has told investors to expect the benefits from higher annual fees to peak in the quarter that just closed, and that's one reason Wall Street pros are predicting a 14% earnings increase this quarter, to about $2.36 per share.

Looking further out, the fee boost should moderately lift earnings through at least the first few quarters of the new fiscal year, giving Costco plenty of resources it can use to invest in future growth, or perhaps send another special dividend to its investors.