Check out the latest Apple earnings call transcript.

Apple (AAPL -2.19%) changed some of its financial reporting this year. It took away unit sales of its devices in its quarterly report, but it added cost of sales information about its burgeoning services business.

And services are extremely profitable. The company reported a gross margin of 62.8% for services during its first quarter of 2019, which include App Store and iTunes downloads, Apple Music and iCloud subscriptions, and Apple Care sales. Not only is that above the consensus estimate of 56% analysts held last month, it's a 4.5 percentage point expansion from services gross margin in the first quarter last year.

Overall, service revenue grew 19% year over year, and services gross profit grew 28%. Here's what's driving the services business at Apple.

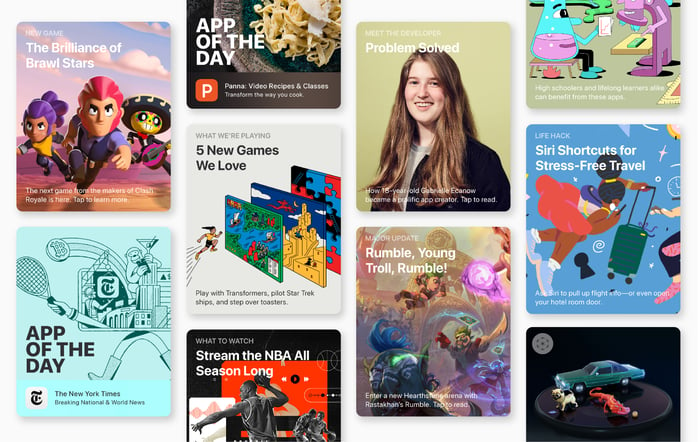

Image source: Apple.

The install base

Apple provided two big updates on its install base. The last update it provided was in January last year, when the company said it had 1.3 billion active devices. It says that number is now 1.4 billion. Apple also revealed that it has 900 million active iPhone users, up about 75 million over the past year.

CFO Luca Maestri says the company plans to provide periodic updates on its install base, so investors ought to expect them to come more frequently.

Apple would like investors to focus on its install base instead of its quarterly unit sales. "Very little of our services revenue is driven by what we sold in the last 90 days," Maestri said on the company's first-quarter earnings call.

More services per customer

Apple is doing an excellent job getting customers to pay for more services. While the install base grew around 8% over the past year, services revenue grew around 19% in its first fiscal quarter, and more than 20% in its prior three quarters. That means Apple is selling more services to its customers.

Apple Pay is constantly expanding to more and more retailers and geographical markets. Apple Care is available through more points of sale. Apple Music now has 50 million subscribers. The streaming service is responsible for iTunes having its best quarter in music revenue ever last quarter.

Apple is also growing services like advertising for its developers. Ads are primarily confined to the App Store, but it still represents a massive opportunity for growth.

Apple will continue to add new services for customers to take in the future. It's been working on some sort of video service for a long time, and that's expected to launch later this year.

As Apple adds more services to its portfolio, it can generate much higher revenue per active user.

Subscriptions are growing

Apple has put a lot of focus on subscriptions over the past couple years in an effort to drive App Store revenue. Apple changed its fees for subscriptions sold through the App Store in 2016, incentivizing developers and services to create subscription products. Instead of taking a 30% cut on all in-app purchases, Apple reduced that fee to just 15% after a customer has subscribed to an app for a year.

Maestri says subscriptions are growing faster than overall service revenue. Paid subscriptions across Apple's products grew 50% year over year to 360 million. The company expects to surpass 500 million sometime next year.

Apple's forthcoming video service may spur further growth in subscriptions. While the details aren't definitive, Apple seems to be interested in bundling its own original content with premium video subscription services.

The recurring revenue from subscriptions ensures Apple's services revenue will remain relatively stable from quarter to quarter.

It all adds up

A growing user base taking more services and paying for them on a regular basis is a recipe for growing revenue. What's more, Apple is able to produce even higher gross margins on its services by maximizing revenue per user. As that trend continues, investors should expect Apple to show continued service revenue growth and gross margin expansion.