Despite its phenomenal growth over the past quarter century, Amazon.com (AMZN -1.14%) has mostly been able to stay off the radar of antitrust regulators. The company is known for offering low prices and great customer service, which has helped allay concerns about its size.

Nevertheless, there have been quite a few calls for greater antitrust scrutiny of the company recently. In Europe, regulators have already started to act. Here's why Amazon investors shouldn't ignore the risk of antitrust action against the company.

It's not just about size -- and it's not about AWS

Amazon has ballooned in size in recent years. Analysts expect revenue to reach $235 billion in 2018. Even that massive figure underestimates the volume of goods sold through the platform, since Amazon doesn't book the full value of sales by third-party sellers as revenue -- only the commissions that it charges them.

Amazon's e-commerce business has massive scale, especially in the U.S. Image source: Amazon.com.

As it has grown, Amazon has spread its tentacles through every corner of the economy. Some critics believe that its size and the breadth of its operations give it more power than any private corporation should have.

Retail analyst Mark May suggested last month that Amazon should spin off its Amazon Web Services (AWS) business to reduce the risk of antitrust scrutiny. He argued that Amazon's $1 trillion valuation -- which has since fallen back to around $850 billion -- makes it a target. He believes that splitting into two companies, each worth substantially less than that amount, could reduce regulators' interest in the company.

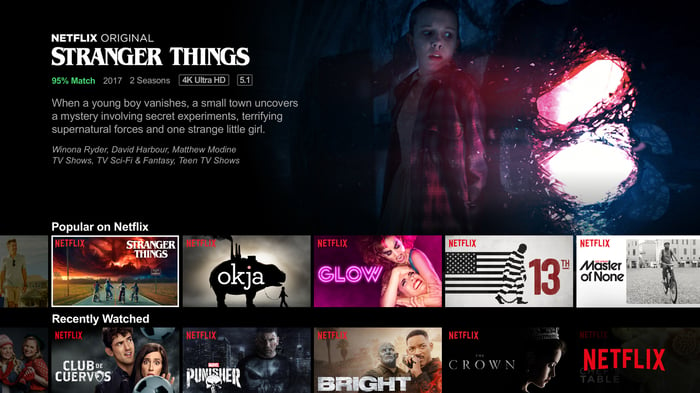

However, AWS faces plenty of competition in the cloud infrastructure market, primarily from Microsoft (MSFT -1.84%). Even businesses that Amazon competes with directly, like Netflix, have been happy to use AWS services despite the availability of alternatives. Thus, it's hard to argue that Amazon's ownership of AWS is a serious antitrust issue.

Meanwhile, U.S. antitrust doctrine is still laser-focused on consumer harm. To the extent that Amazon provides lower prices, better products, and superior customer service, its size alone is unlikely to trigger an antitrust case.

Even competitors like Netflix have been willing to use Amazon's AWS cloud platform. Image source: Netflix.

Conflicts of interest are rampant

Yet while Amazon's size alone may not be an antitrust problem, some of its business practices could cause it to run afoul of regulators. One potential issue is its growing private-label operation, spearheaded by the AmazonBasics brand.

Amazon is an essential sales channel for many small companies that have developed unique products. No other internet retail platform has equivalent reach. However, Amazon uses the data on third-party sellers' product sales to find opportunities to launch its own private-label alternatives.

To the extent that Amazon is just driving prices down by competing with third-party sellers on its platform, U.S. regulators might not care. Its actions might hurt other businesses, but at least consumers would be benefiting from lower prices. However, antitrust laws are different in Europe, and the EU is already investigating Amazon's business practices.

Furthermore, if Amazon starts driving competitors out of business -- reducing customers' choices and potentially allowing the company to raise prices for its private-label products -- then even U.S. antitrust authorities would start to take notice. This could lead to an effort to break up the company, just as the U.S. Department of Justice tried to break up Microsoft in the late 1990s for using its free Internet Explorer browser to undermine rivals.

Amazon's growing ad business is even more problematic

Regulators could be even more concerned about Amazon's fast-growing ad business. Today, more than half of all online product searches in the U.S. start on Amazon. As a result, consumer products companies increasingly feel the need to pay Amazon for "sponsored" listings. That gets them top placement on Amazon search pages and could also potentially lead to recommendations by Alexa in the future.

Amazon's revenue from sponsored product ads more than doubled last year. One analyst thinks the ad business could be generating $22 billion of revenue and $16 billion of operating profit annually by 2021.

There's a clear antitrust issue if Amazon is using its e-commerce dominance to pressure product manufacturers to buy ads to avoid slipping down the search rankings. Consumers get no benefit from this aspect of Amazon's business. In fact, the growth of Amazon's ad business could drive prices higher over time, as companies would have to build higher advertising expenses into their business models.

Antitrust scrutiny could be costly

A separation of AWS from Amazon's retail business probably wouldn't hurt investors. The two businesses should be worth as much (or even more) separately as they are worth together.

By contrast, it wouldn't be easy to untangle Amazon's wholly owned retail operations from its third-party marketplace business. For example, they share the same distribution system. If regulators were to demand that the two businesses be completely separate to foster competition between Amazon and other merchants, it's likely that there would be significant "dis-synergies" -- i.e., lower profits on a combined basis -- from splitting them up. Meanwhile, a crackdown on Amazon's ad business could remove one of the company's biggest sources of earnings growth.

In short, Amazon is leveraging its dominance of online retail to extract advertising dollars from brands and build a lucrative private-brand business. These moves are driving much of its profit growth right now. However, they could ultimately form the basis for an antitrust crackdown on the company that would cause future profit growth to be much lower than what bullish investors expect.