In general, dividend stocks are the best means of turning a rather modest amount of money into a huge sum over the long term.

Their amazing growth potential largely stems from the incredible power of compounding, which occurs when you reinvest dividends. In the second year after buying a dividend stock, you earn a dividend not only on your original investment sum but also on the dividend you received and reinvested in year one, and so on and so on.

No matter your age or how close you are to retirement, you'll likely find at least one of the following top dividend stocks a good fit: American Water Works (AWK 0.51%), Realty Income (O 0.11%), and NextEra Energy (NEE 1.36%).

Image source: Getty Images.

Overview

|

Company |

Market Cap |

Dividend Yield |

3-Year Beta |

Projected Average Annual EPS Growth Over Next 5 Years* |

Return Since American Water's April 2008 IPO (11 years and 2 months) |

|---|---|---|---|---|---|

|

American Water Works |

$21.3 billion | 1.7% | 0.23 | 8.2% | 678% |

|

Realty Income |

$23.1 billion | 3.7% | 0.21 | 7.8% | 382% |

|

NextEra Energy |

$98.8 billion | 2.4% | 0.13 | 7.9% | 346% |

|

S&P 500 |

N/A | 1.9% | 1.0 | N/A | 168% |

Data sources: Yahoo! Finance and YCharts. Data as of June 19, 2019. EPS = earnings per share. *Wall Street's consensus estimates.

Beta is a measure of stock-price volatility relative to the overall market. So American Water's beta of 0.23 means that it's been only 23% as volatile as the overall market over the last three years.

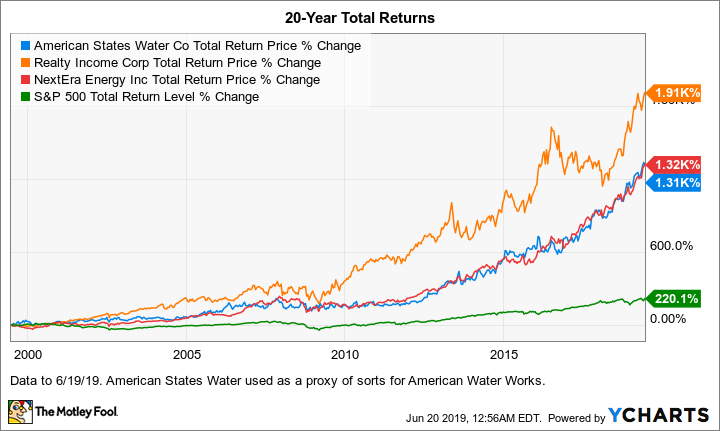

The following chart shows the total return picture over 20 years. American Water has been publicly traded for just over 11 years, so I used American States Water as a proxy for American Water. (American States operates regulated water utilities in California and, like American Water, also has a notable military base business.) It's likely a conservative proxy, as American Water has outperformed American States since it went public.

NextEra Energy and American States Water stocks have returned six times as much as the broader market over the last two decades -- and Realty Income stock has beaten the market by nearly nine times!

Data by YCharts.

American Water Works

New Jersey-based American Water Works is the largest investor-owned water and wastewater utility in the United States, providing regulated and market-based services to about 15 million people in 47 states and one Canadian province. It has regulated businesses in 16 states -- double the number of the second-most geographically diverse U.S. water utility.

Its large size and wide footprint give it an edge over competitors in acquiring small regulated utilities, which is a notable advantage since municipalities across the country are increasing sales of their water and wastewater systems. Water utilities generally expand where they have current operations, as it's much more efficient than expanding elsewhere.

American Water has increased its dividend every year since it went public in 2008. While it's not a high yielder, the dividend is very secure, and investors should be able to count on continued annual dividend increases of 7% to 10%.

Realty Income

Realty Income is a real estate investment trust (REIT) that has historically focused on freestanding, single-tenant retail occupancies in the U.S. In April, however, it channeled its inner affluent college junior and ventured abroad for the first time, scooping up 12 properties in the U.K.

The San Diego-based REIT owned more than 5,800 properties in 49 U.S. states and Puerto Rico at the end of the first quarter. It targets financially sound tenants that are resistant to economic downturns and competition from online retailers. Many of its tenants are household names, with pharmacy chain Walgreens, convenience store chain 7-Eleven, and FedEx its three top tenants.

Its consistently high occupancy rate, continued expansion, and use of triple-net leases (whereby tenants pay all major variable expenses) with built-in annual increases result in a predictable and growing income stream, which it uses to fund its dividend. Realty Income's dividend is quite robust, as REITs are required to pay out at least 90% of their income as dividends to investors.

Image source: Getty Images.

NextEra Energy

NextEra Energy bills itself as the world's largest utility. It owns two electric companies in Florida: Florida Power & Light Company, or FPL, which keeps the lights on for more than 5 million customer accounts in the Sunshine State, and Gulf Power Company, which serves more than 460,000 customers in northwest Florida. The company also owns NextEra Energy Resources, the world's largest generator of renewable energy from the wind and sun.

Moreover, NextEra Energy has a noncontrolling stake in NextEra Energy Partners LP (NEP 4.77%), a limited partnership that owns interests in wind and solar projects across North America and natural gas pipeline assets in the U.S. As is typically the case with such setups, the LP is riskier and more volatile -- as reflected in its beta of 0.6 -- and its dividend yield (currently 4.1%) is more generous. Of the two, NextEra Energy is the better choice for most investors, as it's less risky and has outperformed the LP by 81% since the LP went public in mid-2014.