Investors have thousands of stocks to choose from, but there are far fewer stocks you should consider buying. And then there's a relatively small group of stocks you can build a portfolio around.

We asked three Motley Fool contributors to identify the stocks they think could be at the core of investors' portfolios. Here's why those chose Baozun (BZUN 1.28%), Hormel Foods (HRL 1.00%), and Alphabet (GOOG 0.37%) (GOOGL 0.35%)

Image source: Getty Images.

This growth stock's best days are still ahead

Keith Noonan (Baozun): Depending on how you look at it, Chinese e-commerce companies might not scream "great foundation-level stocks" in the midst of an ongoing trade war that's been a source of significant market consternation. Baozun, in particular, might seem like a fraught play because it specializes in bridging big Western brands to China's online retail market. The e-commerce stock has an above-average risk profile and won't be a great fit for every investor, but Baozun stands out as a stock that's worth steadily building a position in for those willing to take on risk for stellar long-term return potential.

The company provides online retail website-creation services, marketing, and order fulfillment for American and European companies looking to quickly deploy and scale in China's large and fast-growing e-commerce market. This hook, along with the highly regarded quality of its services, is helping Baozun rapidly build its list of brand partners and put up impressive sales and earnings growth despite the tense trade situation.

Owning Chinese stocks comes with some specific risks, but it can also serve as a worthwhile means of diversification and help investors prepare for a potential future in which China continues to gain political and economic power. And while some investors are understandably hesitant to invest in Chinese companies because some businesses offer poor visibility into operating and accounting practices, that hasn't been the case with Baozun. It gets clear votes of confidence from some of the world's biggest brands and online retailers as well. Companies including Nike, Microsoft, and Johnson & Johnson rely on its services, and China's e-commerce giants, including Alibaba and JD.com, feature direct portals to Baozun-operated stores.

Baozun is consistently profitable and still has a long runway for expansion as it adds new brands to its platform and increases gross merchandise volume for existing brand partners. Shares trade at roughly 35 times this year's expected earnings and still offer big upside for long-term investors.

A growing dividend stream

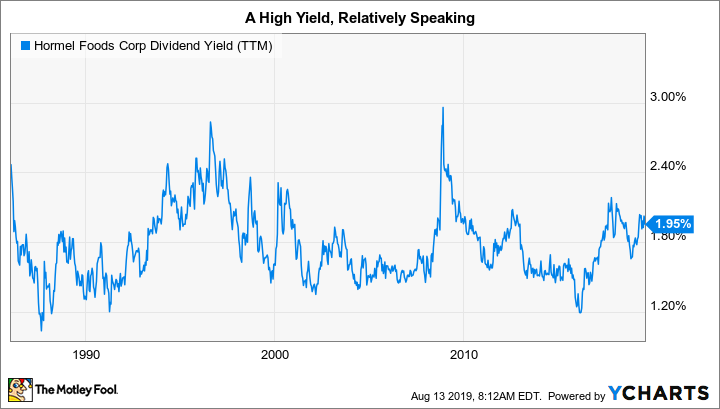

Reuben Gregg Brewer (Hormel Foods): Income investors might dismiss Hormel because of its modest 2% yield. Others might pass it by because the packaged-food space is getting hit by a shift in customer buying habits. Both choices would be a mistake.

For starters, Hormel's yield is toward the high end of its historical range. That suggests that now could be a decent time to look at the stock, valuation wise. Add in over five decades of annual dividend increases and an incredible annualized dividend growth rate of 15% over the past decade, and Hormel starts to look like a strong core holding.

HRL Dividend Yield (TTM) data by YCharts

But what about the packaged food industry? Well, a company doesn't get to 50-plus years of annual dividend increases without successfully adjusting to market changes. And Hormel is working to do just that again. This time, it's moving out of stagnant categories like salt and into areas with higher growth rates, like deli products. It's also looking to expand overseas, with a recent investment in South America and an ongoing commitment to China. All of this, meanwhile, is being accomplished without compromising the company's rock-solid balance sheet, where debt makes up less than 10% of the capital structure.

Put it all together, and Hormel is the type of company that you can build a portfolio around. It will never be an exciting stock, but it will be one that rewards you over time with prudent management and a steadily growing dividend.

Best vision for the future

Keith Speights (Alphabet): Motley Fool co-founder David Gardner said something that I think is both profound and 100% right: "Make your portfolio represent your best vision for our future." For me, I'd love for the future to include technology that makes everyday life easier and life itself longer and more fruitful. To be sure, there's no one stock that perfectly fits that vision. However, I think Alphabet comes pretty close.

Alphabet already has made everyday life easier for many people around the world. I use the company's Google Search, Chrome web browser, and Google Drive every day. I use YouTube, Google Maps, and Gmail frequently. I also have family and friends who routinely use other Alphabet products, such as Android, Chromebooks, Google Fi, Nest, and Waze.

But I'm even more excited about how Alphabet could change everyday life in the future. The company's Waymo subsidiary is without question a pioneer in self-driving car technology. Another subsidiary, Loon, is attempting to bring web access to remote areas using hot air balloons. Wing has developed drones that deliver packages.

Alphabet is also focusing on extending the human lifespan with its Calico business. Its Verily unit is working on projects like creating smart lenses to correct vision and building robotic surgical systems. Google DeepMind is using artificial intelligence to predict life-threatening kidney injuries.

Of course, investing can't be merely idealistic. A company must have a strong business and great growth prospects, too. The good news is that Alphabet possesses both qualities. There aren't many stocks you can build your portfolio around, but I think Alphabet is one of the few that fit the bill.