If it had struck just a few years ago, the historically low snowfall season that occurred in the western United States in 2018 would have seriously hurt Vail Resorts (MTN -2.68%) business. But Vail is a stronger company today, boasting a broader geographic profile, higher profitability, and a steadier customer base of season pass holders.

These assets combined to power higher core earnings for the ski resort giant while putting it in position to reach new sales and profit records in fiscal 2019. Let's take a closer look at the metrics that made all the difference.

Image source: Getty Images.

12.3 million: skier visits

Fiscal 2018 was Vail's first full year running the Whistler Blackcomb resort in Canada, which diversified its geographic base further from the properties it maintains in and around the Rocky Mountains. That broader base allowed overall ski visits to rise 3% to 12.3 million, even though these western U.S. resorts logged slight declines due to unusually low snow levels. In this case, bigger is clearly better, as Vail's base of resorts is up to 15 properties, across varied geographies, from nine at the end of fiscal 2016.

7%: Mountain revenue growth

Vail's core mountain revenue growth outpaced visitor gains thanks to rising prices and broad gains across its other business lines. Ski school and dining sales were each up 7%, for example. CEO Rob Katz credited the company's "strong base of high-end consumers" for pushing spending higher. The company's aggressive capital investment strategy is helping, too, as improvements like new ski lifts raise the satisfaction level of resort visitors. It's easier to lift prices and secure repeat visits when you're delivering memorable vacation experiences.

$616 million: adjusted earnings

Adjusted core profits rose 4% to $616 million, to fall right within the guidance that executives had issued back in March. Considering many of its properties saw 30-year lows in early season snowfalls, it's a testament to Vail's business strength that the company could achieve stable, and steadily rising, earnings this year.

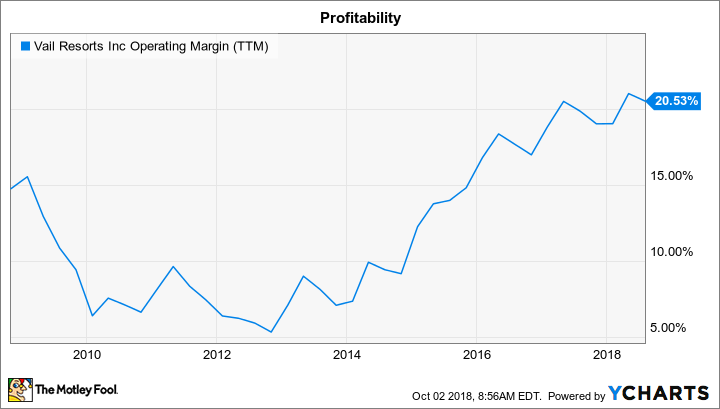

MTN Operating Margin (TTM) data by YCharts.

9%: spike in season pass sales

Vail has been working hard over the last few quarters at improving the marketing of its season passes, and these efforts are working. Last year, the company booked more vacation commitments -- at higher prices and earlier on in the season -- and that success helped the company sail through a tough winter period.

The momentum has continued into the new year, too, as sales pass volume is up 9% while average prices are up 5%. "We believe this growth continues to be driven by our increasingly sophisticated and data-driven targeted marketing efforts to move destination guests into our season pass products," Katz explained in a press release.

$734 million: projected earnings

Executives forecast that adjusted earnings will range between $715 million and $753 million in the new fiscal year, with the midpoint of that range landing at $734 million. Hitting that result would translate into a head-turning 19% profit spike.

A portion of those gains will come from the rising resort base and the higher volume and selling prices for lift tickets and resort stays. The bigger contributor will be the expected return to normal snowfall conditions that Vail is counting on, which should put its fiscal second quarter back in line with past results. Of course, actual snowfall totals might deviate from these predictions, but the 2018 fiscal year helped demonstrate that Vail's business can thrive through weather-based volatility that might affect any one of its geographic regions in a given season.