Check out the latest Intuitive Surgical earnings call transcript.

As is standard for Intuitive Surgical (ISRG -1.16%) -- maker of the da Vinci surgical robot -- much of the buildup leading into fourth-quarter earnings has already played out. The company presents annually at the J.P. Morgan Healthcare Conference in early January and offers preliminary results before taking the stage.

This year was no exception, and the company's preliminary release left investors very excited. The main benefit of the official earnings release is the chance to dive deeper into the results to get a better idea of the company's priorities.

Image source: Getty Images.

Intuitive Surgical earnings: The raw numbers

Before we dive into those details, however, let's glance at the headline numbers for the fourth quarter:

| Metric | Q4 2018 | Q4 2017 | Growth |

| Revenue | $1.047 billion | $892 million | 17% |

| EPS | $2.96 | $2.60 | 14% |

Data source: Intuitive Surgical IR. EPS presented on non-GAAP basis.

At first blush, investors might worry that earnings aren't growing as fast as sales. But the fourth quarter included a $25 million "operating expense" that was actually a donation to start the Intuitive Foundation, which will support clinical research and community philanthropy. Removing that one-time donation from the equation, EPS would have been $3.12, which represents 20% growth.

Intuitive also ended the quarter with $4.8 billion in cash and investments, and zero long-term debt.

Breaking the results down by division, Intuitive had strong sales growth across the board.

| Division | Q4 2018 | Q4 2017 | Growth |

| Instruments & Accessories | $539 million | $457 million | 18% |

| da Vinci Systems | $341 million | $285 million | 20% |

| Service | $167 million | $150 million | 11% |

Data source: Intuitive Surgical IR.

For the quarter, a total of 290 da Vinci systems were shipped, up 34% from the same quarter last year.

One key difference is that more of these systems are being shipped under operating leases or usage-based agreements. The flexibility and lower up-front costs of this arrangement makes it easier for hospitals to afford a da Vinci. For the quarter, 84 of the systems placed (29% of the total) were under such an arrangement, versus 40 (19% of total) from the fourth quarter of 2017.

Operations have a strong showing

As important as the financial numbers are, they pale in comparison to the importance of procedure growth metrics, which show how the da Vinci system becomes even more useful over time. Medical professionals who use the system are constantly finding new uses for it, which is demonstrated by procedure growth.

Procedure growth drives Intuitive's revenue from instruments and accessories. More hospitals can justify shelling out the money for a da Vinci system when they know it improves patient outcomes in a growing number of procedures.

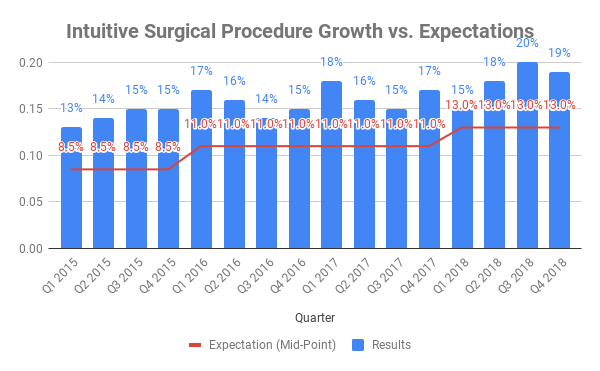

When 2018 began, the company called for procedure growth in the range of 11% to 15%. It blasted past this expectation, coming in at 19% during the fourth quarter. As you can see below, that continues a trend of coming in well above the guidance offered at the beginning of the year (depicted by the red line).

Data source: SEC filings.

Intuitive's earnings also offered details on where all that growth came from: U.S. general surgery, and procedure growth outside the United States. More specifically, growth in hernia and colorectal procedures drove the U.S. general surgery category, while robust growth in several countries -- most notably Japan, which saw a 40% jump in procedures -- helped the international segment.

This year also marks the first year that U.S. general surgery is the largest "procedure" for the company; use of da Vinci in gynecology procedures has already become the standard. Taken together, you can see this is a continuation of trends over the past five years.

Data source: SEC filings and company conference call. 2018 figures are approximations based on management comments on conference call.

Intuitive's CEO Dr. Gary Guthart routinely reminds investors that it is in early stages of international adoption. This gives investors an idea of the type of growth that remains to be captured globally.

Looking ahead

Many telling details were disclosed for the year ahead. The headline numbers most investors were interested in were: Procedures are expected to grow in the range of 13% to 17%, and the company expects operating expenses to increase between 20% and 28%.

Management believes that there's huge global opportunity, which explains why it will be spending so much more in 2019. In particular, it expects to increase its presence in China, Taiwan, and India. And in research and development, it will devote capital to its single port (Sp) surgical arm, its advanced visualization capabilities, and development of Ion -- a tool to improve the ease of lung biopsies.

Guthart's four big priorities for Intuitive's year ahead are:

- Increasing adoption of da Vinci in general surgery (like hernia and colorectal procedures, among others).

- Continuing the launch of Sp and initiating the launch of Ion.

- Driving intelligent surgery innovation -- particularly through the use of cloud computing.

- Supporting clinical and economic validation globally -- in other words, showing that daVinci helps patients recover from surgery more quickly than laproscopic surgery, and at a lower overall financial cost.

While the headline numbers will always be worth watching, long-term investors should keep a keen eye on these four initiatives as 2019 progresses.