With bond rates already low and the Fed hinting at rate decreases, dividend stocks are in high demand these days, as alternatives in the fixed-income market are in short supply.

There's no easier way to reap the rewards of the stock market than to find a safe, reliable dividend payer and hold on to it for the long term. However, with the S&P 500 at an all-time high, dividend yields are shrinking. Luckily, these Motley Fool contributors have three recommendations for you to capitalize on today's market. Keep reading to see why they like Brookfield Infrastructure Partners (BIP -0.72%), CVS Health (CVS -0.85%), and Costco Wholesale (COST -0.14%).

Image source: Getty Images.

Every dividend investor should own Brookfield Infrastructure

Jason Hall (Brookfield Infrastructure Partners): That's a bold statement above, I'll admit. I'm not one to make such pronouncements lightly, but in the case of Brookfield Infrastructure, I'll unabashedly state it again: Every dividend investor should own shares. Here's why.

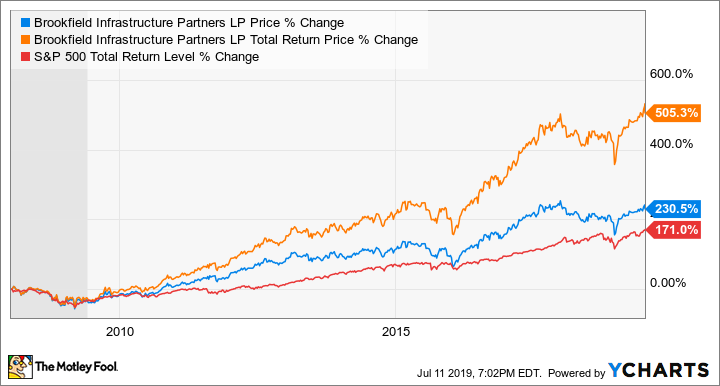

To start, Brookfield Infrastructure is part of the Brookfield Asset Management family of businesses, one of the best asset management organizations on the planet. Since going public, Brookfield Infrastructure has had an incredible track record of making prudent investments in infrastructure assets that have generated enormous returns and few losses for investors. Since going public -- and at a terrible time, near the pre-financial crisis peak -- this publicly traded partnership has delivered more than 500% in total returns, crushing the S&P 500 over the period:

Moreover, it yields 4.6% even after seeing its stock price gain 231% over the past decade, due to a track record of growing the dividend by nearly double-digit rates each year.

Enough about the past: Brookfield Infrastructure's future looks just as bright. The global middle class is booming, and trillions of dollars will need to be invested in expanding and improving water, energy, utility, transportation, and telecommunications infrastructure all around the world. With its track record as an infrastructure asset investor and manager, this falls right in the company's sweet spot, and should support decades of growth.

It gets even better: Brookfield Infrastructure also has all the best qualities of a defensive stock. The services its infrastructure assets provide are necessary (and often critical) across every economic environment. That makes it a perfect stock to buy now and hold through whatever the market throws at you.

Put it all together, and you have an amazing combination of growth, income, and downside protection. Dividend investors shouldn't hesitate to add it to their portfolios.

Dividend-paying healthcare stocks don't get much cheaper than this

Sean Williams (CVS Health): There's little denying that pharmacy giant CVS Health has had a rough year. It began by lowering its full-year outlook, and announced that cost synergies from its Aetna acquisition would take longer to realize than originally anticipated. These plus reimbursement weakness in CVS' pharmacy operations created the perfect storm to crater the company's share price.

But what investors may not realize is that these are short-term concerns, and the company's long-term outlook could be just what the doctor ordered.

Traditionally, we wouldn't think of an insurance company like Aetna as being much of a growth stock. But the thing to remember about pharmacy chains like CVS is that they generally run on very tight margins. Pharmacy sales provide the bulk of profits, with front-end retail sales having very thin margins. The addition of Aetna into the fold is actually expected to boost CVS Health's organic growth rate while resulting in $300 million to $350 million in cost synergies in 2019, and $800 million in synergies next year, up from a prior forecast of $750 million in annual savings.

Investors would also be wise not to overlook the fact that the U.S. population is growing older and living considerably longer than it was a few decades ago. Pharmaceutical sales are projected to increase as the boomer generation ages, which places CVS Health in prime position to win at a well-defined numbers game.

While growth may be tepid now, CVS Health announced at its analyst day in June that the company should deliver mid-single-digit growth in 2021 and low-double-digit earnings-per-share growth in 2022 and for a few years thereafter. That makes the company's forward price-to-earnings ratio of less than eight seem downright cheap, and it really emphasizes what a deal its 3.6% dividend yield currently offers.

A special dividend on the way?

Jeremy Bowman (Costco Wholesale): On the surface Costco may not look like much of a dividend stock. The warehouse retailer pays a yield of just 0.9%, but it has actually been rewarding shareholders much more generously than that through special dividends it started paying every two to three years starting in 2012.

Costco offered shareholders a special dividend of $7 a share in December 2012, followed by a $5 payout in February 2015, and then another $7 one in May 2017. In other words, if the pattern keeps up, shareholders are due for another big payout any day now, and a $7 dividend alone would give investors a yield of 2.5% at today's price of $280 a share.

Leaving the special dividend aside for a moment, Costco still looks like a great stock to own for a number of reasons. It's one of the few Amazon-proof retailers out there, and its membership model and bargain prices have consistently delivered strong growth. The company has posted a comparable sales increase of 6.2% (excluding fuel and currency exchange) through the first 44 weeks of its current fiscal year, a pace few retailers can match, and earnings per share have increased 22% through the first three quarters of the fiscal year to $5.79.

Costco has also raised its dividend every year by 10% or more since it started paying one in 2004, showing the payout has grown quickly even if the yield is modest. Management brushed off a question about another special dividend in the March earnings call, but several Wall Street analysts have predicted one in the near future. For investors looking for income and growth, now could be a great time to grab a few shares of Costco.