Shares of Chinese electric-car maker NIO (NIO 1.62%) have fallen sharply since the company reported on May 28 that it lost $395.23 million in the first quarter of 2019. NIO's first-quarter revenue and deliveries both declined significantly from the fourth quarter of 2018.

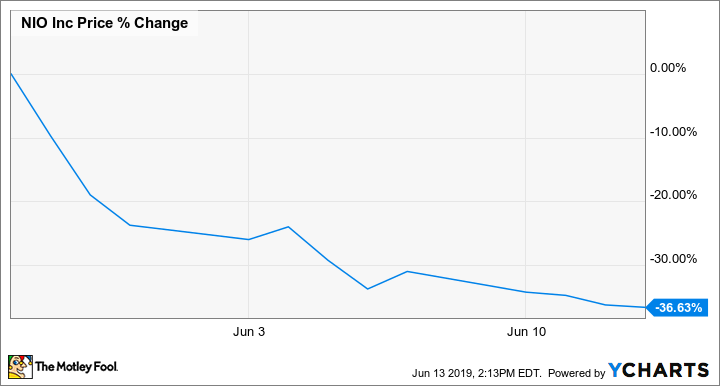

The declines were stark, but they weren't quite as bad as Wall Street had feared. NIO's net loss of $0.38 per share and revenue of $243.1 million both beat the consensus estimates of analysts polled by Thomson Reuters. But investors weren't convinced: While NIO's shares rose briefly after the results were released, they've slid almost 37% in the days following the report.

Why do investors seem to be walking away from NIO, which was once seen as a credible China-based rival to Tesla (TSLA 1.63%)? Let's look more closely at those first-quarter numbers -- and at what we've learned since.

The raw first-quarter numbers

NIO is based in China and reports its results in yuan. But because its stock is listed in the United States, it also provides U.S. dollar equivalents for key figures in its earnings release using the exchange rate that was in effect on the last business day of the quarter, March 29 ($1 = RMB 6.7112.)

| Metric | Q1 2019 | Change vs. Q4 2018 |

|---|---|---|

| Revenue | $243.1 million | (52.5%) |

| Vehicles shipped | 3,989 | (50%) |

| Gross margin | (13.4%) | 13.8 ppts lower |

| Operating profit (loss) | ($390 million) | (24.1%) |

| Adjusted operating profit (loss) | ($372.2 million) | (25.5%) |

| Net income (loss) | ($395.2 million) | 24.6% improvement |

| Net income (loss) per American Depositary Share | ($0.38) | $0.11 improvement |

Data source: NIO, Inc. "Adjusted" figures exclude share-based compensation expenses.

Deliveries of the NIO ES8, an upscale electric SUV, have slumped in 2019. Image source: NIO, Inc.

Why investors are walking away after NIO's first-quarter results

Monthly sales of NIO's upscale electric SUV, the ES8, fell sharply from December to January after the Chinese government reduced a subsidy for buyers, and again from January to February as dealers were closed for Chinese New Year celebrations. Neither of those things was a surprise, and a decent result for March helped NIO beat its guidance for first-quarter deliveries. (3,989 vehicles delivered versus guidance of between 3,500 and 3,800.) Revenue also came in above its guidance range.

That all sounds like good news under the circumstances, and it arguably was. But CFO Louis Hsieh warned that he expected demand and deliveries to decrease further in the second quarter as China's new-car market remains soft and competition in the upscale-electric-vehicle space intensifies.

So far, the quarter has played out as he expected. NIO's delivery totals in April and May were both down from the prior month:

Data source: NIO, Inc. Chart by author. Chart shows NIO ES8 deliveries by month since the start of production in June 2018.

Long story short, NIO's sales seem to be going in the wrong direction, and that's a big part of why Wall Street has soured on the stock.

NIO could still turn things around

There's still some reason for hope. NIO is in the process of rolling out a second electric SUV, the one-size-down ES6, and expects to have production up to speed in the third quarter. At least on paper, the ES6 appears to be a solid contender, with more range and a more attractive price than the ES8.

But with competition from domestic Chinese automakers increasing -- and with Tesla building its own factory in Shanghai -- it's hard to be too excited about NIO's prospects right now.