Most investors have been quite happy with how the financial markets have bounced back in the first part of January. After suffering losses during 2018 for the first time in years, markets are making up for lost time, and some key sectors have seen gains of 20% or more in just three weeks.

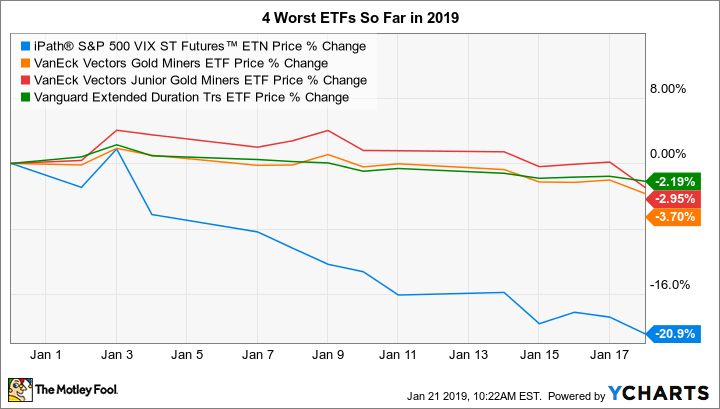

With most of the market up significantly, there aren't that many exchange-traded funds that have lost ground so far in 2019. Yet there are a few trends that have sent some ETFs lower, and some investors are concerned about whether their losses so far are just the tip of the iceberg for what could turn out to be substantial underperformance in the coming year. Below, we'll look at four of these laggards to see whether they can bounce back in short order.

The 4 worst ETFs so far in 2019

|

ETF |

Assets Under Management |

YTD Return (Loss) |

|---|---|---|

|

iPath S&P 500 VIX Short-Term Futures (VXX) |

$790 million |

(21%) |

|

VanEck Vectors Gold Miners (GDX 3.65%) |

$9.98 billion |

(4%) |

|

VanEck Vectors Junior Gold Miners (GDXJ 2.42%) |

$4.13 billion |

(3%) |

|

Vanguard Extended Duration Treasury (EDV -0.80%) |

$852 million |

(2%) |

Data source: ETFdb.com, fund companies. Includes ETFs with assets of $500 million or more, but excludes leveraged or inverse ETFs.

A big drop in volatility

2018 marked the return of volatility into the stock market, and investors who tapped into that trend by using volatility ETFs were rewarded for their efforts. The iPath volatility ETF jumped almost 70% in 2018, benefiting from two major episodes of stock market declines during the year. More often than not, it's downside volatility that causes the iPath ETF's price to rise, and that was definitely the case last year.

The positive start to 2019, however, has made some volatility investors fearful that the markets will return to their relative calm of past years. Even with the ETF's gains in 2018, the iPath volatility fund has lost 94% of its value since early 2014, and the structure of the iPath ETF makes it hard to use for long-term volatility exposure. It'll take another sharp move lower for the volatility ETF to regain its losses for the year so far.

All that glitters is not gold

In a similar vein, some investors turned to the traditional safe haven of gold to protect themselves against stock market volatility. During the last part of 2018, gold prices rose as stocks fell, and the companies that mine gold saw solid gains. The VanEck Vectors Gold Miners ETF, which concentrates on the large players in the mining industry, saw gains of 14% during the fourth quarter of 2018. The Junior Gold Miners ETF, which instead looks at smaller miners, posted a 10% rise in the fourth quarter.

The recovery in the stock market has led some of those safe-haven seekers to sell out of their gold holdings, and that's likely responsible for these two ETFs' modest losses so far in 2018. Yet with signs of consolidation within the mining industry, it's possible that these funds could push back into positive territory in 2019 even if the rest of the stock market stays on an upward trajectory.

Image source: Getty Images.

A bond reversal

Finally, one reason why 2018 was so tough for investors was that many different asset classes suffered losses. Even those who sought the protection of bonds had to deal with negative total returns, although funds like the Vanguard Extended Duration Treasury ETF did outperform major stock indexes like the Dow and S&P 500.

As stocks have soared to start 2019, bond yields have risen, and that's hurt ETFs like Vanguard Extended Duration Treasury. There's plenty of disagreement about the future direction of interest rates this year, with some suggesting the Federal Reserve will remain overly diligent in pushing rate hikes, while others see a possible slowing in the economy as cause to expect the Fed to pause. In either event, it's important for bond investors to understand that ETFs like this one can lose money in certain market environments.

Keep an eye on these ETFs during 2019

Investors in these ETFs are disappointed that they haven't seen the same gains that some of their counterparts have. But it's still early in the year, and if the positive mood to start January gives way to the same fears that the market dealt with toward the end of 2018, then the early declines for these ETFs could reverse themselves quickly.

Check out all our earnings call transcripts.