Stocks wilted in May. The S&P 500 plunged 6.4%, including dividends, which is a huge monthly drop that equates to an annualized loss of nearly 77%.

Last month was the market's first down month in 2019, and the worst May for stocks since 2010.

High-flying stocks were generally the hardest hit, particularly those in the cannabis space. Amid the carnage in the sector, however, there was a little-known gainer: EnWave (ENW -1.79%) (NWVCF -3.35%). Along with making all-natural dried cheese snacks, the Canada-based company licenses, manufactures, and installs equipment for dehydrating organic materials, including marijuana and hemp.

Here's what you should know.

Image source: Getty Images.

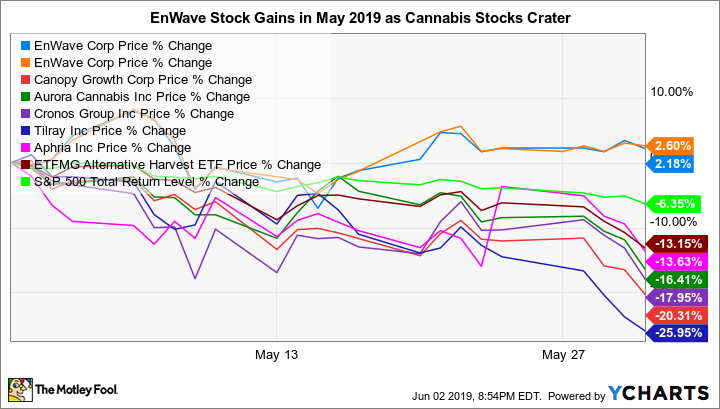

EnWave stock gains in May as cannabis stocks crater

Cannabis stocks were largely dragged down by the poor overall market. When the market declines, stocks that are speculative and highly valued -- and cannabis stocks are the poster children for these adjectives -- tend to suffer the most. During such times, many investors ditch riskier stocks and buy shares of stable companies that pay dividends, such as leading water utility American Water, which returned 5% in May.

The main catalyst for May's market sell-off was escalating global trade tensions. Along with moving closer to a trade war with China, the U.S. could now be heading down that same path with Mexico. On May 31, President Trump threatened to impose a 5% tariff on Mexican imports until our neighbor to the south stems the flow of immigrants crossing its border to the United States. This news naturally rattled the financial markets, as Mexico is our biggest trading partner. So what was already a poor month for the market ended on a down note, with the S&P 500 falling 1.3%.

Even in declining markets, however, there will always be winners. Unlike American Water, EnWave is atypical of the stocks that bucked May's downtrend -- the company isn't profitable, nor does it pay a dividend. Nonetheless, thanks to investor enthusiasm about EnWave's increasing partner and customer wins in the cannabis realm, shares that trade over the counter (OTC) in the U.S. notched a 2.2% gain during the month, while those that trade on Canada's TSX Venture Exchange were in the green by 2.6%. Such modest gains usually wouldn't be worth mentioning, but they're notable when you consider they represent outperformances of 8.6% and 9%, respectively, relative to the S&P 500.

Data source: YCharts. EnWave's OTC shares in blue, TSX shares in orange.

The stocks of the five largest cannabis growers by market cap experienced double-digit losses last month. Shares of Canopy Growth, Aurora Cannabis (ACB 12.87%), Cronos Group, Tilray (TLRY), and Aphria dropped 20.3%, 16.4%, 18%, 26%, and 13.6%, respectively. Alternative Harvest ETF, the sector's biggest exchange-traded fund, declined 13.2%. Granted, shares of EnWave's fellow ancillary cannabis players Innovative Industrial Properties, a real estate investment trust that's profitable and pays a dividend, and KushCo Holding, the leading packaging supplier to cannabis companies, didn't post double-digit declines. However, they did show single-digit losses.

EnWave's business and recent financial performance

EnWave has two businesses: NutraDried Food and EnWave Canada. NutraDried, which accounted for nearly 87% of the company's total revenue in its most recently reported quarter, uses EnWave's proprietary Radiant Energy Vacuum (REV) technology to make Moon Cheese dried cheese products. The Washington state-based food maker has been posting steady growth, thanks to winning increased distribution outlets among major retailers, such as Walmart, Costco, and Whole Foods.

EnWave Canada licenses, manufactures, and installs equipment for dehydrating organic materials. Its target markets include the food, pharmaceutical, and cannabis industries. The machines use the company's REV technology, a vacuum-microwave dehydration tech that "enables uniform drying with flexible moisture content unattainable with freeze drying or air drying," according to EnWave. The company touts that REV is faster than other dehydration or drying technologies and shortens the drying time for cannabis from four to six days (air drying) to about an hour. Moreover, REV reportedly has decontamination capabilities.

Image source: Getty Images.

EnWave's cannabis partners, which are also customers, include two of the four largest Canadian cannabis growers -- Aurora Cannabis and Tilray. As I previously wrote:

- In January, "EnWave and its licensed cannabis partner, major Canadian grower Tilray signed a royalty-bearing sublicense with The Green Organic Dutchman Holdings (TGOD.F -8.13%) giving its fellow Canadian company non-exclusive rights to use REV tech to dry organic cannabis in Canada. ... EnWave also received a purchase order from TGOD for a large-scale 60kW REV machine."

- In late April, "EnWave entered a licensing deal and formed an intellectual-property partnership with Aurora Cannabis. ... In addition, Aurora made a $10 million strategic equity investment in EnWave, giving it an approximate 4.91% stake." Moreover, Aurora placed a purchase order for two of EnWave's 120kW REV dehydration systems.

Last week, EnWave reported its second-quarter results for fiscal 2019. Revenue soared 110% year over year to $8.77 million Canadian, and, as with the previous two quarters, earnings per share came in at breakeven. That EnWave is profitable on an operating basis and appears to be on the cusp of profitability on a net basis sets it apart from nearly all other cannabis players.

Unlike '80s band A-ha (remember "Take on Me"?), EnWave isn't a one-hit wonder, as the stock had been performing well before May. It's up about 75% (both OTC and on the TSX) in 2019 through June 3, leaving nearly all cannabis stocks high and dry (pun intended), with the exception of Innovative Industrial Properties, which has returned 86% over this period.

In short, if you're a risk-tolerant investor interested in the cannabis space, EnWave is worth putting on your watch list.