North America's two top garbage collection companies -- Waste Management (WM 1.08%) and Republic Services (RSG 0.82%) -- excel at one thing in particular: turning trash into cash for investors. Each has returned more than 400% to their shareholders over the past decade, and both appear to be well positioned to deliver even more gains in the years ahead.

But which of these trash titans should you buy today? Let's find out.

Image source: Getty Images.

Competitive position

As the leading provider of waste collection and recycling solutions in North America, Waste Management enjoys powerful competitive advantages. It owns the largest network of landfills, transfer stations, and recycling facilities in the industry. Together, they make up a wide competitive moat around Waste Management's business, as regulatory hurdles and homeowner objections make it difficult for potential rivals to build new waste facilities.

These industry dynamics also benefit Republic Services. As the second largest waste collection company in North America, Republic Services enjoys many of the same advantages as Waste Management. Its collection operations, recycling centers, transfer stations, and landfills also tend to operate as de facto regional monopolies. Like Waste Management, this gives Republic Services pricing power -- the ability to consistently raise prices without sacrificing sales -- and helps to insulate its profits from smaller rivals.

While building new waste facilities is difficult, Waste Management and Republic Services are able to grow their operations by acquiring smaller waste businesses. And as they continue to consolidate the waste-collection industry, they further widen their competitive moats.

All told, both Waste Management and Republic Services have strong competitive positions in the trash industry. But as the larger of the two, Waste Management benefits from greater economies of scale and thus tends to earn higher returns on invested capital. That gives it the edge here.

Advantage: Waste Management

Financial strength

Let's now take a look at some key financial metrics to see how these garbage giants compare.

|

Metric |

Waste Management |

Republic Services |

|---|---|---|

|

Revenue |

$14.9 billion |

$10 billion |

|

Operating income |

$2.8 billion |

$1.7 billion |

|

Net income |

$1.9 billion |

$1 billion |

|

Operating cash flow |

$3.6 billion |

$2.2 billion |

|

Free cash flow |

$1.9 billion |

$1.2 billion |

|

Cash |

$61 million |

$71 million |

|

Debt |

$10 billion |

$8.3 billion |

Data sources: Company filings.

Republic Services has slightly more cash and $1.7 billion less debt on its balance sheet. However, Waste Management generates significantly more profit and cash flow each year, and it wouldn't take long for it to pay down its debt and build up its cash reserves if it chose to. Thus, the garbage king has the edge here.

Advantage: Waste Management

Growth

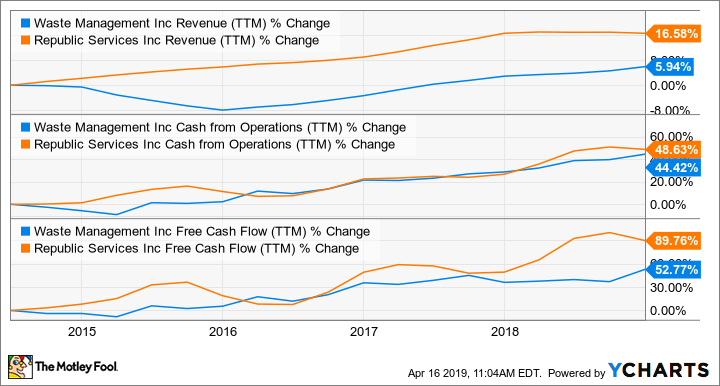

Waste Management may currently produce more cash, but Republic Services is growing faster. The No. 2 trash collection company's revenue, operating cash flow, and free cash flow have all increased at a quicker pace than its larger rival over the past five years.

WM Revenue (TTM) data by YCharts

Wall Street expects this trend to continue. Republic Services' earnings are projected to climb by nearly 12% annually over the next five years, fueled by additional tuck-in acquisitions, price hikes, and bountiful share buybacks.

Waste Management's profits, meanwhile, are forecast to increase by 10.5% annually over the next half-decade. Acquisitions -- including its recent $4.9 billion purchase of Advanced Disposal (ADSW) -- are likely to remain a key part of Waste Management's growth strategy.

A 1.5% annual difference in expected earnings growth rates may not seem like much, but it's enough to give Republic Services the edge here.

Advantage: Republic Services

Valuation

Finally, let's review some common stock valuation ratios.

|

Metric |

Waste Management |

Republic Services |

|---|---|---|

|

Price-to-sales |

2.97 |

2.52 |

|

Price-to-free cash flow |

23.34 |

21.12 |

|

Trailing price-to-earnings |

23.47 |

24.92 |

|

Forward price-to-earnings |

21.85 |

22.00 |

|

Price-to-earnings-to-growth |

2.19 |

2.00 |

Data source: Yahoo! Finance.

Waste Management's stock is slightly cheaper based on earnings. But Republic Services' shares are significantly less expensive based on sales and free cash flow -- and when we adjust its price-to-earnings ratio to account for its higher expected growth rate, as we do with the PEG ratio, that makes Republic Services' stock the bigger bargain.

Advantage: Republic Services

So which stock should you buy?

With this better-buy analysis all tied up after four rounds, there's no clear victor. Some investors may prefer Waste Management's leading competitive position and superior cash-flow generation, while others might favor Republic Services' higher growth rate and more attractively priced shares.

As such, the best move may simply be to buy both of these trash titans today. That way, you can diversify your risk and claim a larger share of the overall trash collection industry's profits.