Check out the latest Intuitive Surgical earnings call transcript.

Perhaps Dr. Gary Guthart -- CEO of Intuitive Surgical (ISRG -1.69%), which makes the daVinci surgical robot -- learned a lasting lesson in 2013 and 2014. During those years, several negative events coalesced -- questions about robotic surgery's efficacy, and the new Affordable Care Act -- and Wall Street ruthlessly punished the stock, which fell 40% over 20 months.

Since then, it's been a different story. The stock has more than quadrupled as Guthart has continually lowballed expectations -- and overdelivered on his promises.

Image source: Getty Images.

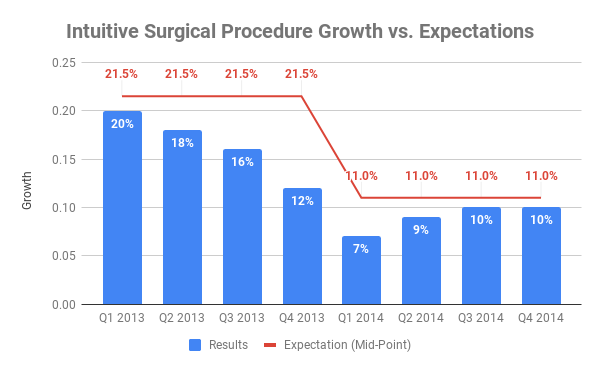

Case in point: At the start of 2013, Guthart and his team told investors to expect procedure growth of 20% to 23%. What followed was thoroughly disappointing. When the next year's results only barely met expectations, investors were worried.

Data source: SEC filings and company conference calls. Chart by author.

But then, the company seemed to learn its lesson. Management was well aware that it had two enormous growth drivers: international expansion and continued tinkering with the daVinci that could lead to ever more procedures that benefit from using the machine.

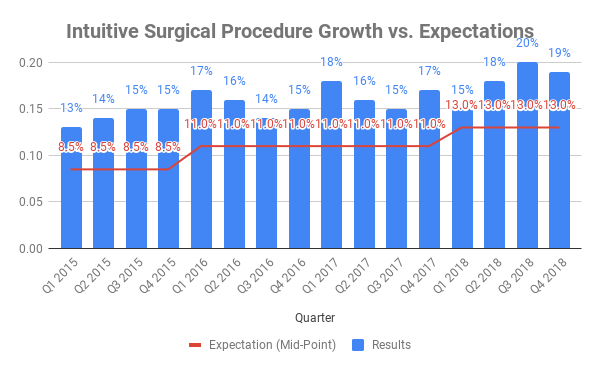

Here's how the company performed against expectations over the next four years.

Data source: SEC filings and conference calls. Chart by author.

Here's the key: In the first chart, all the blue bars were below the red line. In the second chart, all of the blue bars were above the red line. Yes, results matter on an absolute basis. But because investing is a forward-looking activity in which people (investors like you and me) make moves based on the future, expectations matter, too.

When management at a company is able to hold investor expectations in check, three valuable things happen:

- Investors get a more realistic view of the future and can make investing decisions accordingly.

- Management gives itself breathing room in case the company experiences difficulties.

- There's more room for upside surprises, as opposed to the disappointment of falling short of lofty expectations.

That's why I'm exceptionally excited by Intuitive Surgical's preliminary earnings release from last week.

We didn't get the same kind of granularity that we'll see when the company reports earnings later this month. But we do know that U.S. General Surgery -- which has been the key growth driver of the past four years via hernia and colorectal procedures -- grew 34%. That's very encouraging; investors should listen closely to see if all of that came from the two aforementioned procedures, or if there's another growth driver at play.

But perhaps most importantly, Guthart said that 2019 procedure growth is expected to come in between 13% and 17%. That's the highest figure the company has put out (to begin a year) since the abysmal performance in 2013. No doubt, that growth in U.S. general surgery, and the potential for more growth abroad, will play a role.

Given what Intuitive and Guthart have delivered over the past four years, it wouldn't be a stretch for Intuitive's total procedure growth for the year ahead to eclipse 20%. That may sound ambitious, but Intuitive estimates there are 21.8 million invasive surgical procedures just in the U.S. every year. Intuitive's worldwide procedures just eclipsed 1 million annually for the first time. Clearly, there's plenty of room to grow.

Executives from other companies -- none more obvious than Tesla's Elon Musk -- could learn something from this. Keep investor expectations in check, and let your results -- not hype -- do most of the talking.