The battle among the top U.S. telecommunications companies today is fierce. Customers are looking for the best service at the lowest price and there's not a lot of product differentiation when people can use the same smartphones on different networks.

What telecoms do to add value for customers and themselves is build bigger networks that take advantage of scale and allow for a small pricing advantage. And it's that scale that highlights the biggest difference between the two stocks we'll be looking at today: AT&T (T 0.30%) and Sprint (S).

Image source: Getty Images.

AT&T's scale advantage

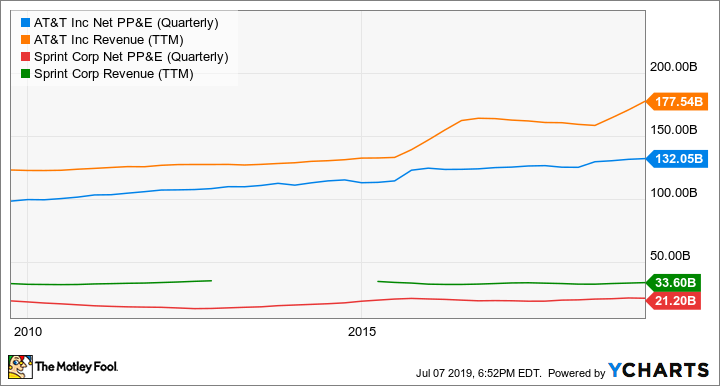

One way to measure the scale of a telecommunications company is to examine the assets it has installed to build its network. These are commonly referred to as property, plant, and equipment (PP&E) assets. Below, you can see that AT&T has more than six times the amount of PP&E as Sprint, in large part because it has built a much larger mobile network.

T Net PP&E (Quarterly) data by YCharts.

This scale difference translates into better coverage, often faster speeds, and more infrastructure. That, in turn, can drive sales and aid in differentiating the product through advertising. It's also a big reason why Sprint thinks it needs to combine with T-Mobile to survive in wireless telecommunications. Sprint admits that it doesn't think it can compete nationally with such a scale deficit. A potential merger between Sprint and T-Mobile is still in the works, but there's no guarantee it will go through, especially after being blocked for years. For the purposes of this discussion, I'll assume Sprint remains a stand-alone company.

It should be no surprise that a larger network allows AT&T to serve a greater number of customers and generate higher revenue. For investors, though, bigger wouldn't necessarily be better if it didn't translate to better returns on investment. But, in telecommunications, scale often does matter.

Generating a return on billions of investment

AT&T uses its size to drive more value to customers through better coverage and faster speeds, allowing it to charge higher prices. This helps with margins and ultimately leads to a better return on assets than Sprint (see chart below). Over the past decade (except for an anomaly year related to the 2017 U.S. tax code changes), AT&T has regularly generated better returns than Sprint.

T Return on Assets (TTM) data by YCharts.

Return on assets may be the most problematic financial indicator for Sprint in the long term. It shows a pretty regular negative return on investment, and it highlights how the company falls further and further behind bigger rivals like AT&T. It doesn't generate enough money to invest in the next wave of infrastructure technology and that's why it's pushing so hard to complete a merger with T-Mobile. Without more scale and better margins, the company is in a consistent uphill battle.

The leader in 5G wireless

The next phase of large-scale investment that U.S. telecoms need to make is in 5G technology. Again, AT&T should have a clear lead because of its scale and better returns on assets than Sprint. Its current plan has AT&T building a 5G network that will be in 21 states by the end of 2019. It's doing this using millimeter wave spectrum leased at auction from the FCC that brings faster speeds that better reach users.

Sprint is going with a lower-cost method, using the midband 5G spectrum that doesn't have the same speed as AT&T's 5G and isn't as good at penetrating walls and other surfaces. Sprint may be in the 5G game, but its network won't be as high-quality because it doesn't have the capital to access the better-quality spectrum.

The rich get richer in mobile telecommunications, and that seems to be the case with Sprint and AT&T based on their 5G strategies.

AT&T is the clear winner today

This last chart highlights another massive difference between the two companies. AT&T is highly profitable and paid a dividend of $2.01 per share over the past year, while Sprint is losing money and doesn't pay a dividend. For long-term investors, this makes the choice of AT&T over Sprint easy.

T Net Income (TTM) data by YCharts.

Sprint's financials could make a surprise comeback if its merger with T-Mobile gets government approval. That's its best argument for being a good investment option right now. But the risk of a merger not happening is too high for me to take the chance. I'll take the safer bet of AT&T in this battle.