Real estate investment trust (REIT) Realty Income (O 0.55%) is one of the market's most beloved income stocks. There are good reasons for that, of course, but with a giant portfolio, the net lease REIT will increasingly find it hard to live up to the high expectations investors have set. That's likely one of the key reasons it just did something with its portfolio that it has never done before. Here's what the change is and what it means for Realty Income and the net lease industry as a whole.

A lot to like

Realty Income owns properties, but its tenants pay most of the operating expenses on the assets they occupy (like maintenance and taxes). This is what's known as a net lease property, and it's a fairly low-risk business that's more like a financing transaction than anything else. Essentially, a company looking to free up capital locked in a property sells it and then instantly rents it back under a long-term lease. It still gets to use the property and gets the cash it wants to put to use elsewhere. Realty Income and its peers make the spread between their cost of capital and the rent the property generates.

Image source: Getty Images

Realty Income has historically been very selective about the deals it inks. So the properties it owns tend to be very desirable, which helps explain the impressive 98.2% occupancy level it achieved in the first quarter, and why it was able to increase the rent on the properties it released in the quarter, resulting in "recapturing" 104% of the previous rents on those assets.

The REIT's strong ongoing performance, meanwhile, has led to an incredible string of 86 consecutive quarterly dividend increases. That's more than 20 years of annual hikes. And, adding to the dividend allure here, the dividend is paid monthly, so it's like getting a regular paycheck. Historically strong performance and a dividend history that few companies can match have led to investors bidding the shares up (the yield is a relatively low 3.8% or so) in anticipation of continued strong performance.

A tough act to follow

That could be a problem when you consider that Realty Income has a portfolio of more than 5,800 properties. It simply takes more to move the needle as a portfolio expands in size. And it's not like Realty Income has the market to itself -- it faces competent REIT peers and private investors that are looking to own the same net lease assets. That helps explain why Realty Income just did something it has never done before: It bought a portfolio of grocery stores located in England.

The deal isn't exactly huge, involving just 12 properties. The new assets will account for only around 2.2% of the rent roll. But the move into Europe is huge because it opens up a new continent of investment potential for Realty Income. The REIT estimates that the United Kingdom alone is a $1 billion market opportunity. Clearly, Realty Income won't get all those deals, but at least it will now have the chance to compete.

Overall, Realty Income shareholders should be pleased. But Realty Income's overseas move isn't exactly unique: Competitor W.P. Carey (WPC 0.02%) has been investing in Europe for years, with the region making up roughly a third of its portfolio. Adding a new, sizable competitor isn't great news for W.P. Carey, but it's not all bad, either.

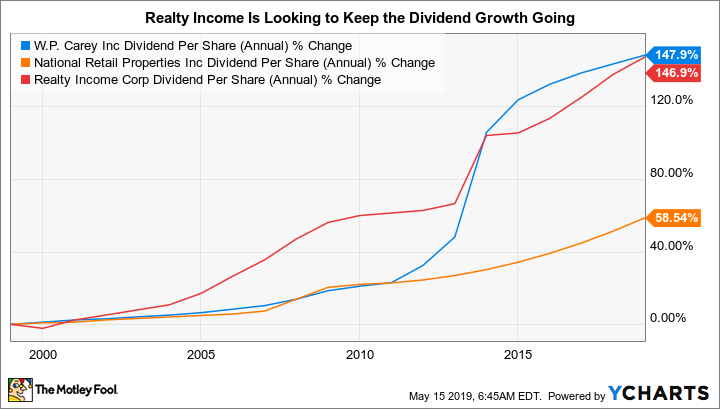

WPC dividend yield (TTM) data by YCharts

For a long time, investors have viewed Carey's foreign exposure cautiously, seeing it as more of a negative than a positive. It's one of the reasons why Carey has historically traded at a discount to domestically focused peers like Realty Income despite very strong performance. To be fair, Carey is also more diversified by sector, as well. But even there Realty Income has been branching out beyond its historical focus on retail properties. Today, Realty Income generates 82% of rent from retail, 11% from industrial, 4% from office, and 2% from vineyards. It's looking more and more like W.P. Carey because the size of its portfolio increasingly means it needs to look beyond retail for investment opportunities. And now it's also looking beyond its core North American market.

The changing shape of Realty Income's portfolio is likely to increase investor acceptance of diversification in a net lease REIT. And, with Realty Income moving to Europe, expect domestic competitors to strongly consider following along. That's a good thing for W.P. Carey even if it means that it will likely face new competition in Europe. Essentially, it will allow investors to revisit their thesis about Carey's risk profile and, perhaps, narrow the valuation gap between it and industry leaders like Realty Income.

WPC dividend per share (annual) data by YCharts

Investors looking to Realty Income for a steadily rising income stream, meanwhile, have another reason to expect that it will live up to the task. There are clearly risks involved in investing abroad, especially when a company has little experience in a region. However, the long-term potential here is well worth any short-term growing pains as Realty Income looks for new avenues of growth.

Broad implications

Realty Income's move into Europe isn't big on an absolute level. But it's a huge deal when you think about the future. It opens a new avenue for growth at Realty, it validates W.P. Carey's business model, and it could lead to more U.S.-centric net lease REITs seeking out foreign investments. In other words, investors across the REIT industry should be pleased with Realty Income's U.K. investment because it could lead to new opportunities not just for Realty Income but for other REITs as well.