After stagnating over the course of two and half years, Starbucks (SBUX -0.35%) stock is showing signs of perking up. In fact, since its summer swoon, better-than-expected earnings have catapulted shares a handsome 40% off their July 2018 lows.

With the stock now trading at a P/E ratio of 30 times trailing earnings and over 25 times forward earnings estimates. It's hard to make the argument that Starbucks is cheap. But if you're a current Starbucks investor, is it time to sell? Or is there still another sip left in that half-caf-skim no-whip Frappuccino?

The answer depends on what kind of stock you (or the market) think Starbucks is.

The argument that Starbucks is expensive

There are plenty who will scoff at Starbucks' valuation. Twenty-five times earnings estimates may be a reasonable figure to pay for a high-growth company, but Starbucks' recent guidance calls for only 5%-7% revenue growth in FY 2019. That's hardly "high-growth."

Can Starbucks grow into its valuation? Image source: Getty Images.

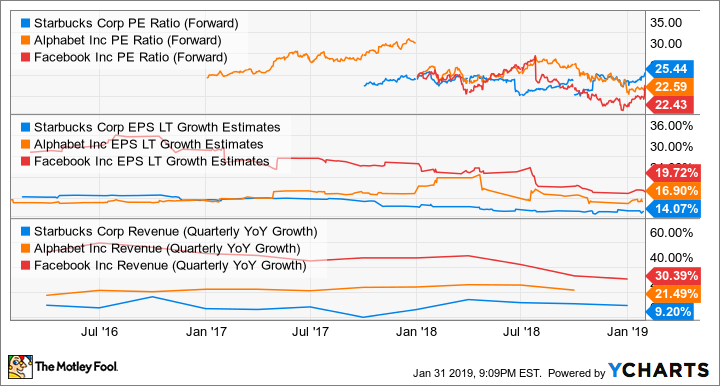

In addition, there are other dominant brands we use every day -– mostly in the technology space – that are growing much faster, yet sport lower valuations. For instance, Alphabet and Facebook are each growing much faster than Starbucks, yet both have lower forward P/E ratios.

Check out some stats for the three companies in the following charts.

SBUX PE Ratio (Forward) data by YCharts

As you can see, both Alphabet and Facebook are growing revenue 20%-30% yet both have forward P/E ratios of about 22.5, below Starbucks' 25. Not only that, but Alphabet and Facebook also have huge amounts of excess cash on their balance sheets. When stripping this out, they are even cheaper by comparison.

Check out the net debt of Starbucks, Alphabet, and Facebook in the following chart.

SBUX Net Financial Debt (Quarterly) data by YCharts

So, even though Starbucks is a dominant global brand, other dominant global brands make Starbucks seem quite expensive indeed.

The argument that Starbucks isn't expensive

On the other hand, there's also a decent argument that Starbucks stock isn't expensive. While growth rates play heavily into a company's price-to-earnings ratio, so does safety. While Starbucks may seem expensive relative to the aforementioned tech giants, it actually looks cheap if viewed as a consumer staple or fast-food stock.

Consumer staples and fast-food companies, for the most part, have sub-standard growth, but are deemed relatively "safe" from volatility or recessions. In today's low-interest rate environment, the dependable nature of these companies' revenue streams and dividends makes them almost like fixed income investments, and they can therefore garner P/E ratios above 20, even while standing still. Starbucks' dividend yields about 2% at the stock's recent price.

Fries with that?

From the standpoint of a fast-food chain, Starbucks suddenly doesn't seem so pricey. Starbucks actually had much, much higher revenue growth than fast-food competitors in 2018, yet its valuation is just a hair above these no-growth rivals. And it's far, far cheaper than "growth" darling Chipotle, which trades at an astronomical 43 times forward earnings, even though Starbucks is currently growing at a higher rate.

Check out some stats for Starbucks, McDonald's, Yum! Brands, and Chipotle in the following charts.

SBUX PE Ratio (Forward) data by YCharts

Maybe you consider coffee a necessity

Starbucks also seems reasonably priced when compared to consumer staples stocks. Consumer staples conglomerates sell things like toothpaste, diapers, and shampoo that we use (or, uh, should use) everyday, so they're often regarded as recession-proof safe havens. As you can see in these charts with metrics for Starbucks, Procter & Gamble, Colgate-Palmolive, and Clorox, despite inferior growth prospects, these stocks are nearly as expensive as Starbucks.

SBUX PE Ratio (Forward) data by YCharts

What is Starbucks?

While Starbucks has historically been a high-growth retail disruptor, its ubiquitous presence across the country in high-traffic retail locations, along with an addictive product, appears to have made the company more of a consumer staple in investors' eyes.

Check out the latest Starbucks earnings call transcript.

Starbucks has also done a fantastic job keeping customers loyal and returning, with its best-in-class My Starbucks Rewards program. Last quarter, the company had 16.3 million U.S. Rewards members, up 14% year-over-year. The generous rewards program has done a great job of turning Starbucks from an affordable luxury into more of a daily habit for millions of Americans. Last quarter, the rewards program helped power U.S. same-store sales growth to 4%, accelerating from just 2% growth a year earlier.

In other words, Starbucks investors don't seem to be caring as much about eye-popping growth as much as they used to, and are now assessing the company's safety, dependability, and dividend. In that light, I don't think Starbucks is over-priced.