What happened

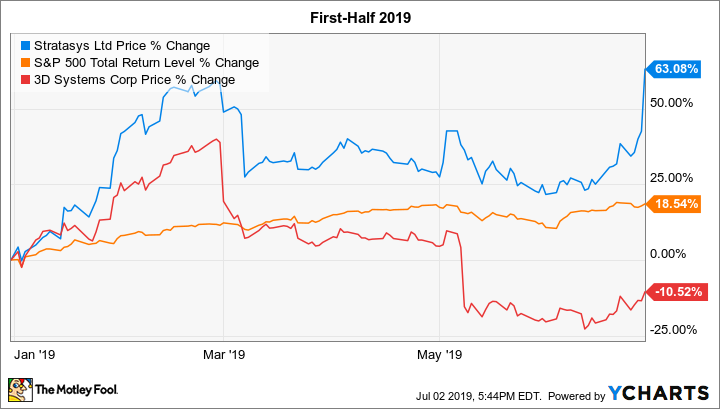

Shares of 3D printing company Stratasys (SSYS 0.61%) rocketed 63.1% higher in the first half of 2019 (January through June), according to data from S&P Global Market Intelligence.

For context, shares of rival 3D Systems (DDD 0.57%) fell 10.5% and the S&P 500 returned 18.5% over this period.

The story is similar over the one-year period through July 2, with Stratasys stock's 39.6% gain handily beating the broader market's 11.3% return, while shares of Triple D are nearly 37% in the red.

Image source: Getty Images.

So what

We can attribute Stratasys stock's outperformance of the market largely to the company continuing to beat Wall Street's consensus earnings estimates. In three of the last four quarters, it has crushed bottom-line expectations, and in the other quarter it slightly beat the consensus.

We'll get into specifics in a moment, but you should know that shares also got a 14.4% boost on the last trading day of June -- Friday the 28th. However, as my colleague Rich Smith wrote, there didn't appear to be any identifiable catalyst for the move. If there is some material news, we should know about it relatively soon. And if not, as Rich noted, shares will give back their gain. In fact, in the first two trading days of July, Stratasys stock has already given back 50% of its spoils from Friday.

Moving to the company's most recent earnings release: In the first quarter of 2019, Stratasys' revenue edged up 1% year over year to $155.3 million, reported net loss narrowed considerably, and earnings per share (EPS) adjusted for one-time items doubled to $0.10. Wall Street was looking for adjusted EPS of $0.06 on revenue of $152.8 million, so Stratasys easily beat both expectations.

Underlying revenue growth was better than suggested by the reported number. In constant currency and after adjusting for sales from the company's entities that it divested during 2018, revenue was up 5% year over year. That's still far from strong growth, but it is respectable for a company that's in turnaround mode.

Data by YCharts.

Meanwhile, 3D Systems has missed Wall Street's earnings estimates in two of the last four quarters, with last quarter being a huge disappointment. In Q1, its adjusted loss per share widened by three times to $0.09, whereas the Street was projecting a loss of $0.01 per share. Revenue declined more than 8% year over year to $152 million, falling short of the $164.7 million that analysts were expecting.

Now what

Stratasys has made solid progress righting its ship, but "a sustainable turnaround will depend upon the company being able to profitably grow revenue," as I've previously written. Cautious optimism is warranted, giddiness is not -- particularly since the company doesn't yet have a permanent CEO.

Stratasys hasn't yet announced a date for the release of its Q2 results, but it should be sometime very late this month or early next month. Investors should focus on growth in 3D printer and consumables revenue. In the first quarter, both these key metrics grew just 1% year over year.