What happened

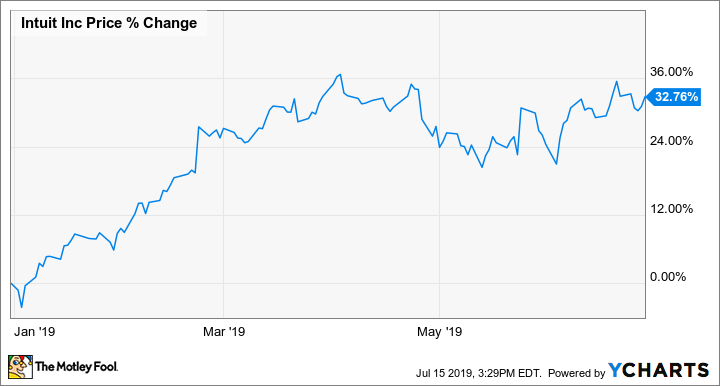

Shares of Intuit (INTU -1.17%), the company behind the popular TurboTax software, moved higher through the first six months of the year, propelled in part by a pair of strong earnings reports. The company got a boost from the new tax law as 2019 marked the first filing season since the Tax Cuts and Jobs Act was passed. According to data from S&P Global Market Intelligence, the stock was up 33% through June.

As the chart below shows, Intuit's gains came largely at the beginning of the year on anticipation of a busy tax season, and thanks to a strong earnings report in February.

So what

Intuit, which also owns other business management software tools like QuickBooks, kicked off the year on a strong note as the stock rose with the broader market recovery. It added to that momentum on Feb. 22, jumping 6.8% after its fiscal second-quarter report beat expectations. Revenue was up 12% to $1.5 billion compared to expectations for $1.48 billion, while adjusted earnings per share increased 19% to $1.00, easily outpacing the forecast of $0.86.

Image source: Getty Images.

The number of TurboTax units sold was flat at that point due to a delay related to the U.S. government shutdown, but data showed Intuit gaining market share, a positive sign for the upcoming quarter. Management touted the company's investment in the do-it-yourself segment with services like TurboTax Live that connect users with advisors via a live videochat.

The stock actually slid when the company reported tax season results at the end of April: Total TurboTax units sold were up 5% for the year, and management forecast that full-year consumer group revenue would increase by 10%, which was at the high end of its prior outlook range of 9% to 10%. Though Intuit called the results "great" and said the company gained market share, investors nonetheless seemed disappointed.

However, the stock bounced back in May after the company delivered its earnings report for the full quarter that included tax season; the share price rose 6.7% on May 24. For the quarter, the company turned in revenue growth of 12% to $3.27 billion, and adjusted EPS increased 16% to $5.55, topping estimates of $5.40. The company also raised its guidance across the board.

Now what

Intuit shares have continued to gain in July, and the company seems well positioned as the economy continues to grow, though it also offers some defensive positioning as people need tax prep and bookkeeping software even in a recession. Moreover, the company's pivot to cloud-based products should help it expand its margins, and deliver outsize growth. It's not surprising that the stock has more than tripled over the last five years as Intuit competitive advantages are getting stronger.