Realty Income (O 1.46%), a real estate investment trust (REIT) focused on freestanding, single-tenant retail occupancies in the United States and Puerto Rico, has been a terrific long-term investment.

The key thing investors want to know, however, is where Realty Income will likely be in the future -- let's say 10 years from now.

Let's channel our inner Nostradamus and explore that question.

Image source: Realty Income.

Realty Income's business

San Diego-based Realty Income was founded in 1969 and went public in 1994. It owned 5,876 properties in 49 U.S. states and Puerto Rico and had an enviable 98.3% occupancy rate as of the end of the first quarter. (In April, the company announced that it was buying its first international properties. In a sale-leaseback transaction, it acquired 12 properties in the U.K. for 429 million British pounds, or about $555 million, from Sainsbury's, a leading grocery store operator in the U.K. and Ireland.)

Realty Income's portfolio by rental revenue comprised 82% retailing, 12% industrial, and 6% other occupancies at the end of the first quarter. Of its total 261 tenants, its five largest were Walgreens Boots Alliance's Walgreens pharmacy chain, which accounted for just 6.1% of its total rental revenue, convenience store 7-Eleven, FedEx, Dollar General, and LA Fitness. The company targets tenants that are resistant to economic downturns and direct competition from online companies, namely the retailer killer named Amazon.com. These include service-based businesses and retailers that sell low-cost and/or nondiscretionary items, including dollar stores and drugstores.

Its multifaceted diversification and focus on financially robust tenants help insulate Realty Income from regional economic weakness, industry-specific challenges, and individual tenant troubles.

Another factor in Realty Income's success is its use of long-term, triple-net leases (tenants pay property taxes, insurance, and maintenance expenses), with annual rent increases built in. All these components add up to produce a reliable, steady, and growing income stream, from which the company funds its dividend.

Realty Income's past stock performance

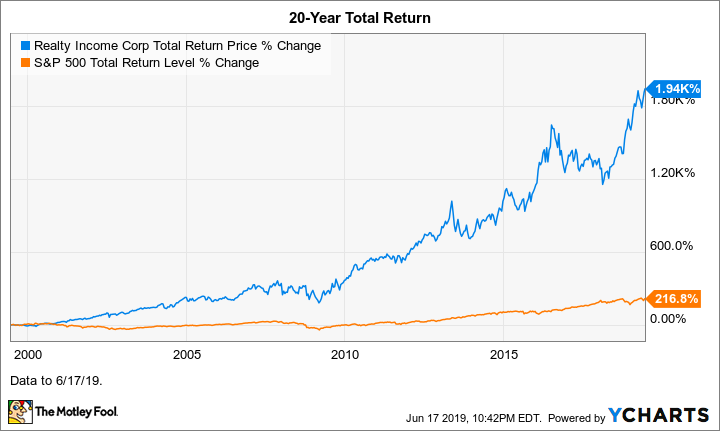

Over the past decade, Realty Income stock has returned 447% -- more than 50% higher than the S&P 500's 291% return. The stock's dividend -- paid monthly -- is currently yielding 3.7%. Since the company's initial public offering (IPO) in 1994, it's increased its dividend by an average of 4.6% per year.

If we go back 20 years -- hello, June 1999, which saw Ricky Martin's "Livin' La Vida Loca" topping the music charts -- Realty Income stock's magnitude of outperformance is much greater. Thanks to the wonders of compounding, over the last two decades, it's returned 1,940% -- about 9 times the S&P 500's 217% return.

Data by YCharts.

Where will Realty Income likely be in 10 years?

Realty Income should still be flourishing in 2029. Some points to support this opinion:

Winners often keep winning. Granted, the oft-repeated investment phrase "past performance is no guarantee of future results" is true. However, robust stock performance over the long haul is often indicative of a solid business model and strong management execution.

The company's business model should prove durable despite what will likely be considerable changes in the retail landscape in a decade. Among other things, online shopping's portion of total retail sales will almost surely have increased from today's roughly 10%, a decisive plus for Amazon. Nonetheless, even Jeff Bezos' ravenous beast isn't likely to disrupt certain businesses. As long as some folks like to exercise indoors among others and have a wide choice of equipment, there should be gyms. As long as Slurpee cravings exist, 7-Eleven should be around to serve up its iconic frozen drink.

Moreover, Realty Income's willingness to expand internationally significantly increases its total addressable market.