Canadian marijuana stocks are increasingly deciding it's time to offer their shares to investors directly on the major U.S. stock exchanges, and Aurora Cannabis (ACB 12.87%) is the latest of them to take the leap. This week, Aurora Cannabis announced it's filed to list its shares on the New York Stock Exchange. Trading of its shares under the ticker symbol "ACB" could begin by the end of October if everything goes off without a hitch. Does Aurora Cannabis' decision make it a stock worth adding to portfolios?

A major market opportunity

The United Nations estimates that the global marijuana market is worth $150 billion annually; over the coming years, more of those billions of dollars in spending are likely to happen in government-regulated marketplaces.

IMAGE SOURCE: GETTY IMAGES.

In the U.S., where marijuana remains illegal federally, 31 states have already passed laws legalizing medical marijuana in one form or another, and nine states have passed laws that clear the way for regulated adult-use markets.

In 2014, Canada made changes to its medical marijuana laws that established a national marijuana market, and on Oct. 17, the country's national recreational use marketplace will open for business.

There's also a growing willingness in Europe to embrace cannabis. Germany created a nationwide medical marijuana market in 2017, and recently, the United Kingdom agreed to review its existing marijuana policy.

The potential for many countries to establish marijuana markets is why beer, wine, and spirits maker Constellation Brands (STZ 0.53%) estimates the legal, global marijuana market will be worth over $200 billion in 15 years.

The race is on

Recognizing the potential associated with capturing a substantial share of this market as it moves away from the black market, Aurora Cannabis has been among the most aggressive companies when it comes to investing in marijuana production facilities and acquiring competitors.

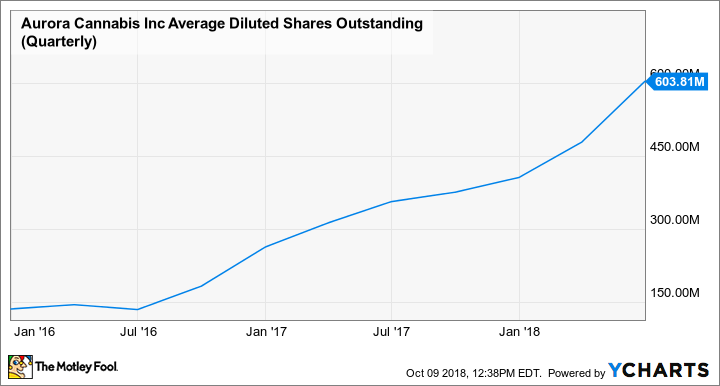

Decisions to dilute shareholder value by issuing shares to finance its strategy have caused its outstanding shares on the Toronto Stock Exchange, where it has its primary listing, to soar. But they've also put Aurora Cannabis in the lead in terms of marijuana production capacity and marijuana revenue.

ACB Average Diluted Shares Outstanding (Quarterly) data by YCharts.

As early as next year, Aurora Cannabis' Canadian greenhouses, including Aurora Sky, will be able to produce over 500,000 kilograms (1.1 million pounds) of cannabis to serve the Canadian recreational market. Estimates for how big the Canadian marijuana market may be in 2019 vary, but Deloitte thinks it could eclipse $7 billion, including $4.3 billion in legal sales.

If this projection is right, then the opening of the recreational market will cause revenue at Aurora Cannabis and its peers to soar.

For perspective, Statistics Canada estimates that Canadians only spent about $430 million on marijuana in the legal medical marijuana market last year.

Over 100 marijuana licenses have been issued to growers in Canada, but make no mistake: Big players like Aurora Cannabis are dominating the market. In its recently reported fiscal year, Aurora Cannabis' sales surged 206% to 55.2 million Canadian dollars ($42.7 million), and that doesn't even take into consideration the full impact of its acquisition of MedReleaf, a major competitor. If you include MedReleaf, Aurora Cannabis' pro forma sales were CA$33 million last quarter alone.

That matches up very nicely against its top competitors Canopy Growth (CGC 20.65%) and Aphria Inc. (NASDAQOTH: APHQF). Aphria's updating its quarterly results on Oct. 12, but in its prior quarter, sales were tracking at about CA$12 million per quarter. Meanwhile, Canopy Growth's sales are clocking in at about $26 million per quarter.

Does the U.S. listing make sense?

Aphria hasn't said if it plans to list on a major U.S. stock exchange, but Canopy Growth made the move earlier this year, and so far, it looks like a savvy decision. Canopy Growth's market cap has surged since it listed on the NYSE in May, in part because the listing opened the company's stock to institutional investors that had been prohibited from owning it because of mandates preventing investments in over-the-counter or foreign stocks.

The extra liquidity associated with tapping into these institutional buyers isn't the only benefit to a U.S. listing. Institutional investors tend to be more long-term focused than individual investors, and that means that as their ranks increase among shareholders, the company's shares could experience less volatility. Having said that, the driving reason behind this decision is to broaden access to its shares so it can access more capital to fund future expansions, acquisitions, and investments in its grow facilities.

Should Aurora Cannabis be in your portfolio?

Rather than trading based upon historical revenue generated serving Canada's small medical marijuana market, marijuana stocks are trading largely on optimism over the opportunity to generate billions of dollars in sales worldwide as more countries legalize cannabis. Because of that, marijuana stocks are unsurprisingly overvalued on every traditional valuation metric. For instance, Aurora Cannabis' $9.9 billion market cap values it at 238 times its trailing-12-month sales.

Canada's recreational market opening this month could improve valuation if Aurora Cannabis' sales skyrocket, but it's common for investors to buy shares ahead of market-moving events like this, only to sell them shortly thereafter. This "buy the rumor, sell the news" tendency could mean marijuana stocks could face some headwinds until recreational sales confirm investor optimism has been warranted. Investors should also recognize that while Aurora Cannabis is likely to sell a lot more marijuana in the coming year, there's no telling when that sales growth will translate into earnings.

Overall, Aurora Cannabis is one of a handful of marijuana stocks that's positioned itself best to take advantage of this market, but it's undeniably a risky stock. Therefore, its shares are best-suited to growth investors who are able to withstand losses.