Shares of Duke Energy (DUK -0.56%) have been on a roll lately, recently hitting 52-week highs and racking up nearly 15% gains in one year. Duke's performance mirrors that of closest rival Dominion Energy (D -1.63%), but it's only recently that Dominion shares have inched higher to catch up with Duke.

On the one hand, a favorable interest rate environment is a positive for Duke Energy. The Federal Reserve's recent decision to leave interest rates unchanged bodes well for debt-heavy utilities.

On the other hand, Duke's rally has left investors wondering if there's still time to buy the stock.

While Duke can be sensitive to interest rates in the short term, whether the stock can fetch you money in the longer run if bought now depends largely on three factors: growth plans, dividend growth, and valuation. Here's how Duke stacks up on these parameters.

Where will Duke Energy be five years from now?

Duke is one of the largest power companies in the U.S., providing electricity to nearly 7.6 million customers and natural gas to 1.6 million. Dominion's customer count is roughly 7.5 million.

Image source: Getty Images.

Because Duke is a regulated electric and gas utility, the rates it charges for its services are approved by federal utility regulatory agencies, and so are its capital investments. The rates cover the utility's costs of providing services plus a reasonable return on equity and invested capital.

That means two important things for Duke shareholders. First, with regulated rates, Duke's revenue and cash flows are pretty stable and predictable. Second, prior approval for capital investments offers investors better visibility into how the company intends to use money and the kind of growth to expect.

DUK Revenue (TTM) data by YCharts.

Between 2019 and 2023, Duke aims to spend nearly $37 billion, significantly higher that Dominion's planned capital outlay of $26 billion for the same period. Duke will focus on three key areas: modernizing its power grid (including investment in electric vehicle infrastructure and battery storage), expanding its natural gas infrastructure, and strengthening its renewable energy portfolio. Coal's share in Duke's energy output is expected to come down to only 15% by 2030, from 61% in 2005.

Duke believes these investments should drive its adjusted earnings per share by compound annual rates of 4% to 6% through 2023 from its 2019 midpoint earnings guidance of $5 per share.

Taking a cue from Duke's forecast, analysts foresee average annual earnings growth of 4.5% from the company in the next five years. That may not sound exciting, but utilities are typically slow-growth companies. That they grow slowly but steadily is what potential investors need to remember.

What's more important, the returns you can expect from Duke shares depend a great deal on its dividends, and things look good on that front.

Dividends you can count on

Duke Energy has paid a consistent dividend for 92 years and increased it every year for the past 13 years, with about a 4% hike in each of the past two years. That pales in comparison to Dominion's 10% dividend increase in 2017 and again in 2018, but Dominion's dividend growth is expected to decelerate to the low single digits in 2020 and beyond.

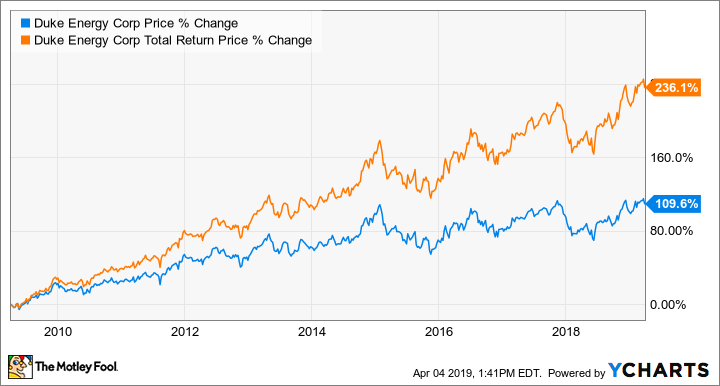

Duke, on the other hand, should be able to grow its dividends in line with adjusted EPS and maintain yields at current levels of around 4.1%. For shareholders, that could mean high-single-digit annual returns from the stock. As you can see in the chart above, owning Duke shares over the years wouldn't be half as profitable if not for its stable and growing dividends.

But there's one risk Duke investors need to be aware of: uncertainty surrounding a key project.

A weak spot in Duke's growth prospects

The Atlantic Coast Pipeline project -- a joint venture among Duke, Dominion, and Southern Company -- was originally estimated to cost $5.1 billion and be operative by 2019, but has hit cost overruns and delays thanks to regulatory hurdles.

In Duke's latest earnings conference call, management upped the cost range of the project to $7 billion to $7.8 billion, 47% of which will be borne by the company.

But a bigger threat is the possibility of the project being shelved altogether. A recent report by Oil Change International, which advocates for clean energy, and the Institute for Energy Economics and Financial Analysis examined how the project is no longer justified given the change in the supply and demand dynamics for natural gas over the years.

The pipeline is expected to be a crucial transmitter of natural gas from West Virginia and is a key part of Duke's renewables growth equation as it retires coal plants and switches to alternative fuel sources. Duke's CEO Lynn Good even said recently that the company will have to build another pipeline if the Atlantic Coast project doesn't work out.

Investors should watch for developments on this front as Duke has significant amounts of money at stake here.

Valuation: Buy Duke stock only if...

At a forward P/E of 18, Duke isn't cheap. For a utility, though, the ratio of enterprise value to EBITDA is a better gauge than earnings ratios as it excludes noncash items, reflects cash flows, and considers debt as well. Again, at around 12 times EV-to-EBITDA, Duke appears fairly priced, at par with its peers. Don't touch your Duke shares if you already own some, but you might want to wait for a better price to buy them unless you're purely an income investor looking for stable dividend growth and high yield.