Value investors will be looking at ABB (ABBN.Y 0.65%) for a number of reasons, not least of which is its eye-catching forward dividend yield of 4.3%. Throw in the argument that the company's significant restructuring initiatives could lead to substantive performance improvement relative to its peers, and the case gets even stronger.

ABB is definitely a turnaround story, but is it buy? And what do you need to know before buying the stock? Let's take a look in the light of the recent results.

ABB brings the changes

Going back to 2016, activist hedge fund Cevian Capital pushed ABB to separate its poorly performing power-grids division, leaving it to focus on automation, robotics, and motion. Management's response in early 2017? Keep power grids but invest in internal development and acquisitions in order to digitalize products. Clearly, ABB's management believed software and digitalization were the way to go.

Image source: Getty Images.

Move ahead to the end of 2018, and the announcement that ABB would be selling the power-grids division to Hitachi for $11 billion. But two things stayed consistent. First, Ulrich Spiesshofer, the CEO at the time, continued to invest in digital technologies by forming a partnerships such as that with Dassault Systemes to develop digital-twin solutions or with Microsoft to support ABB's industrial internet of things (IIoT) platform.

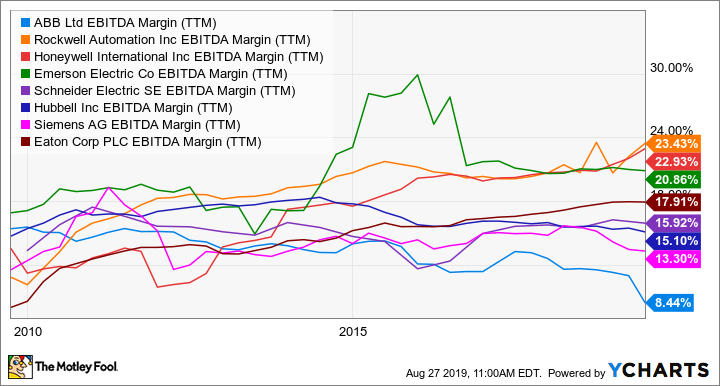

Second, the company's margin performance continued to lag just about any peer or rival you could think of.

ABB EBITDA Margin data by YCharts. TTM = trailing 12 months.

ABB continues restructuring

Not content with merely selling its power grids division, ABB announced it would restructure into four new divisions (electrification, industrial automation, motion, and robotics & discrete automation) replacing electrification products, industrial automation, robotics & motion, and power grids. Moreover, the company's longtime matrix organizational structure would be ditched in favor of the pyramid structure that most other companies use.

Did I mention that Spiesshofer left in April, and the company would be embarking on these changes without a permanent CEO in place? No matter: Former Sandvik CEO Bjorn Rosengren was appointed CEO in August. Meanwhile, the portfolio pruning continues with the recent announcement that ABB would be giving up on solar energy by exiting its solar inverter business.

Where ABB stands now

Putting all this together, there's a lot of opportunities for Rosengren to turn around ABB. And a glass-half-full approach sees all the changes -- such as divisional restructuring, organizational change, portfolio pruning, management change, and digital investments -- as preparing the company for a significant turnaround under a new CEO. Throw in a yield of more than 4% while you wait, and it's a compelling proposition.

ABB's turnaround won't be easy

Unfortunately, the glass-half-empty viewpoint sees a lot of turbulence ahead. There are three key points. First, the restructuring plans were put in place before the appointment of a new CEO, and he's likely to have his own ideas. Meanwhile, the changes are significant in scale, and it's highly unlikely that they will come without friction.

Second, ABB's ongoing performance is weak. Electrification had a decent second quarter, but as you can see from the chart of comparable-orders growth below, ABB's growth is definitely slowing and margin remains an issue. Total comparable-orders growth was just 1% in the second quarter.

Data source: ABB presentations.

Third, there's clear evidence of a slowing in automation markets, with Rockwell Automation cutting sales and earnings guidance for the second time in 2019 during its recent earnings report, and Emerson Electric's management talking of order project delays and a weakening environment in process automation. It's highly unlikely that ABB is going to sail through the turbulence unscathed.

What it all means for investors

All told, ABB is an interesting turnaround story. But anyone buying it will have to recognize that it's going to take time and, more importantly, the optics around it are going to get murky due to the weakening end-demand environment. In other words, it's a lot harder to tell just how well the restructuring efforts are going when sales growth is weakening or even turning negative.

As such, ABB investors will need to be patient, and for most investors, the stock is probably worth avoiding for now.