It's back! Whether you realize it or not, the cryptocurrency market is on fire, once again, and it's being led by the most popular, and largest, digital currency in the world, bitcoin.

After hitting an all-time high of more than $20,000 per token in December 2017, bitcoin wound up losing more than 80% of its value over the next year. But since bottoming in the low $3,000 range this past December, bitcoin has been virtually (and literally) unstoppable. Earlier this week, bitcoin eclipsed the $8,800 mark during intraday trading, its highest value in just over a year, with the all-important and psychological $10,000 level once again within striking distance.

But, to many, bitcoin's ascent is somewhat of a mystery. After doing some digging, here are six logical reasons for bitcoin's near tripling in value over the past six months.

Image source: Getty Images.

1. It's sort of "technical"

One of the biggest knocks against cryptocurrency investing is that there are no fundamental metrics (at least the sort that we're used to as investors in equities) that'll help investors determine an appropriate value for crypto tokens. With the exception of underlying blockchain processing speed, there are no comparable metrics between tokens and blockchains.

What this means is that investors almost always rely on technical analysis -- i.e., chart patterns, supports, resistances, and volume -- to determine where digital currencies will head next. Relying heavily on technical analysis tends to lead to wild and momentum-based swings upward and downward in cryptocurrencies, which is exactly what we're witnessing with bitcoin at the moment.

2. Mining rewards will soon be halved

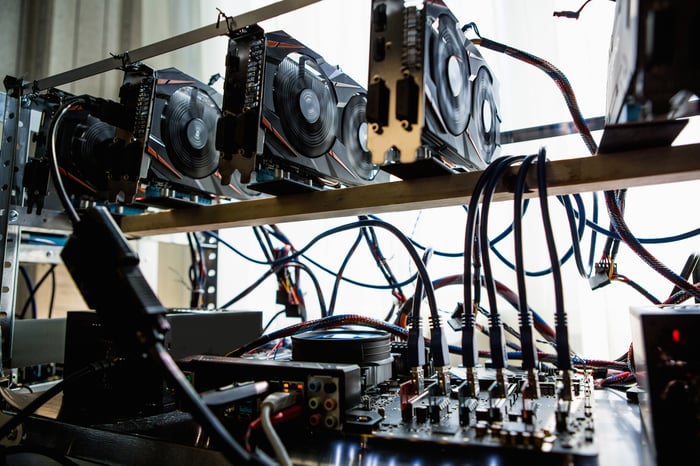

A slightly more tangible reason for bitcoin's ascent has to do with the expected halving of mining rewards by May 2020.

Cryptocurrency mining describes the act of people or businesses validating transactions on a blockchain as accurate and true. In the case of bitcoin, its transactions are validated via the proof-of-work model, whereby high-powered computers solve complex equations to proof transactions on the blockchain. As you can imagine, operating these high-powered computers can be expensive due to electricity costs and cooling needs (computers can create a lot of heat when at full operation). However, the block reward for folks who are the first to solve a block (i.e., group) of transactions is 12.5 bitcoins, which as of Tuesday's price of $8,700 per token equates to a haul of $108,750.

But every couple of years bitcoin's block reward halves. The next expected halving should occur in May 2020, with the reward dropping to 6.25 bitcoin per resolved block. Essentially, investors and miners are getting in ahead of this expected event by pumping up bitcoin's price, with miners attempting to gobble up as many block rewards as possible prior to this halving event.

Image source: Getty Images.

3. Perceived scarcity

Building on the previous point, bitcoin's perceived scarcity is probably responsible for some of its recent ascent.

The largest cryptocurrency in the world has a glass ceiling cap of 21 million tokens, with more than 17.72 million already circulating, according to data from CoinMarketCap.com. This supply grows as new blocks are solved and block rewards are paid to miners. Similar to how gold derives its value from the scarcity of physical metal in existence, bitcoin has pushed higher on the idea that its limited supply of tokens creates value. This upcoming halving event next May provides further "evidence" of this perceived scarcity.

4. Increased institutional interest

A fourth reason bitcoin has been heading higher can be traced to growing institutional interest in bitcoin from Wall Street and wealthy professional traders.

