Canopy Growth Corporation (CGC 15.03%) stock has soared 110% over the one-year period through Nov. 26, versus the S&P 500's 4.7% return.

The Canadian marijuana company's torrid stock performance, along with the legalization of recreational marijuana in Canada on Oct. 17, has naturally heightened investor attention in Canopy Growth stock. These eight charts should help get you up to speed on the fast-growing cannabis player and its stock.

Image source: Getty Images.

Legal marijuana market is projected to balloon

Canopy is in a business that is expected to explode in size, so it has potentially massive long-term growth potential. Worldwide spending on cannabis is projected to grow at a torrid 27.5% compounded annual growth rate (CAGR) and reach $32 billion in sales in 2022.

Chart by author. Data source: ArcView Market Research and BDS Analytics.

Stock performance: The big and relative pictures

One of the first things a potential investor in Canopy Growth probably wants to know is how the stock has performed over the long term, and how it has performed relative to shares of its closest peers and the broader market. The following chart shows the degree to which Canopy stock has whipped the broader market since its April 2014 initial public offering (IPO).

Data by YCharts.

The chart below shows how Canopy Growth stock has performed over the two-year period through Nov. 26 relative to shares of its largest peers that have traded on a U.S. stock exchange for this period. These include Aurora Cannabis, Aphria, and Cronos Group, all of which are also Canadian companies. Canopy takes the silver medal, behind Cronos.

Data by YCharts. A longer time period couldn't be used, as comparables would rapidly drop off. Shares of Canada's Tilray, which went public on the Nasdaq in July, are up 395% from their opening price on IPO day.

Canopy Growth's business

Canopy Growth was founded in 2013 by Bruce Linton, who is the company's co-CEO and chairman. The company is the largest legal marijuana company in the world based on market capitalization, as of this writing. It grows, processes, and sells medical and recreational cannabis primarily in Canada, but it also has medical marijuana operations in other countries, most notably Germany.

Canopy's brands include Tweed (which the company touts as "the most recognized brand" of marijuana in the world), Spectrum Cannabis (its international medical brand), and others. The company has set many "firsts" in the industry, including:

-

The first cannabis company in North America to be publicly traded.

-

The first cannabis-producing company to be listed on the New York Stock Exchange (NYSE). This milestone occurred in May 2018.

-

The first Canadian marijuana producer to be approved to export dried cannabis to Germany.

-

The first marijuana company to forge a strategic relationship with a Fortune 500 alcoholic beverage maker (Constellation Brands).

In the company's second quarter of fiscal 2019, for the period ended Sept. 30, revenue increased 33% year over year to 23.3 million Canadian dollars, equal to approximately $18.1 million at that time. Here's how revenue broke out by product category:

|

Product Category |

Fiscal Q2 2019 % of Total Revenue |

Fiscal Q2 2018 % of Total Revenue |

|---|---|---|

| Dried cannabis flower and other |

66% |

82% |

| Cannabis oils (including Softgels) |

34% |

18% |

|

Total |

100% |

100% |

Data source: Canopy Growth Corp.

It's a plus that sales of oils, including the company's Softgel capsules, are growing faster than sales of dried cannabis, because these value-added products generate higher profit margins. This dynamic helped boost the company's average selling price per gram of product in the quarter by 24% year over year to CA$9.87.

Canopy can't enter the huge U.S. marijuana market -- yet

Image source: Getty Images.

Canopy Growth can't currently enter the U.S. cannabis market because of the stock exchanges the company is listed on, the NYSE and the Toronto Stock Exchange (TSE). Both exchanges prohibit their listed companies from engaging in any enterprise in the U.S. that is illegal on a federal level -- and selling marijuana falls into this category.

While it seems only a matter of time before marijuana becomes legal across the U.S., the downside to the current situation for Canopy is that companies that can do business in the U.S. have a head start in establishing a foothold in the market. (One such company is Origin House, which is listed on the Canadian Securities Exchange (CSE) and trades over the counter (OTC) in the U.S. This company is targeting the massive California cannabis market.)

Canopy Growth's key financial metrics

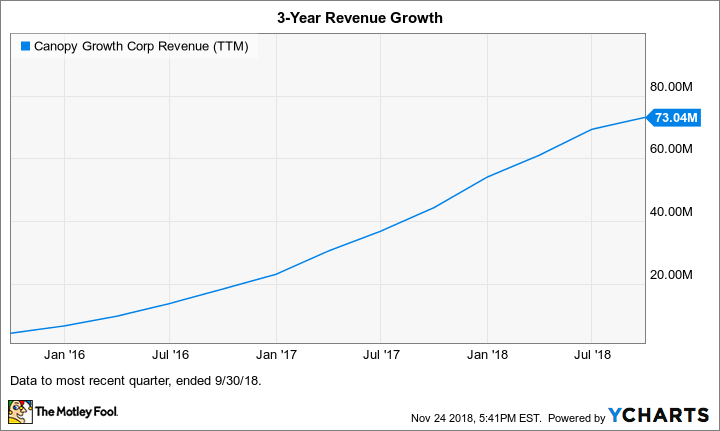

Like most of its peers, Canopy's revenue has been increasing rapidly.

Data by YCharts.

However, as is also the case with nearly all of its peers, Canopy's losses from both an operational and a net basis have also been escalating very quickly because the company is rapidly scaling up and investing to lay the groundwork for long-term growth.

Data by YCharts.

Canopy's mountain of cash

In a fast-growing new market, cash is even more critical than usual. It takes big money to expand growing capacity, establish or expand production lines to process marijuana into various finished products, establish a global distribution network, and develop top brand names.

Canopy Growth was already top among its peers in terms of cash position at the end of its most recent quarter, as the following chart shows, and that's before it received a $3.8 billion investment from alcoholic beverage giant Constellation Brands. In August, the maker of Corona and Modelo beers announced it was upping its previous stake in Canopy to 38%, though the deal didn't close until after Canopy's most recent quarter ended. This humongous cash infusion puts Canopy in a class of its own. Canopy and Constellation are working on developing cannabis-infused beverages, which are expected to be legal in Canada next year.

Data by YCharts.

Marijuana stocks' sky-high valuations

Nearly all marijuana companies are unprofitable, so we're stuck using the price-to-sales (P/S) ratio as a valuation metric. Valuations are beyond sky-high for the group, meaning much future growth is already priced in. For some context, shares of beer behemoth Anheuser-Busch sport a P/S ratio of 3.4. That said, it's a mature, slow-growing company, so we'd expect its stock valuation to be much lower than those of marijuana companies, which have potentially huge growth runways. For additional context, of nearly 1,800 mid-cap or larger stocks (stocks with market caps of over $2 billion) in the finviz.com universe, only four had P/S ratios greater than Tilray's as of Nov. 23!

That said, at this early stage in the burgeoning legal marijuana market, P/S valuations -- at least on an absolute basis -- aren't very useful, in my view. But you may want to consider relative valuations when making investing decisions in the marijuana space. Canopy stock is extremely pricey, but its P/S ratio isn't quite as stratospheric as those for Tilray and Cronos stocks.

Data by YCharts.

In short, with the company's large relative size, mountain of cash, and partnership with Constellation, Canopy Growth stock deserves a place on the watchlists of investors interested in the cannabis space.

To be clear, it's a very risky stock at this point, with much future growth -- which may or may not materialize -- already priced in.