Dividends are great. Large dividends are better. And large dividends with the chance to grow substantially over the next few years are the best. For investors looking to supercharge their retirement portfolios with some income investments, or those who want to let dividends do the heavy lifting over several decades, high-yield dividend stocks are a go-to investment.

We asked three of our Motley Fool contributors to each highlight a dividend stock they see as a great investment today, and we added the extra twist of requiring the stock to have a yield higher than 5%. Here's why they picked pipeline company MPLX LP (MPLX 0.83%), healthcare real estate investment trust HCP Inc. (PEAK 1.40%), and asset manager Brookfield Property Partners (BPY).

Image source: Getty Images.

An undervalued opportunity in North America's energy infrastructure business

Tyler Crowe (MPLX LP): If you haven't noticed, oil and gas production in the U.S. is experiencing an unprecedented boom. Both oil and gas production are setting all-time records, and it looks like it won't be slowing down anytime soon. All that additional capacity is putting a severe strain on our pipeline and processing infrastructure, which puts companies like MPLX in a great position to grow the business over the next few years.

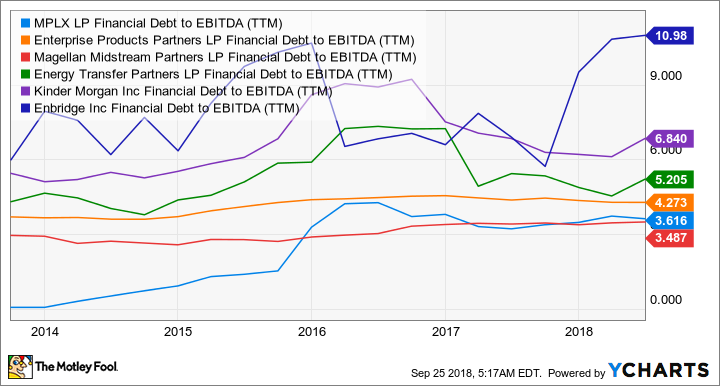

What also makes MPLX so compelling as an investment with the ability to grow is it appears to have the financial strength to do so. As of the most recent quarter, the company had a distribution coverage ratio (total distributable cash generated divided by cash distributed) of 1.37 times, which means that it is retaining lots of cash to reinvest in the business. Also, its investment grade credit rating and debt-to-EBITDA ratio of 3.6 times -- one of the lowest in the industry -- give it room to take on debt to pay for projects without seriously compromising its current business.

MPLX Financial Debt-to-EBITDA (TTM) data by YCharts.

With a bevy of growth projects in the wings and the apparent financial strength to pull it off, you would think that investors would be clamoring to buy this pipeline stock. That hasn't been the case, though, as shares currently have a distribution yield of 7%. MPLX looks like a great high-yield stock that has fantastic growth prospects despite the way Wall Street is pricing this stock.

An amazing long-term opportunity

Matt Frankel, CFP (HCP Inc.): One of my favorite high-yielding dividend stocks is healthcare real estate investment trust HCP, which pays about 5.6% as of this writing.

HCP owns healthcare real estate, specifically senior housing, medical offices, and life science properties. Over the past couple of years, HCP has gotten rid of its riskier assets, reduced its concentration to its largest tenant, and taken several steps to improve its balance sheet and its general financial strength.

Healthcare real estate will be a pretty exciting opportunity over the next few decades. The aging U.S. population (the number of senior citizens will roughly double over the next 35 years) should create a steadily rising demand for healthcare, particularly senior housing and medical offices. And, with only about 15% of all healthcare real estate owned by REITs, there's lots of room for consolidation in the existing $1.1 trillion market.

There are a couple of reasons I like HCP better than some of the other big players in healthcare real estate. First, it's well diversified, with its property portfolio nicely divided among its three core property types. On the other hand, peers are generally more heavily weighted in senior housing. Second, HCP focuses more on private-pay healthcare properties, with roughly 95% of its revenue from private sources as opposed to less-predictable government reimbursements.

This stock should fetch you fatter dividends every year

Neha Chamaria (Brookfield Property Partners): Brookfield Property Partners currently yields a hefty 6.2%. There are good reasons to expect a stable and steadily growing dividend.

Brookfield Property is a typical dividend growth stock, or a company that is focused on increasing its payout year after year, backed by strong financials and a robust cash flow stream. Between 2014 and 2017, the company grew its annual dividend per share at a compound rate of 6%, well covered by 9% compound growth in its funds from operations.

The key to Brookfield's healthy dividends is a hugely diversified, global portfolio of real estate assets in office, retail, industrial, and hospitality that it owns, develops, and operates under long-term leases. To give you an example, the company's core office portfolio comprises of 150 properties spread over 99 million square feet and has an average remaining lease term of 8.5 years. In short, Brookfield has already locked in a good portion of future revenue, which is also why it can generate stable cash flows and pay good dividends.

With an active pipeline of properties spanning nearly 10 million square feet under development, Brookfield Property Partners is confident of generating enough cash flows to be able to increase its annual dividend by 5% to 8% in the long run. That should ensure consistently strong dividend yields, making Brookfield a top high-yield dividend stock to put on your radar.