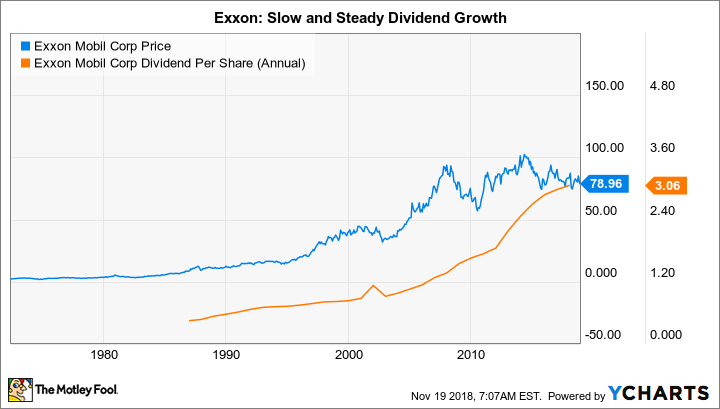

At around 4%, ExxonMobil Corporation's (XOM -0.10%) dividend yield is near a 25-year high. Investors clearly have some concerns about the integrated oil and natural gas company's business. But long-term investors with an income focus shouldn't get too caught up in the current negative sentiment here. Here's why Exxon's 4% dividend yield is safe.

1. Production is falling, but a turn is coming

One of the big knocks against Exxon is that production has been falling for a couple of years. In 2016 and 2017 output fell 1% and 1.7%, respectively. Declines continued through the first three quarters of 2018 as well. Declining production is clearly not a great sign for long-term dividend continuity. However, production grew sequentially between the second and third quarters as Exxon ramped up its onshore U.S. drilling activity. And that's just one of the company's big growth projects that stretch out to 2025, suggesting that the downtrend could soon reverse. Exxon appears well on its way to fixing this issue.

Image source: Getty Images.

2. Management is not going to waste money

The company's efforts on the production side are noteworthy for two reasons: Not only are they starting to show results, but the plans stretch out through the middle of the next decade. In fact, Exxon has specifically stated that it isn't interested in low-return projects that would improve production numbers today at the expense of long-term financial performance. It will only invest in high-return projects that it believes can add long-term value. That's the type of mentality you want to see from a dividend-paying company, and it speaks volumes about management's conservative approach.

3. The company is financed conservatively

Exxon isn't just conservative on the investment front -- it also has one of the strongest balance sheets in the energy industry. Long-term debt makes up a little under 10% of the capital structure, lower than its major peers. In fact, that's low for any company in any industry. Low leverage provides a solid financial foundation, particularly for an industry that is reliant on highly volatile commodities for its top and bottom lines. The upshot here is that leverage isn't likely to force Exxon's hand on the dividend.

XOM Financial Debt to Equity (Quarterly) data by YCharts

4. Exxon's willing to use its balance sheet strength when necessary

That said, Exxon isn't afraid to use its financial strength to support growth -- and its dividend. For example, during the oil downturn that started in mid-2014, Exxon increased its long-term debt from roughly $6.5 billion to $27.7 billion. At the peak, however, long-term debt still only made up about 15% of its capital structure -- hardly a troubling figure. The added debt, meanwhile, was used to support long-term capital investment plans and the company's growing dividend. Having a strong balance sheet and the willingness to use it are complementary facts. Together, they should give investors some confidence that dividends are a priority for Exxon's management team.

5. The oil giant has a 36-year record of dividend proof

All of that said, there's probably no greater proof of Exxon's commitment to its dividend then the 36 consecutive annual dividend increases it has made. That's doubly impressive when you consider that the energy industry is highly cyclical and prone to swift and dramatic ups and downs. The 2014 downturn wasn't an unusual event, and clearly Exxon's hiking the dividend despite the headwind wasn't strange either. It's worth noting here that many of Exxon's peers either paused their dividend hikes or cut their dividends during that downturn. Exxon stands out on the dividend front.

6. Its growth plans can withstand weak oil prices

Although Exxon is financially strong and clearly committed to the dividend, what if its growth plans don't coincide with high oil prices? After all, there's a long time between 2018 and 2025 for oil prices to decline -- the recent 20% drop was a stark reminder of oil's volatile nature. While Exxon has been hyping the potential for doubling earnings, or more, by 2025, it also provided a lower-end estimate of earnings growing 35% if oil were to fall to $40 per barrel (oil has been in the $60- to $70-a-barrel range lately). Put another way, relatively low oil prices won't derail the company's growth plans, just slow them down a little. That, in turn, means that low oil prices aren't a big risk for the dividend.

7. Exxon's payout ratio has been solid over time

With all of this as a backdrop, it's worth highlighting that Exxon's payout ratio over the last 12 months has been around 60%. So Exxon is covering the dividend reasonably well, a fact that wasn't true at all a few years ago; the payout ratio in 2016 was a disastrous 138%. Over the last decade, it has been as low as 18%.

As points one through six show, Exxon has built its business to weather the ups and downs of the industry, which means investors need to take the payout ratio in stride. It is important to monitor, but one year's payout ratio isn't an indicator of the company's long-term dividend-paying ability. You need to get into the business model to really understand what's going on.

Exxon is built to pay you

As one of the most conservative oil companies in the energy industry, Exxon has proven it takes a growing dividend very seriously. Its actions during the deep 2014 oil downturn were clear evidence of that fact. Moreover, the oil giant's conservative growth plans, complete with downside estimates, shows management intends to keep its 36-year history of dividend hikes growing for years to come.

Exxon's play-it-safe approach has been a little out of step lately following the oil recovery after the 2014 downturn. But that's the flip side of having a dividend that can withstand oil downturns. If you are looking for a safe dividend, Exxon has you covered.