You've probably seen those Wayfair (W -3.72%) commercials on TV. The company is spending a lot on those ads, which has taken a bite out of Wayfair's profitability. However, those ads have translated to a fast-growing business that is quickly gaining share of the massive $600 billion home goods market.

We're going to look at three charts that provide an overview of Wayfair's business performance, and why management is not concerned about the company's lack of profitability right now.

IMAGE SOURCE: GETTY IMAGES.

There's a world of opportunity out there

The knock against Wayfair is that it hasn't reported a profit. It's not that the company can't earn a profit, but management has made the decision to sacrifice profit in the short term to build the foundation for long-term dominance in the home goods market. The consistency in Wayfair's top-line growth quarter after quarter suggests that management is right to forgo profitability at this early stage of the company's growth.

Data source: Wayfair. Chart by author.

After the company reported near triple-digit growth rates a few years ago, there was a steep deceleration in 2016. Since then, Wayfair has settled into a consistent growth rate of 40%-plus over the last two years.

Management estimates its total addressable market at about $600 billion, which currently consists of mostly brick-and-mortar spending. However, e-commerce growth in the U.S. is far outpacing retail overall, and spending in the home goods category is rapidly shifting online. Wayfair believes it is positioned to capture a sizable share of spending for home goods based on its vast selection, customer service, apps and technology, and shipping operations that allow for fast delivery while reducing damage during transit.

Not a typical retailer

Wayfair is investing heavily in its CastleGate warehouses and delivery network, which is one reason why the company hasn't reported a profit. The company can deliver small parcels within one or two days and large items within a week. The company claims that its shipping speed is about twice as fast as other home goods retailers.

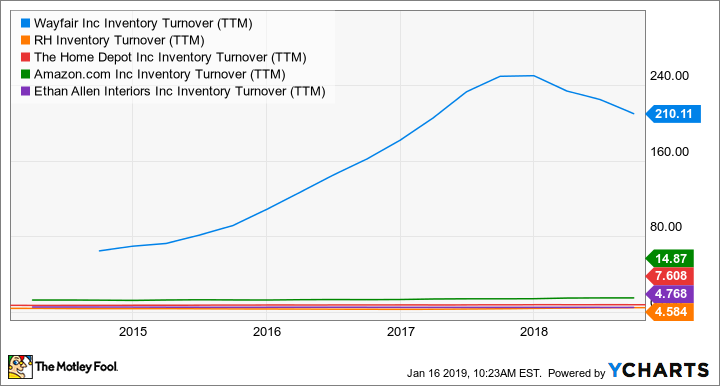

Even though Wayfair offers one of the largest online selections of home goods, it's eye-opening how little inventory the company carries on its books. In the third quarter, Wayfair generated $1.7 billion in revenue while ending the quarter with only $35.7 million in inventory. Take a look at this chart that compares Wayfair's inventory turnover (which measures the number of times the company moves merchandise over a period) to other retailers that sell home goods:

W Inventory Turnover (TTM) data by YCharts.

When I see that sky-high turnover ratio, I don't see Wayfair as a traditional retailer. A retailer in the traditional sense spends a considerable portion of capital on inventory and holds it for sale until it moves out the door. Wayfair's incredibly high 200-plus turnover ratio reflects a different breed. It's better to think of it as a data analytics company that is applying technology to managing and processing orders for home goods online. The founders of Wayfair are both engineers with backgrounds working in technology, and they are in the business of connecting suppliers with buyers. It's that simple.

Because Wayfair doesn't have to spend hundreds of millions of dollars on inventory, it can instead funnel that spending to what it needs the most to drive those 40%-plus revenue growth rates -- marketing, back-end technology, and a delivery network to beat competitors to the massive opportunity that is clearly in front of them.

Wayfair is spending within its means

In Wayfair's early days, management grew the business out of its cash flow and turned a profit for nine years. Although the company hasn't reported a profit since its IPO in 2014, the business is producing cash that management can spend to build out the infrastructure that is needed for long-term growth.

W Cash from Operations (TTM) data by YCharts.

The cash from operations the company generates indicates that Wayfair's business model is sustainable, and I believe it's only a matter of time before the company does report a profit on its income statement. Currently, Wayfair is spending 30% of its revenue on operating expenses, but as Wayfair gains scale and brand awareness, management plans to bring this percentage down over time. Wayfair is seeing an increasing number of its orders coming from repeat customers;if that trend continues, it means less money will have to be spent on marketing down the road, which would provide a respite for the bottom line.

What's next?

Over the long term, management is targeting a single-digit operating margin, consistent with other discount retailers. Investors seem to be buying in to management's strategy, given the stock is up 158% over the last five years.

I'm one of those who has taken the plunge. There are similarities in what Wayfair is doing and how Amazon.com has expanded over the years. Both companies understand that to win in a dynamic, hypercompetitive e-commerce landscape, you have to be willing to invest aggressively up front. That means no profit in the early going, but it's the right move if Wayfair wants to capture the huge opportunity in the home goods market before larger competitors fill the gap.

Check out the latest Wayfair earnings call transcript.