Generally speaking, bitcoin can only be purchased via unregulated cryptocurrency exchanges, which is almost always a no-go for institutional investors. The one exception being that bitcoin futures contracts were introduced in December 2017 by the CBOE Global Markets and CME Group (CME 1.62%) that allowed institutions to make bets on the future price of the popular digital coin. While volume for the CME's bitcoin futures contracts had typically ranged between 3,000 and 4,000 contracts per day before it began rising, it effectively doubled in the weeks and months that have followed. Although it's unclear if these bets are overwhelmingly bullish, it does suggest that interest in bitcoin is picking up on Wall Street.

Image source: Getty Images.

5. An upcoming SEC decision on bitcoin ETFs

The rally in bitcoin could also be tied to an upcoming decision by the Securities and Exchange Commission (SEC) on whether or not bitcoin exchange-traded funds (ETFs) will be allowed on exchanges.

A decision by the SEC was actually expected months ago, but it's been delayed on numerous occasions by the regulatory agency. In a document filed by the SEC a little more than two weeks ago, it announced that it would be fielding comments from the public for three weeks, as well as rebuttals to those comments for an additional two weeks. Based on the new deadline, the SEC is expected to make its ruling on bitcoin ETFs by Aug. 19, or Oct. 18 at the latest if it chooses to delay its decision once again.

Should bitcoin ETFs be allowed to list their shares on major U.S. exchanges, it would likely lead to an influx of capital from small and large investors alike, and it could be something of a stabilizing force in an otherwise very volatile cryptocurrency space.

6. Blockchain projects are advancing

A sixth and final reason for bitcoin's major rally could have to do with the advancement of blockchain projects within the financial space, as well as in other sectors and industries.

Blockchain is the transparent but immutable digital ledger underlying nearly all crypto coins where transaction data is logged. Although bitcoin's blockchain is designed entirely for the purpose of accelerating financial transaction settlements, its blockchain is nonetheless the foundation from which other projects blossomed. As more brand-name businesses consider incorporating blockchain into the mix, the perceived validity of bitcoin's "story" gains steam.

Image source: Getty Images.

Here's why you shouldn't buy into this latest rally

Clearly, there is no shortage of potential reasons behind this incredible surge in bitcoin. But none of these reasons hides the fact that a number of major deficiencies in the cryptocurrency investing thesis have yet to be addressed.

For example, even though blockchain is supposed to be a step up in security over traditional banking networks, theft has become a common problem. Earlier this month, popular crypto exchange Binance revealed that hackers stole 7,000 bitcoins, which are now worth about $61 million. Since the SEC has virtually no ability to track stolen coin or go after hackers outside the confines of the U.S. borders, most stolen cryptocurrency remains lost forever.

Bitcoin's utility, and the utility of nearly every other cryptocurrency, is perhaps the biggest issue of all. Most digital tokens aren't accepted by businesses due to their volatility and lack of financial regulation and backing. What's more, it's the blockchain technology underlying digital tokens that holds the real value... yet investors have zero ownership in this underlying technology when they purchase digital tokens.

With regard to bitcoin, its "perceived scarcity" argument is also an issue. This scarcity is purely based on computer code, whereas an asset like gold has physical (and thereby tangible) scarcity. If the bitcoin community somehow gained consensus, its circulation could extend beyond 21 million, debunking the "scarcity" of the most popular crypto coin.

And, lastly, there aren't any viable investment opportunities that make sense for investors. For instance, the Grayscale Bitcoin Trust (GBTC 1.29%), which owned 225,638 bitcoin as of April 30, 2019, should have an easily calculable net asset value (NAV). But the Grayscale Bitcoin Trust has regularly been valued at well above its NAV since inception, demonstrating that investors have built undue premium into the fund. Not to mention, the Grayscale Bitcoin Trust charges a ridiculous 2% annual management fee for doing virtually nothing with its existing portfolio of coins.

As has been the case for years, the rally in cryptocurrencies like bitcoin may be eye-popping and jaw-dropping, but there's little, if any, substance behind these moves that merits investment.