What happened

YY (YY 0.61%) stock sank 47.1% in 2018, according to data from S&P Global Market Intelligence. The Chinese social media stock underwent a big sell-off last year, but it also gained more than 185% in 2017, so it's not surprising that shares lost ground as the market turned bearish on the country's tech sector.

Slowing growth for the company's video-streaming social network and questions about the long-term viability of its tipping-based business model played a role in the sell-offs, but a broader shift in market sentiment might have been the bigger factor.

Image source: Getty Images.

So what

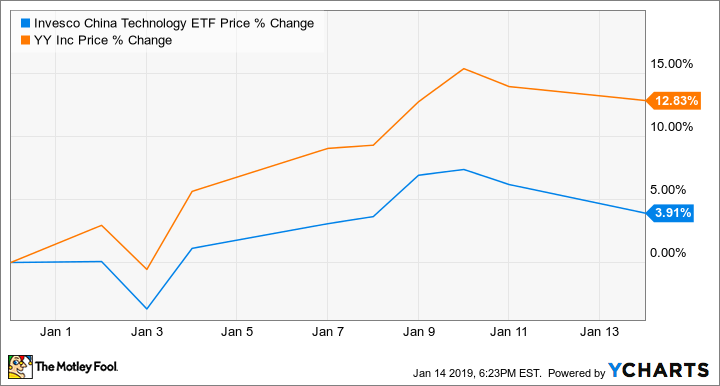

Despite the big stock sell-off, YY continued to post solid operating results in 2018. The company's sales and earnings growth slowed from the prior year, and the Chinese government made a string of moves signaling that it would continue to play an active role in shaping and regulating the growth of content and social media industries, but the stock's movement mostly tracked in line with its sector's performance. The Invesco China Technology ETF climbed roughly 72% in 2017 before falling roughly 35% in 2018, and YY stock losing nearly half of its value last year doesn't look as dramatic when placed in the context of sector performance and its big gains in the previous year.

Now what

YY has regained some ground early in 2019, with shares up roughly 12.8% in January's trading so far.

Shares trade at roughly 8.5 times this year's expected earnings. YY's business is still expanding at a healthy clip, and the company is also the top shareholder in Huya (HUYA 0.45%), a fast-growing video game streaming platform that it spun off earlier this year. With YY still delivering encouraging sales and earnings growth and trading at low multiples, the company could be a worthwhile play for investors who see promise in China's streaming and social media industries.

Check out the latest YY earnings call transcript.