Midstream players Kinder Morgan (KMI -0.16%) and ONEOK (OKE 0.43%) both offer investors impressive 5% yields. But they aren't interchangeable options. Here are a few ways in which these companies are similar and two very important ways in which they are materially different. If you are looking for a reliable dividend payer, the differences between these two high-yield stocks are what you should be focusing on.

On similar turf

Kinder, with a roughly $45 billion market cap, is much larger than ONEOK, which weighs in at nearly $28 billion. However, the core of their businesses are pretty similar. For example, both are heavily focused on the infrastructure that moves natural gas. This is expected to ease the transition from coal to cleaner options in the years ahead as energy demand in emerging economies continues to expand.

Image source: Getty Images

Kinder and ONEOK are also built around largely fee-based businesses. This means that they get paid for the use of the midstream assets they own (such as pipelines and processing facilities), and not based on the price of the commodities that flow through them. Kinder estimates it generates about 90% of its revenue from fees, with ONEOK pegging that number at around 85%. This means that both companies have a steady stream of revenue to back their dividends.

Looking at dividends, ONEOK's dividend coverage was a robust 1.37 times in 2018 and an even stronger 1.43 times in the first quarter of 2019. For reference, 1.2 times is considered strong in the midstream space. That said, Kinder Morgan's dividend coverage was a hefty 2.4 times in the first quarter. However, that number is coming off a low base, because Kinder Morgan cut its dividend 75% in 2016 (more on this below, since it's the basis for one of the two big differences between the companies). This impressive dividend coverage has allowed Kinder to push through some giant dividend hikes in recent years, with a 25% increase in the first quarter. The plan is for a similarly sized increase in 2020 as well. ONEOK's dividend is projected to grow at around 5% a year, a respectable number that bests inflation -- but not nearly as enticing as Kinder's plans.

The dividend increases at these companies, meanwhile, are backed by sizable capital spending plans. Both ONEOK and Kinder Morgan have roughly $6 billion in growth projects in the works. The plans are underpinned by a few large investments at each company, with some smaller ones rounding out the mix. Although there are various completion dates, they have work planned out through the early 2020s. If history is a guide, they will both continue to add to the project list as time goes on.

So far, Kinder Morgan and ONEOK are roughly similar. But Kinder appears to have the dividend edge. But don't jump in just yet. It's time to talk about the notable differences here.

Two key takeaways

One of the big differences is that Kinder Morgan has rewarded investors with much higher dividend growth lately and will likely do so for at least another year. And while that's an important difference, it's not the biggest issue to think about with regard to the dividend. It's the dividend cut that is more important.

In 2014, Kinder Morgan announced plans to simplify its business structure by acquiring a number of controlled public entities, notably including a limited partnership that shared its name. It was a complicated transition period that led to an increase in debt, which peaked in 2016, when debt to EBITDA rocketed to over nine times. That's a very high number in the midstream space and management became concerned with its investment grade credit rating. Without debt as a financing option, it was left with either issuing equity, cutting its dividend to free up operating cash flow, or severely restrict spending on new projects. It chose growth by cutting the dividend.

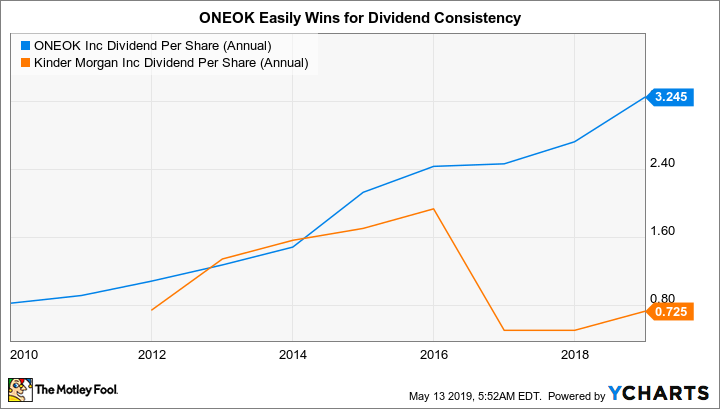

OKE dividend per share (annual) data by YCharts

That's not a good thing for income investors, which is where the really big problem comes in. Kinder Morgan was telling investors to expect a dividend increase in 2016 of as much as 10% just two months or so before it cut the dividend. Income investors should have a major trust issue here, even though Kinder Morgan has gotten back to increasing the dividend again.

For comparison, ONEOK executed a similar simplification transaction and didn't cut its dividend. In fact, ONEOK has increased its dividend annually for 17 years running. The dividend has been maintained at the same level or increased for 25 years. No trust issues there and that should give ONEOK a big leg up on Kinder Morgan for most income investors.

OKE financial debt to EBITDA (TTM) data by YCharts

The next big difference is leverage. A high debt-to-EBITDA ratio was one of the issues that hinted at the risk Kinder Morgan shareholders were facing on the dividend front. Kinder has a long history of using leverage more aggressively than its peers. Although the company has brought leverage down from the peak prior to the dividend cut, at roughly 5.5 times today it is still toward the high end of the midstream industry on this metric. ONEOK's debt-to-EBITDA ratio is much lower, at roughly 3.5 times. That's in line with other large and fiscally conservative players in the space, such as industry bellwether Enterprise Products Partners. If you are a conservative income investor, ONEOK wins out again.

Tread carefully

To be fair, dividend growth investors will likely prefer Kinder Morgan because of the hefty dividend growth lined up for next year. However, investors looking for income stability should tread more carefully. ONEOK has simply managed to reward income investors better than Kinder Morgan over time when you look at the big picture. That, coupled with a more conservative leverage profile, makes it a better pick for most investors. That's particularly true for dividend investors who are relying on a steady stream of income from their investments.