Check out the latest Dropbox earnings call transcript.

What happened

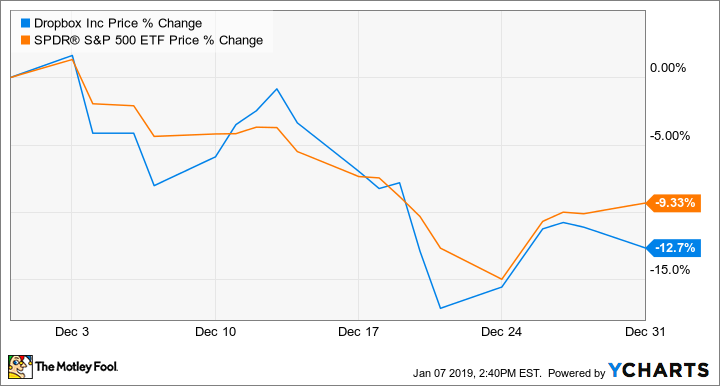

Shares of Dropbox (DBX -0.85%) declined 12.7% last month, according to data provided by S&P Global Market Intelligence. For perspective, the S&P 500 index lost 9.3% in value in December.

For 2018, Dropbox shares fell 28.3%, which underperformed the S&P 500's decline of 3.2%.

So what

There wasn't any specific company-related news that sent the stock down last month. Instead, the decline appears to stem from the overall negative sentiment overhanging the market in recent months.

Dropbox delivered robust growth on the top line for shareholders in 2018. In the third quarter, revenue surged 26% year over year, and non-GAAP earnings per share came in at $0.11 per share. Wall Street analysts had expected the company to report just $0.06 per share on the bottom line. Dropbox has handily beaten the consensus analyst estimate on the bottom line over the last three quarters.

IMAGE SOURCE: GETTY IMAGES.

However, this strong performance hasn't been enough to justify the high expectations reflected in its stock price. At one point in early 2018, Dropbox had a total market capitalization (total shares outstanding times the stock price) of more than $15 billion. That's a rich value to place on a company that hasn't reported a profit on a GAAP basis, and only generated $329 million in free cash flow over the last year.

Now what

While investors readjust their expectations, management continues to build a powerful suite of tools for its more than 500 million registered users. The company has been having success getting a portion of its user base to try premium features for a subscription fee. At the end of the third quarter, Dropbox had 12.3 million paying users. What's even better is that the average revenue per user increased 6% year over year to $118.60, reflecting the high value users place on Dropbox's features.

Wall Street analysts expect Dropbox to grow earnings 17% per year over the next five years. The stock trades at a forward PE of 50 times next year's earnings estimates. However, the shares fetch a more reasonable 25 times multiple based on management's 2018 free cash flow target of $350 million.

The company faces an uphill battle with larger competitors, but that makes the company's strong revenue growth last quarter look that much more attractive. Investors will want to see that trend continue, along with improved profitability, in 2019.